Peak XV Partners has invested $35 million in Neo, a fintech startup founded by industry veterans that is increasingly challenging incumbents including IIFL, Edelweiss and Waterfield Advisors, as the largest India-focused VC broadens its bets on wealth and asset management.

Neo operates a suite of wealth and asset management services, serving businesses, sovereign and pension funds and large family offices and individuals with ultra-high-net-worth. The firm, which began operations in 2021, has already amassed over a 1,000 customers, said Neo founder Nitin Jain in an interview.

The two firms reserve the optionality to extend the size of the investment, they said. TechCrunch reported in August that Peak XV was engaging with Neo for an investment. Neo earlier raised about $40 million from a list of undisclosed investors.

Despite being second only to China in high-net-worth individuals among BRICS countries, and being home to more than 14,000 ultra-high-net-worth households, India’s wealth management sector remains underdeveloped, plagued by a trust deficit and misaligned incentives.

Part of the reason is that the industry is often more geared toward product sales than tailored financial advice, said Jain, who like many of his co-founders and other founding members of Neo started the venture after long stints at investment giant Edelweiss.

The leadership team at Neo. Image Credits: Neo

On the advisory side, Neo serves as an extended CIO to multi-family offices, participating in their investment committees and offering views on asset allocation, corporate holding structure and taxations.

“We sit on their side. It’s slightly different from the classical wealth management practice as we are advising as well as selling products to them. So this is a very unique proposition,” he said.

The startup works with multiple relationship managers, providing them with additional resources and incentives that supplement their existing practices. Jain said he estimates that 350 to 400 RMs in India control 70 to 75% of assets. Neo will aim to attract about 100 of them in the next two to three years, he said.

On the asset management side, Neo focuses on long-term yield-based solutions in real estate and private credit for clients that are looking to generate an income from their investments.

Neo already has about $3 billion of assets under management, it said. The startup didn’t need new capital and doesn’t anticipate raising more than one more round in the future, said Jain.

Sakshi Chopra, an MD at Peak XV Partners, said the firm had been tracking Jain’s journey for over a year and in Neo it found the right combination of experience, expertise and opportunity.

“The founding team, they built asset businesses at Nuvama and Edelweiss, is very high-quality and this is all they have done through their lives,” she said in an interview, adding that the two firms began engaging about 15 months ago. “We share the philosophy on doing good for the people who trust us with their money.”

Having Peak XV becoming a partner will help Neo recruit high-quality talent, said Jain, citing the venture firm’s strong reputation and brand image.

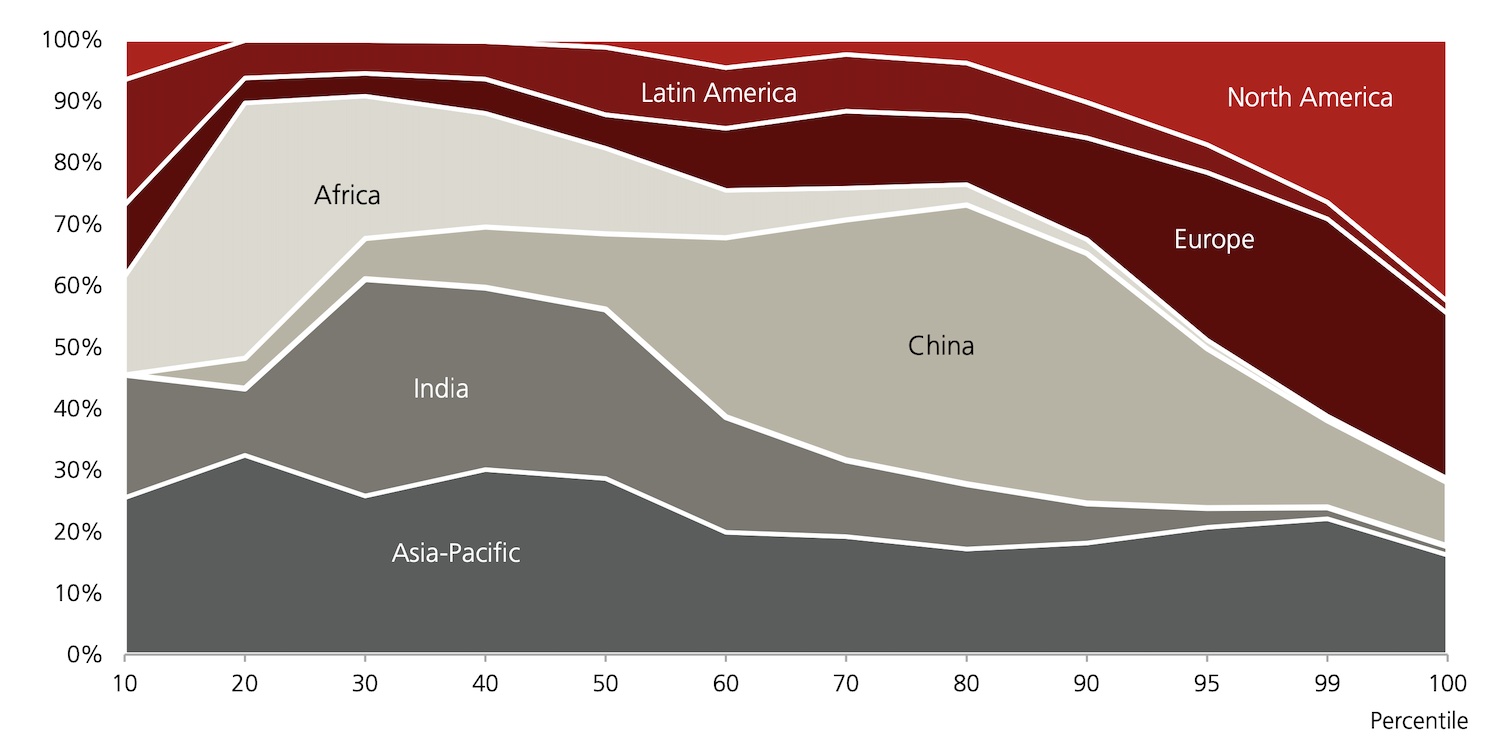

Regional composition of global wealth distribution in 2022. While the bulk of Indian citizens are located in the bottom half of the global distribution, high wealth inequality and a huge population means that significant numbers of Indian citizens also occupy the top wealth echelons. Data and Image: UBS

With the investment in Neo, Peak XV Partners is expanding its portfolio of startups that operate in the asset and wealth management category. The venture firm is also backer of CRED and Groww, though both are currently serving different sets of audiences.

And more players are gearing up to serve the market. Jio Financial Services — backed by Reliance Industries, run by Asia’s richest man Mukesh Ambani — in July said it had partnered with BlackRock to form an asset manager venture, called Jio BlackRock, that will aim to serve India’s growing investor base.