The world’s largest asset manager is re-entering India — and it’s doing so in a partnership with Asia’s richest man. Jio Financial Services and BlackRock have struck a deal to form a joint venture, called Jio BlackRock, aimed at serving India’s growing investor base.

BlackRock and Reliance’s finance unit are targeting an initial investment of $150 million each into the new 50/50 venture, which will seek to offer tech-enabled access to “affordable, innovative” investment solutions for millions of investors in India, they said.

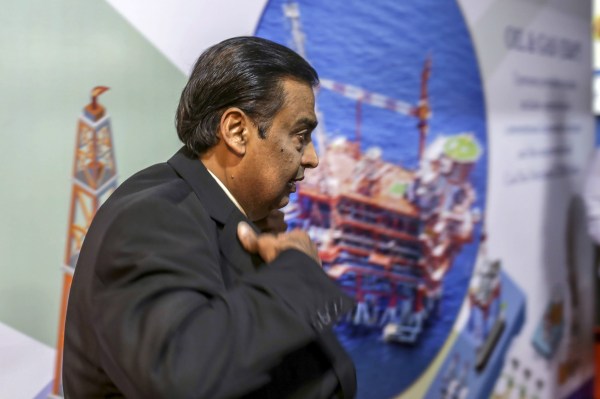

The joint venture gives a peek into billionaire Mukesh Ambani’s ambitions with financial services. In a surprising move last year, Ambani announced the demerger of Reliance Strategic Investments and Holdings and its listing as Jio Financial. Jio Financial Services, which was demerged last week, attained a valuation of about $20 billion in a special session conducted by Indian exchanges.

“This is an exciting partnership between JFS and BlackRock, one of the largest and most respected asset management companies globally,” said Hitesh Sethia, president and CEO of Jio Financial Services, in a statement.

“The partnership will leverage BlackRock’s deep expertise in investment and risk management along with the technology capability and deep market expertise of JFS to drive digital delivery of products. Jio BlackRock will be a truly transformational, customer centric and digital-first enterprise with the vision to democratise access to financial investment solutions and deliver financial well-being to the doorstep of every Indian.”

The venture will launch its operations after securing regulatory and statutory approvals, the two firms said. Some analysts believe that Reliance stands to benefit by leveraging the vast troves of consumer data it collects through Jio, the nation’s largest telecom network that reaches nearly 450 million paying subscribers. For BlackRock, the joint venture is the asset manager’s attempt to re-enter India, which it had left in 2018.

“India represents an enormously important opportunity. The convergence of rising affluence, favourable demographics, and digital transformation across industries is reshaping the market in incredible ways,” said Rachel Lord, Chair & Head of BlackRock in APAC, in a statement.

“We are very excited to be partnering with JFS to revolutionise India’s asset management industry and transform financial futures. Jio BlackRock will place the combined strength and scale of both of our companies in the hands of millions of investors in India.”