India’s fast-growing co-branded credit card market may soon see a new entrant: the country’s most valuable firm.

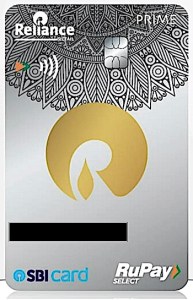

Reliance is working with the state-backed lender SBI to launch two co-branded credit cards on the homegrown RuPay network, according to documents reviewed by TechCrunch.

The cards, called Reliance SBI Card, will offer some “exclusive” benefits, such as vouchers for Reliance Retail (the conglomerate’s retail chain) and discounts on spendings at other Reliance properties, including Trends, Ajio, JioMart, and Urban Ladder, according to the documents.

Image Credits: TechCrunch

SBI briefly confirmed the existence of the cards on a web page that it has since taken down.

Reliance’s interest in the credit card business comes at a time when Jio Financial Services, a Reliance-backed finance unit, has launched lending and insurance businesses. In its annual report earlier this month, Jio Financial Services said it plans to launch debit cards.

The financial services is the newest sector for Mukesh Ambani, Asia’s richest man and who controls Reliance Industries. In the last two decades, Reliance has entered and scaled several businesses, including retail and telecom, to tentpole positions. Reliance Retail was recently valued at $100 billion in funding from a number of investors, including KKR.

Reliance’s interest in the credit card business also follows Indian salt-to-steel conglomerate Tata Group launching its own cards in partnership with HDFC. The Tata Neu credit cards have gained popularity in the past year as Tata exposes consumers of its one business to another.

Scores of firms in India, including Paytm, Zomato, Swiggy, and Ola, have also launched co-branded credit cards in recent years. These cards give the firms an avenue to diversify their revenue streams, make better use of customer data, and stimulate spending. The cards, often laden with tailored benefits, also deepen customer loyalty and provide a lucrative gateway into the country’s burgeoning middle-class market, bolstering growth in a fiercely competitive landscape, analysts say.

However, these cards have also traditionally offered limited credit limits to consumers, something that has alienated their top-spending customers. Pune-headquartered fintech unicorn OneCard is one of the few firms in India that has been able to make inroads with some power users in the country with its co-branded credit cards.