I don’t often tear down angel decks for the Pitch Deck Teardown series for a pretty simple reason: The expectations that angel investors have from a pitch deck are pretty different from what professional institutional investors are looking for. Still, as I was looking through SplitBrick‘s deck, I realized I have some things to say.

For example, there are some major, fundamental problems with this deck that make the company pretty much impossible to invest in. Let’s take a look!

We’re looking for more unique pitch decks to tear down, so if you want to submit your own, here’s how you can do that.

Slides in this deck

SplitBrick submitted an 18-slide, unredacted deck. The slides are:

- Cover slide

- Mission slide

- Business models comparison

- The SplitBrick model

- Market analysis

- Competitive analysis

- How it works

- Management structure

- Traction and journey to date

- Use of funds, the ask, and roadmap

- The team

- Appendix interstitial slide

- Appendix: Screenshots (product walkthrough)

- Appendix: Screenshots (product walkthrough)

- Appendix: Screenshots (product walkthrough)

- Appendix: Screenshots (product walkthrough)

- Appendix: Screenshots (product walkthrough)

- Appendix: Screenshots (product walkthrough)

Three things to love

Sure there was a lot to dislike about this deck, but it’s not all bad, and there are a few points worth highlighting.

Great market context

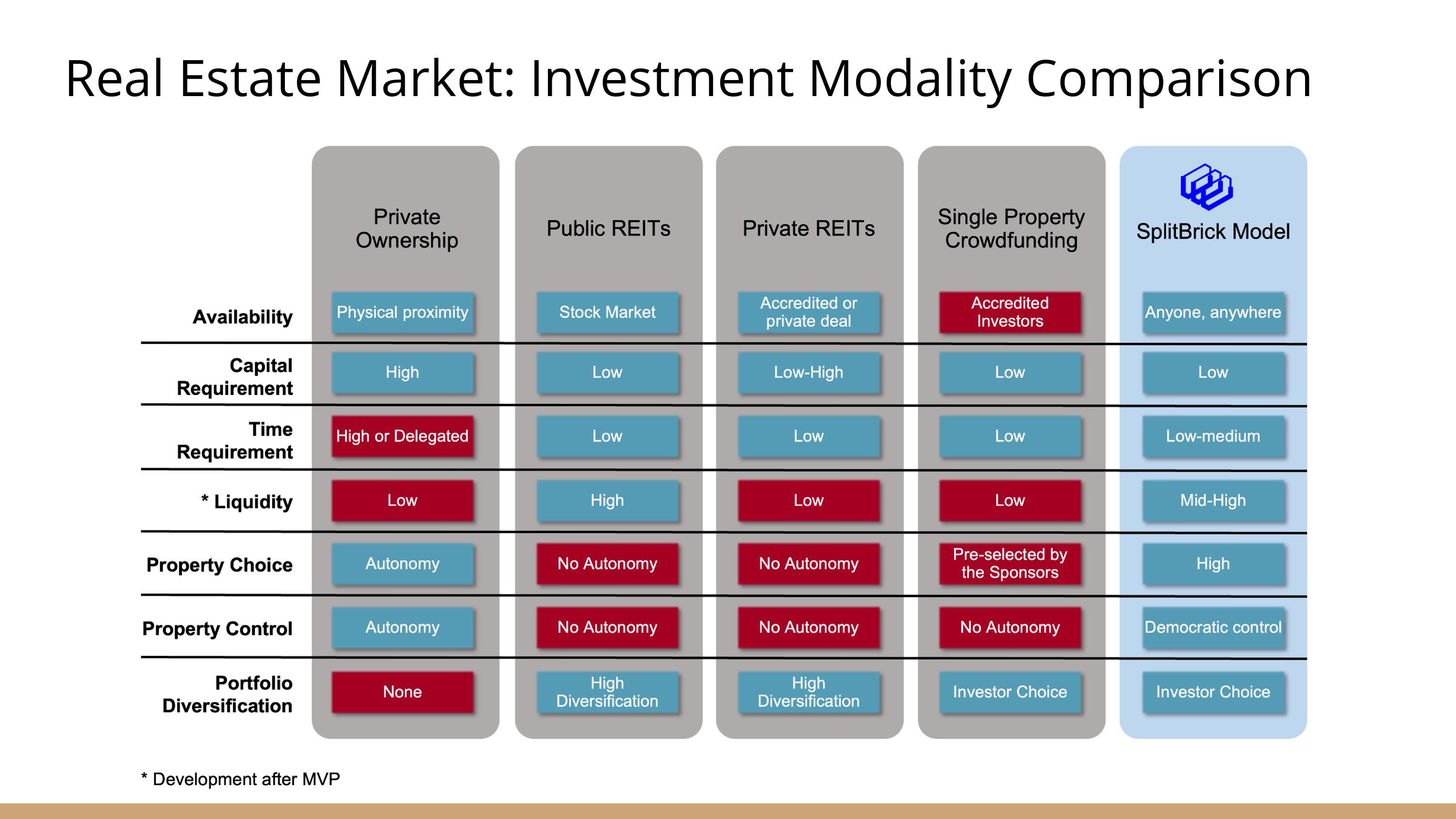

It’s rare that a startup pitch deck needs to break down a variety of business models in an industry in order to position itself, but innovating on business models is a legitimate way to innovate, so it’s a great thing to include:

[Slide 3] Breaking out the various business models helps differentiate the startup. Image Credits: SplitBrick

This is a great example of leading with what makes you unique. There are a lot of challenges with SplitBrick’s specific strategy, but this is exactly where this type of approach shines: Innovate on the aspects of the business that are ripe for disruption, and leave the rest alone.

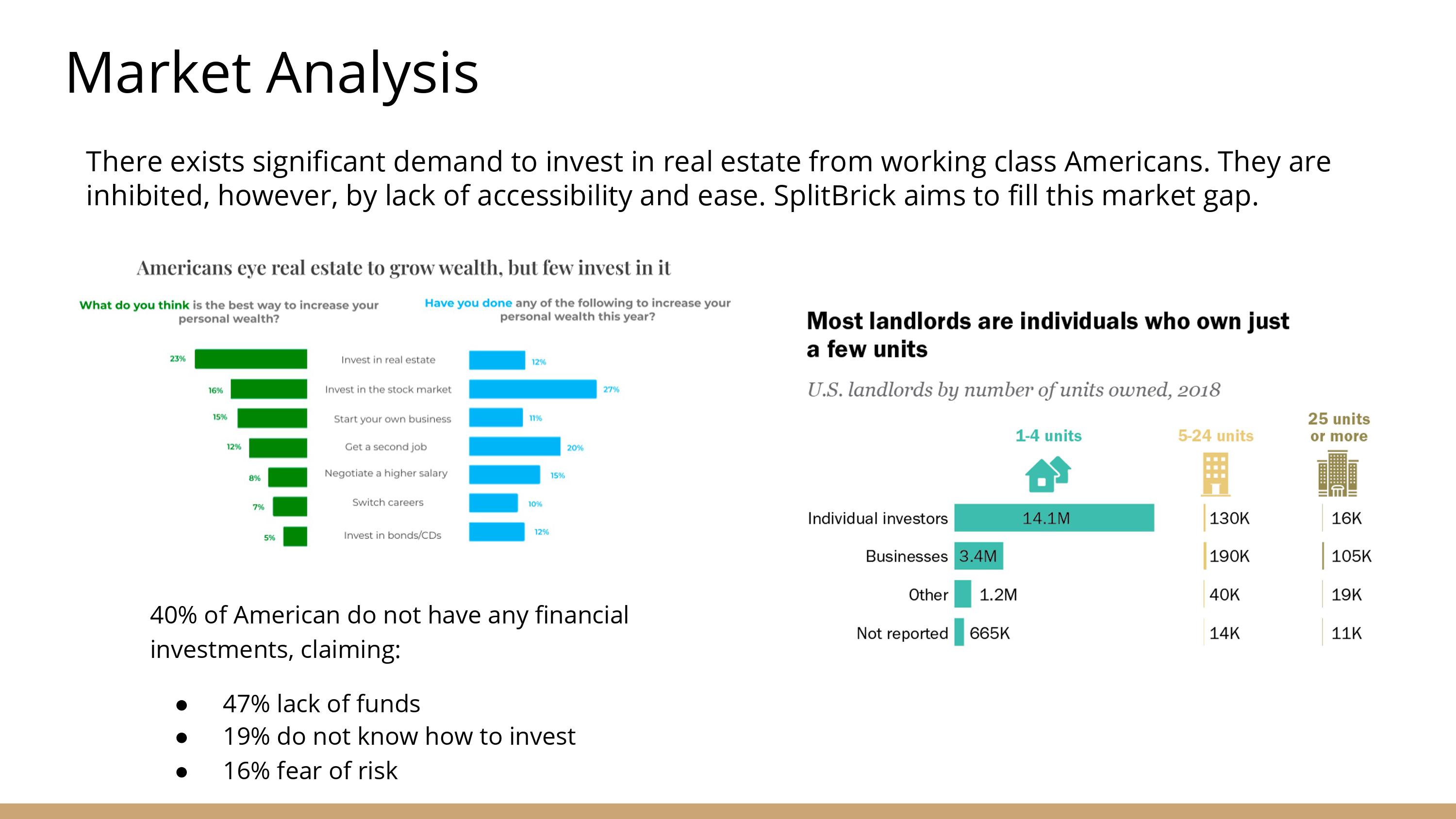

A clear view of the market

I’d have loved to see some sources here to show where the information is coming from, but if we take the numbers at face value, this slide does a great job of painting a clear picture of a market worth taking a closer look at:

[Slide 5] A clear view of the market opportunity. Image Credits: SplitBrick

An elegant take at a product demo

SplitBrick is a very early-stage company and has therefore only built an MVP. That can be challenging to demo, but the company found an interesting way to do it.

[Slide 15] In the appendix, SplitBrick shows off a user journey that’s easy to follow. Image Credits: SplitBrick

In the rest of this teardown, we’ll look at three things SplitBrick could have improved or done differently, along with its full pitch deck!

Three things that could be improved

As I mentioned in the introduction, I think this company is not really investable as it was presented. Here are some of the biggest challenges:

Huge legal and operational red flags

[Slide 4] A legal and operational nightmare. Image Credits: SplitBrick

Every step of this process has huge legal and logistical challenges. To start, there’s no vetting step to see whether the property is any good. In many property markets, real estate sells so quickly that I can’t imagine this process being fast enough to be successful. The buyer will likely not have heard of this, and so some random LLC (that hasn’t been incorporated yet) trying to put a bid on a property will likely cause confusion. Then, if the offer is successful, the LLC has to be formed, but the SEC may have a thing or two to say about how exactly this is implemented. Then finally, anyone who’s ever owned an investment property knows that property management and maintenance can be an utter nightmare. That isn’t addressed in any way in the SplitBrick business model.

Now imagine 100 people buying a four-unit property together as an investment and somehow needing to vote through a governance model on whether or not to replace a roof, who to appoint as a property manager, and who to rent the units to. To anyone who’s been a part of a slightly malfunctioning HOA, you know that this sounds like a nightmare. Based just on this slide alone, I made a mental note to run for the hills and never go close to SplitBrick as an investor. It sounds like a recipe for a large number of people getting caught in legal and operational gridlock for the rest of eternity.

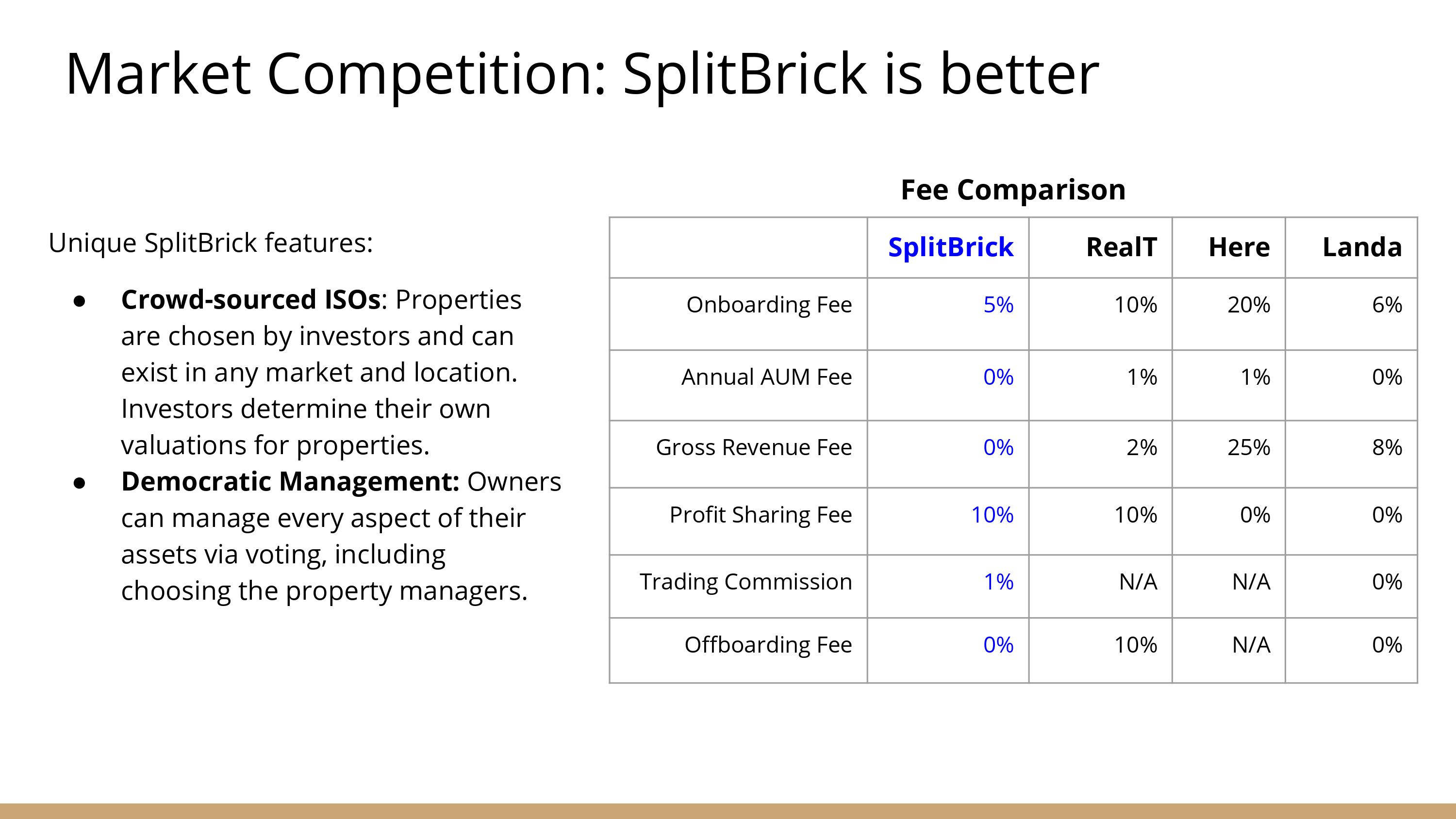

Competitive landscape

Real estate is a mature industry, and of course there are quite a few competitors in this space already that have solved aspects of this in elegant ways. But there are no competitors mentioned on the competition slide:

[Slide 6] Showing that you understand the market you’re entering can take many shapes. A solid competitor analysis is one of them. Image Credits: SplitBrick

More importantly, though, the competitor landscape misses some major, formidable competitors that are out there. Pacaso (PitchBook reports it has raised almost half a billion dollars), Arrived (which raised $60 million to date, including from Jeff Bezos), Lofty and many other players are out there. In addition, Fractional seems to have built something that sounds almost exactly the same as SplitBrick — and it’s raised almost $20 million.

Against this competitive landscape, and with the major legal hurdles SplitBrick is facing, without having explained how what it is doing is defensible, I’m not seeing any reason to invest in SplitBrick.

Lackluster team

The team is the one thing that sets early-stage startups apart from the competition. Sadly, based on this pitch deck, SplitBrick doesn’t tick that box:

[Slide 11] Is this the right team to back to build in this space? Image Credits: SplitBrick

A group of hungry, high-energy entrepreneurs can get a lot done, for sure, and I would be delighted to be proven wrong. However, this is an industry that is full of incredibly experienced, gray-haired billionaires. They may not be as tech savvy as a bunch of recent computer science graduates, but they aren’t stupid.

Launching something that is, at once, a blockchain-like solution, that’s also a marketplace, a fintech play, and a real estate company is not for the faint of heart. When I put on my investor glasses, I look at the whole slide deck and I get the impression that it’s a little on the naive side. There’s nothing in the deck that makes me think that the founders have found anything that’s new, innovative or marketable.

In the words of the investors on “Shark Tank”: I’m out. And I’d be very surprised if angel investors who understand the market would come to a different conclusion.

The full pitch deck

If you want your own pitch deck teardown featured on TC+, here’s more information. Also, check out all our Pitch Deck Teardowns and other pitching advice, all collected in one handy place for you!