Shares of Tesla are off this morning in the wake of the company’s Q3 2023 earnings report. TechCrunch covered the company’s aggregate results here.

While Tesla’s results missed street estimates in both revenue and profit terms, there was much to like about the company’s quarter. Revenue was up modestly (9%), with Tesla’s non-automotive revenues (energy, services) growing much more quickly than top line from selling cars, showing the value of somewhat diversified revenue sources.

The Exchange explores startups, markets and money.

Read it every morning on TechCrunch+ or get The Exchange newsletter every Saturday.

And Tesla is still profitable. Despite a decline in its gross profit in the quarter, the company reported $1.85 billion in GAAP net income in the third quarter and free cash flow of $848 million.

So why is the stock selling off and analysts wringing their hands? Tesla has reduced the price of its vehicles in recent quarters. That has helped the company stick to its goal of delivering 1.8 million vehicles this year, but with a lower price point for much of its line, the company is under margin pressure.

So why is the stock selling off and analysts wringing their hands? Tesla has reduced the price of its vehicles in recent quarters. That has helped the company stick to its goal of delivering 1.8 million vehicles this year, but with a lower price point for much of its line, the company is under margin pressure.

As TechCrunch noted Wednesday after Tesla’s numbers first dropped:

Tesla reported gross margin of 17.9% in the third quarter, falling from 25.1% in the same period last year. It’s also down from Q2 when it reported margins of 18.2%.

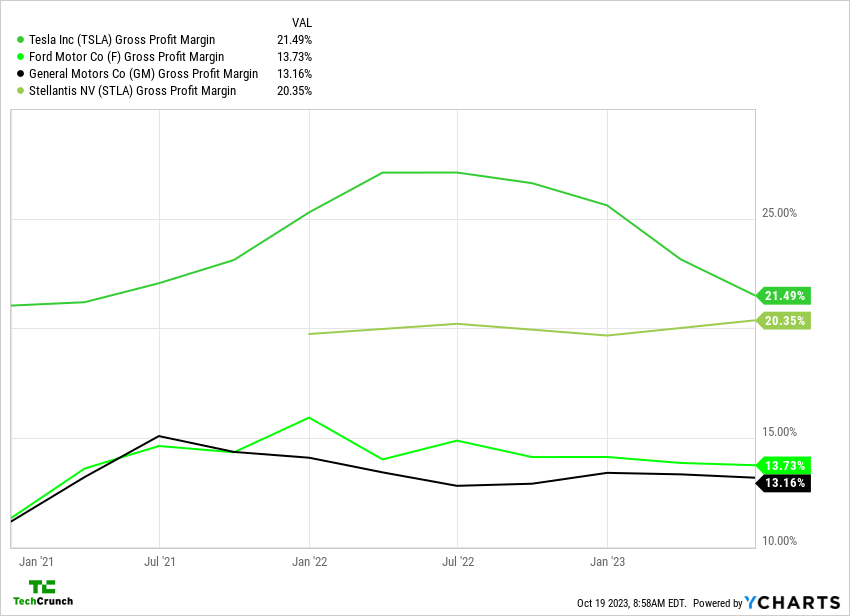

Where Tesla’s margins are going is not an idle question. The company has enjoyed gross margins far in excess of its major automotive rivals in recent years:

This chart does not include Tesla Q3 2023 data, and the other companies listed have yet to report their own third-quarter results, so take the data with a grain of salt.

What matters is that Tesla has managed better gross margins than its rivals for some time, though its lead has started to decline compared to Stellantis. Naturally, when comparing companies of this size, a blended gross margin figure is going to include a host of things that we might want to strip. Still, the trend appears clear even with that caveat, especially if we include the fact that Tesla’s gross margins ticked down to 17.9% in its most recent quarter.

Can Tesla keep making lots of money while cutting the price of its cars? During its earnings call, the company stressed an ongoing effort to reduce costs. Tesla’s CFO Vaibhav Taneja said that the company has a “a whole laundry list of things [it’s] chasing” to find places to reduce per-car costs, adding that the EV giant is “literally going line by line and saying, ‘How can we make it better?'”

CEO Elon Musk likened the situation to the popular “Game of Thrones” fantasy series, but one where the game being played is all about “pennies” and looking for places to save more of them.

The question I have is where to draw the line between reducing per-car costs and continuing to post outsize gross margins at Telsa. The company had a very interesting answer to how it is approaching that question during its earnings call. Here’s Musk during the conversation:

I keep harping on this interest thing, but I mean it just — [rising] interest rate[s] raises the cost of the car. I mean, we’re looking at internal analysis, which I know we think is more or less on track that when you look at the cost — or the price reductions we’ve made in, say, the Model Y and you compare that to how much people’s monthly payment has risen due to interest rates, the price of the Model Y is almost unchanged. . . .

The thing that matters is the monthly [payment] — it’s how much money do they have to put down and do they literally have that in their bank account or their check balance, and then what is the monthly payment. And it doesn’t matter how — if that monthly payment is principal interest or whatever, it’s just a number, and that number has to not cause their bank account to go negative.

So, going from near-zero interest rates to kind of the current very high interest rates, the actual monthly payment is basically the same. It’s just a bunch more of it is going to interest.

Tesla price reductions, then, are an effort to keep the effective monthly payment for its cars steady for consumers who use credit for their purchase. As interest rates have risen, the cost of money has risen. Thus, to borrow money costs more money. Consumers don’t have more, so Tesla has reduced the price of some of its cars so that their actual monthly expense is flat. To some degree this explains the continued, incremental price cuts at Tesla that we have seen lately.

For consumers, this is pretty darn cool. Flat cost of a Model Y on a per-monthly basis despite more expensive money? Killer. For Tesla, however, it’s a bit trickier.

Clearly Tesla can continue to generate tidy profits from lower-priced cars. But investors are anticipating the company’s results to take a ding from the trade-offs it is making — which we infer from the company’s share price falling Thursday in the wake of its earnings report — which is something for us to keep an eye on.

That’s because Tesla is not valued like other car companies. Here’s another chart showing what I mean:

If Tesla winds up valued like its automotive rivals, it would see its valuation dramatically cut. So it needs to perform not like a car company to keep its value high. Thus, seeing its gross margins contract, which makes it look a bit more like yet another car company, is worrying for its investors.