Europe has far too few VCs created by former founders, or “operators” as the industry often likes to call them. Yes, Atomico has Niklas Zennström. Firstminute Capital has Brent Hoberman. More recently Plural was created by Taavet Hinrikus (ex-Wise), Sten Tamkivi (ex-Teleport) and Ian Hogarth (ex-Songkick). But that “operator-turned-VC” list quickly runs out across the European tech scene.

But now that story switches to Bristol, England.

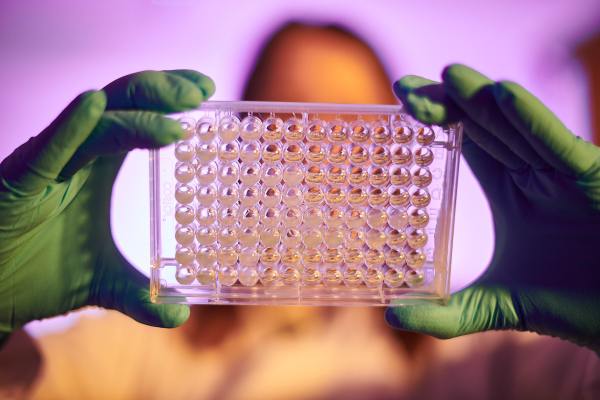

Harry Destecroix co-founded biotech startup Ziylo while studying for his PhD at the University of Bristol. Ziylo, a university spin-out, developed a synthetic molecule that binds to glucose in blood.

But to do this he decided he wanted to be surrounded by like-minded “SciTech” companies. So, in 2017 he launched Unit DX, an incubator, in collaboration with the University of Bristol, to commercialize companies like his own.

A year later, in 2018, Destecroix exited Ziylo to Danish firm Novo Nordisk — which had realized it could use Ziylo’s molecule to unlock a “smart” insulin — in a deal estimated to be be worth over $800 million.

Destecroix used his exit to repeat the exercise of creating deep tech, science-based startups, again, in Bristol. He launched “tech ecosystem” “Science Creates” consisting of the UnitDX and UnitDY wet labs, and a £15 million investment fund with the University and a network of strategic partners.

Fast-forward to today and Destecroix has now taken that journey further with the launch of SCVC, which is aiming to be a $100 million fund, and claims to have reached its first close (at an undisclosed amount). The Bristol-based firm will invest in deep tech around health and climate.

Over a call Destecroix told me: “It’s been two years and I feel like the more I’ve invested, the more I’ve got addicted to it. It’s been a wonderful journey. And I also feel there’s not enough founders in the U.K. that ended up going into venture. So we want to build a venture fund that’s really founder-led.”

SCVC’s first $17 million seed fund (prior to the switch to full-blown VC) backed 12 companies, ranging from therapeutics and diagnostics to quantum sensors and semiconductors.

Recent investments include “Delta g” (quantum gravity sensors), Isomab (biotech) and Scarlet Therapeutics (red blood cell-based therapeutics).

The new fund will invest at pre-seed and seed stage with initial cheque sizes of $500,000 up to $3 million. It will also provide follow-on funding of Series A tickets up to $7 million.

The fund’s first investment is VyperCore, a RISC-V startup developing modified processors. Destecroix is joined by SCVC co-founder Jon Craton, an angel investor and former co-founder of Zynstra, which was was acquired by NCR Corporation.

Bristol-based founder John Williams, co-funder of the floated Kudan (artificial perception technologies) joins as the firm’s first venture partner.

Destecroix explained: “What we do is we specialize in the 1% of startups that come from science, that seem crazy to the outside world. What do you mean you need to raise millions of pounds? What do you mean you don’t even know what your product is like? This. This type of startup is crazy to most people who run conventional businesses. So of course you need to wrap around them a very unique and specific set of skill sets.”

Prior to the recent news that the U.K. would be re-joining the EU’s Horizon science funding programme, Destecroix criticised Brexit.

“I definitely think it hasn’t helped,” he said. “It’s made it harder to fund a fund in terms of European investors… I feel like we need to be part of these bigger trading bloc’s to come together to really go after some of these very big issues like energy and AI.”

However, he backed the U.K.’s approach to AI: “I think the EU is over-regulating it and I think U.K. is taking a much more nimble approach. I’ve heard from startups from France who are thinking of moving to the U.K. We need to think of AI being applied to everything: government, life sciences, healthcare.”

The news of SCVC will be a shot in the arm for Bristol’s booming tech scene, which already boasts companies such as Ultrahaptics, Open Bionics, Graphcore and Immersive Labs.