Jio Financial Services, the Indian conglomerate Reliance Industries-backed financial services firm, has started its lending and insurance businesses and plans to rapidly broaden its offerings as billionaire Mukesh Ambani expands the ever-so-wide tentacles of his oil-to-telecom empire.

The market has been closely paying attention to Reliance’s financial services ambitions for years. But it wasn’t until last year that Ambani, Asia’s richest man, revealed that the firm plans to enter into the sector, which despite growing multiple folds in the past decade remains largely untapped, serving only tens of millions of individuals.

Jio Financial Services, which made its public debut in August, said in its annual presentation that it has started to offer personal loans to salaried and self-employed individuals through its MyJio app and 300 stores across India. Its insurance arm has also partnered with 24 insurers to offer a wide range of coverage across auto, health, and corporate categories, said the firm.

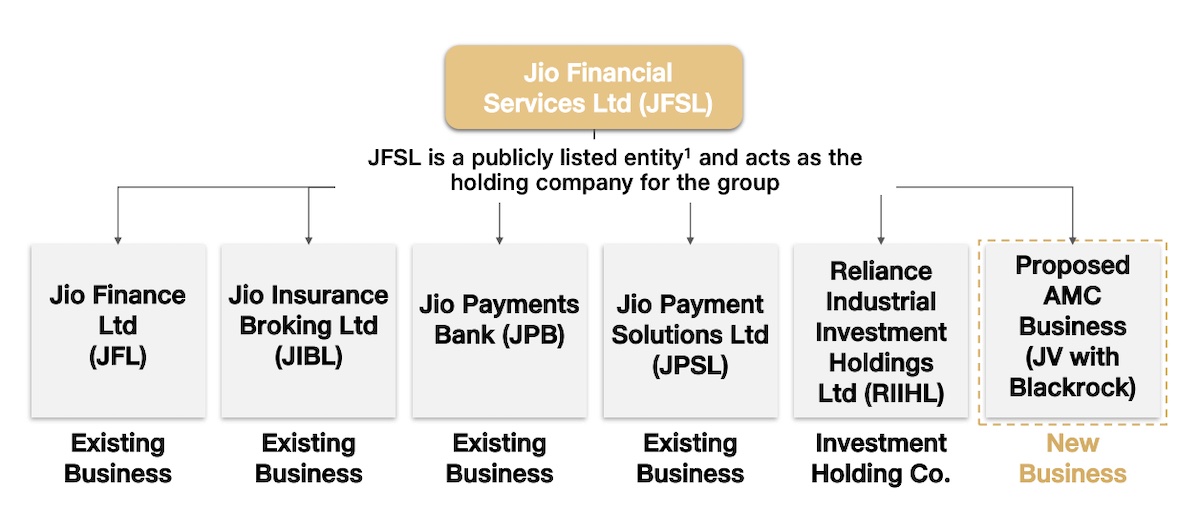

Different arms of Jio Financial Services. Image Credits: Jio Financial Services

Jio Financial Services has largely remained quiet about precisely what all it plans to do. The firm, whose largest backer remains Reliance Industries, earlier this year partnered with U.S. asset manager BlackRock to launch asset management services in the country.

The financial services is the newest sector for Ambani, who has entered several businesses — including telecom — in the past decade and scaled them to tentpole positions. Reliance also operates the nation’s largest retail chain, which has been valued at $100 billion in recent fund raises from investors, including KKR.

As Jio Financial scales its business, it may pose a challenge to a number of players in the industry, including Paytm and Policybazaar. Reliance said it will make use of AI and analytics for its financial services business and operate on a “low cost of servicing.”

Jio Financial Services said it’s taking a direct-to-customer approach with its offerings to drive cost-efficiencies and enabling personalized customer interactions. The firm is incorporating “alternate data models for 360-degree customer view and tailored offerings,” and is developing a unified app for the “diverse financial needs of customers.”

In the annual report, Jio Financial Services said it’s also testing a sound box, the fast-omnipresent portable device that alerts merchants when a transaction has completed, the firm said, confirming an August TechCrunch report. The company is “generating substantial data footprint and enhancing our customer engagement across digital channels, and in turn enriching and facilitating other businesses,” it said.

On lending, Jio Financial Services plans to extend loans to businesses and merchants as well as offer loans to facilitate vehicle and home purchases, it said. It also plans to give loans by using shares as collateral. The firm said it has also “relaunched” savings account services and bill payments and plans to launch debit cards.