When your home is damaged due to weather, fire or some other kind of disaster, all you want is to have it restored to the way it was. However, insurance claim responses can take some time, leaving you and your contractor waiting for weeks or even longer.

Enter iink, a digital payments network out to make it easier to get funds associated with multiparty property insurance claims. The Tampa-based company is integrating with mortgage servicing banks and insurance carriers to create an entirely digital and automated workflow to keep the restoration process moving along.

That work is buoyed by some fresh capital in the way of $12 million in Series A financing led by Headline. The firm was joined by Motley Fool Ventures, Chartline Capital Partners, Silver Circle Ventures and a group of existing investors.

When the company was founded in 2017, and up until 2022, iink was operating as a service business, Tom McGrath, co-founder and CEO, told TechCrunch. That’s mainly because his co-founders Ryan Holiday, Ken Lollar and Ryan Wetzel had experience as restoration professionals.

“They were trying to solve a problem that they themselves were dealing with,” McGrath said. “I came in from a product AI and machine learning background and around 2020, I said, this is a complex workflow that we can automate with technology or even a great UX/UI experience.”

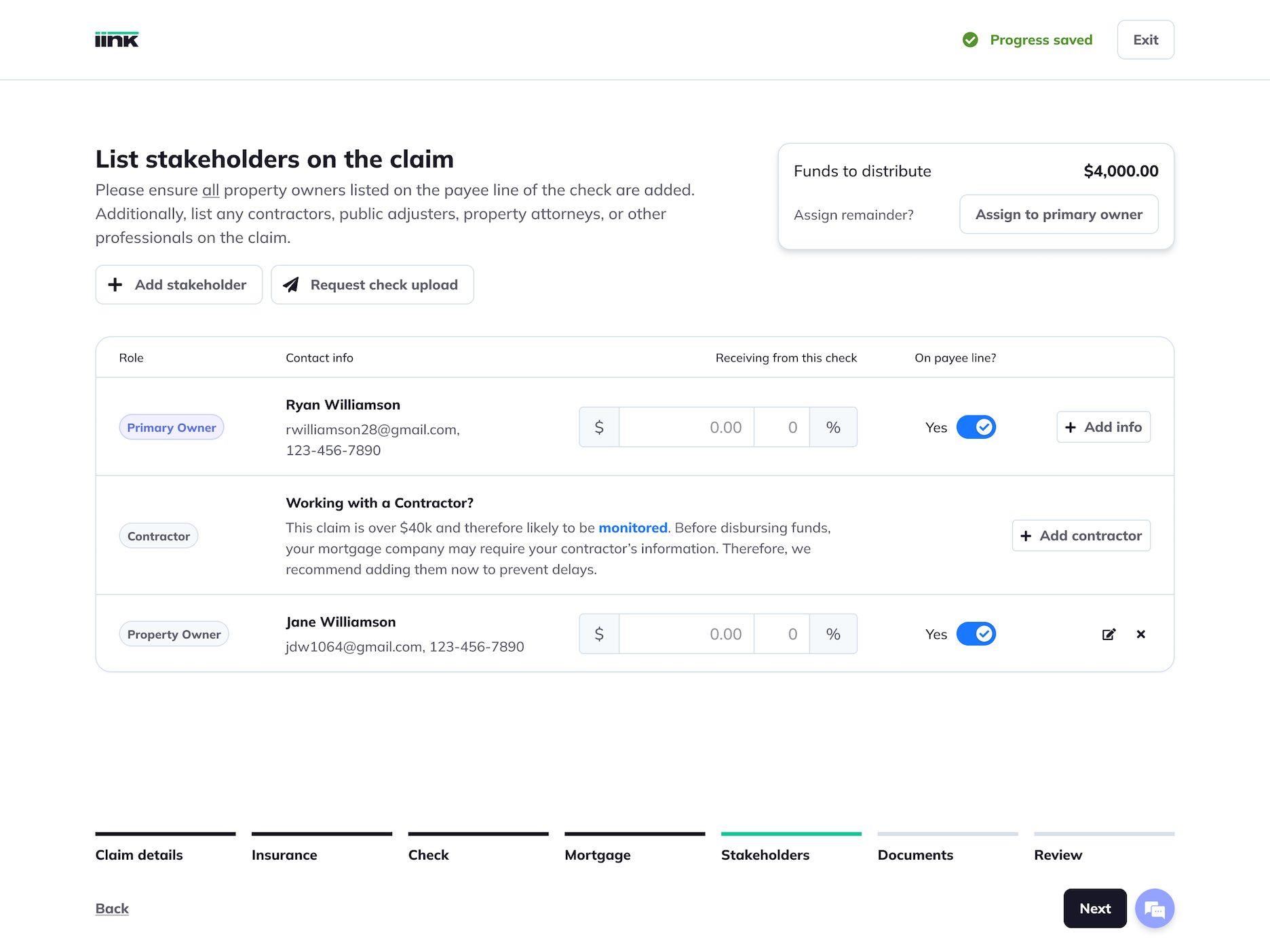

iink’s dashboard shows the stakeholders for each job. Image Credits: iink

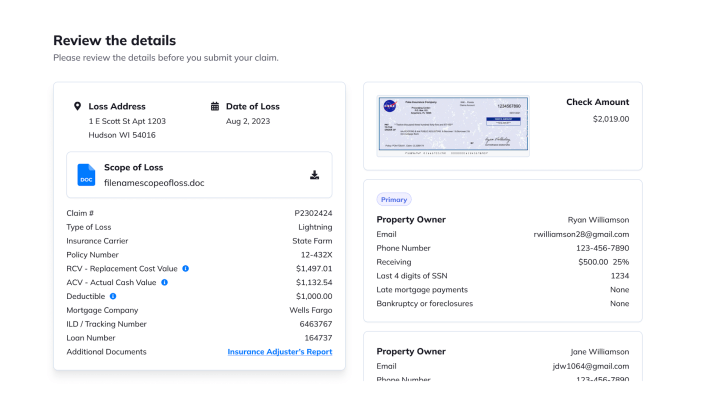

Restoration professionals or property owners still have to do much of the paperwork manually and go back and forth with calls to customer service agents. So iink set out to bring together into the company’s systems all of the guidelines, documentation and checks and balances that banks have in place. They turned it into something similar to TurboTax that would ask a series of questions used to expedite payments, McGrath said.

With its approach, iink knows the bank is going to release funds, so the company will provide the contractor with a line of credit. This solves two problems, according to McGrath: cash flow and administrative burden.

“Having to do all of the follow-up work is oftentimes what is passed off to the contractor,” he said. “What’s unique about us is that we’re not only helping you get the money from lending faster, but helping you pay that loan back quickly.”

iink’s three core products include the cash flow component, for funding in as little as two business days; remote deposit capture and payments, to easily get multiparty claim check processing completed; and the ability to let iink work with the mortgage company on the contractor’s behalf.

The remote check processing solution starts as a free tier with a one-time $299 set-up fee, while the other components can be added for a payment of up to 1.95% of claim check per month with some additional fees. The company also charges a monthly subscription fee for unlimited use.

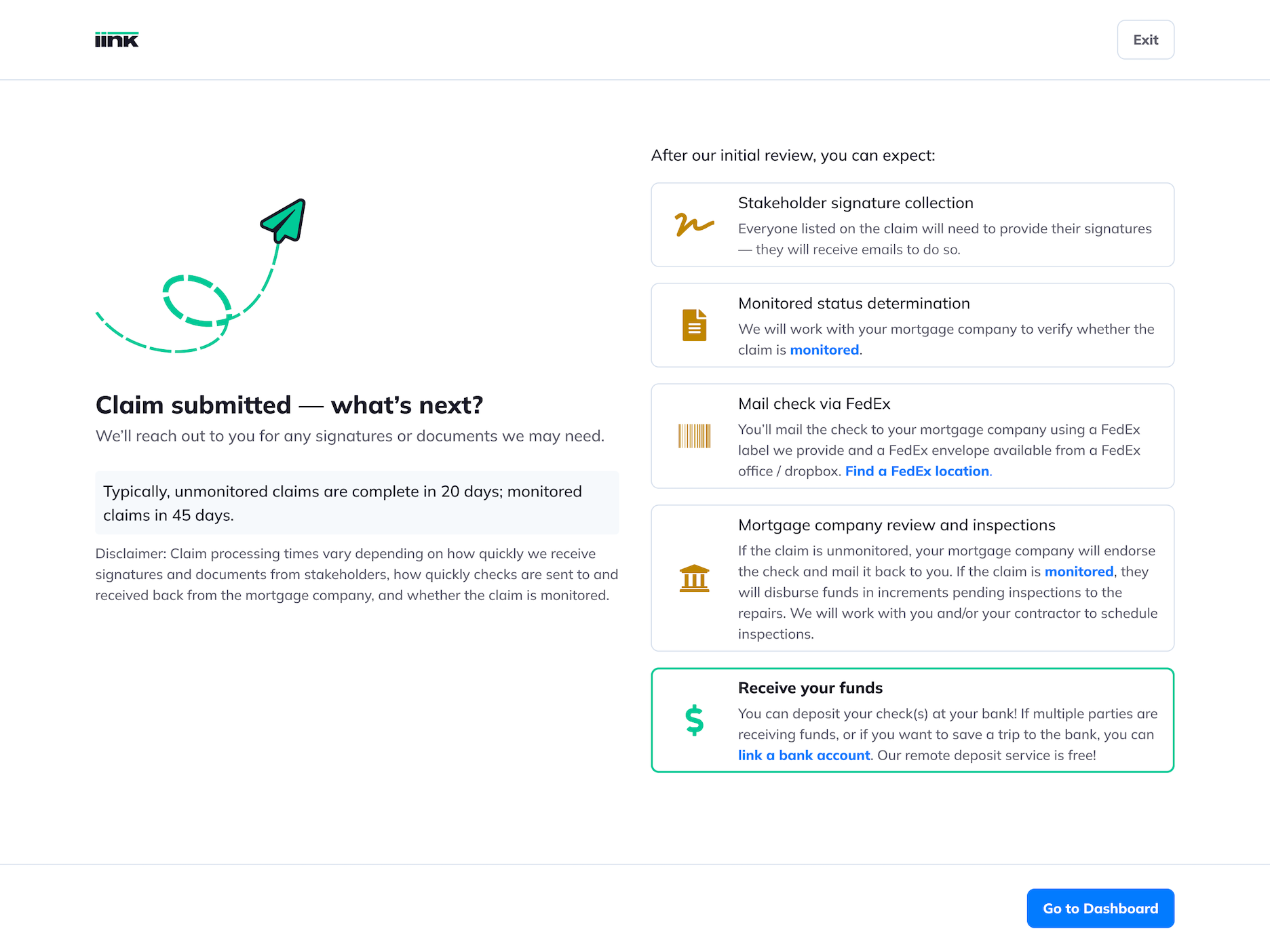

Once the claim is submitted by contractors, they are able to see next steps. Image Credits: iink

In the past 12 months, iink has doubled the number of customers it is working with and is averaging about $72 million in terms of insurance claim dollar volume it is processing. That amounts to a tripling in size of revenue, McGrath said.

Meanwhile, including the new investment, the company has raised around $23 million in total funding. Though McGrath declined to disclose iink’s valuation, he did say that it was an up round that tripled its valuation from the seed round.

“It was very unique, actually, we got about four term sheets for lead,” he said. “The first one that we got was actually for less valuation, and all my investors, for the most part, said that we should take it as it is a very difficult fundraising environment. We decided to take a risk and counter that we think that we’re worth more. Then we found Headline, who saw that potential, saw that growth and allowed us to get the right amount of capital that we needed to get the job done.”

The company intends to deploy the new funds into three buckets: scalability and automation, building the customer base and integrations and channel partnerships. It is also hiring both in the engineering and business areas.

“One of the reasons we named ourselves iink was because we just wanted to get rid of the paper check and the ink,” McGrath said. “By having those partnerships and more close relationships with the banks and carriers, my hope is to make it completely digital, and in a future state, something that’s instant so that no one has to deal with the lapse in time that they deal with today.”

Thurs., Oct. 19, 9:15 a.m. PST, edited to reflect that iink’s monthly insurance claim dollar volume processed is $72 million.