Monday.com is continuing its streak of quick growth following its IPO.

In addition to reporting a 42% rise in its revenue for the second quarter of 2023, the cloud-based platform that lets users create apps narrowed its operating loss and net loss, and improved its cash generation. Investors seem to like the progress, with its stock up by nearly 15% this morning.

Notably, however, Monday.com is enduring the same sort of slowdown in net retention growth that we are seeing at many software companies. As a reminder, software-as-a-service (SaaS) companies grow by selling their products to new customers and by selling more products to existing customers. Monday.com, which charges on a per-seat basis, is one such company.

The Exchange explores startups, markets and money.

Read it every morning on TechCrunch+ or get The Exchange newsletter every Saturday.

Slower growth of net retention, a metric that includes existing customer churn and upsells, means it can be harder to increase your revenue and make it costlier to do so, as it is more expensive to sell to new customers than to juice existing accounts for more seats.

Slower growth of net retention, a metric that includes existing customer churn and upsells, means it can be harder to increase your revenue and make it costlier to do so, as it is more expensive to sell to new customers than to juice existing accounts for more seats.

The slowdown we’ve seen in net retention comes at a difficult time for many tech companies, looking to conserve cash while keeping growth warm. Startups, doubly so. So how did Monday.com delight investors while also seeing its net retention moderate? Let’s find out.

It’s not as bad as it looks

Monday.com reported revenue of $175.7 million in Q2 2023, but narrowed its operating loss to $12.2 million from $46.2 million a year ago. The company also managed to dramatically narrow its net loss to $0.15 per share from $1.01 per share.

Excluding one-time costs, Monday.com reported adjusted operating income of $16.6 million, far better than $15.4 million a year earlier.

The company also made impressive strides in improving its cash flows. In the company’s own words:

Net cash provided by operating activities was $47.6 million, with $45.9 million of free cash flow, compared to net cash used in operating activities of $14.1 million and negative $19.3 million of free cash flow in the second quarter of 2022.

A more than 42% improvement in revenue along with ample cash-generation makes Monday.com an outlier.

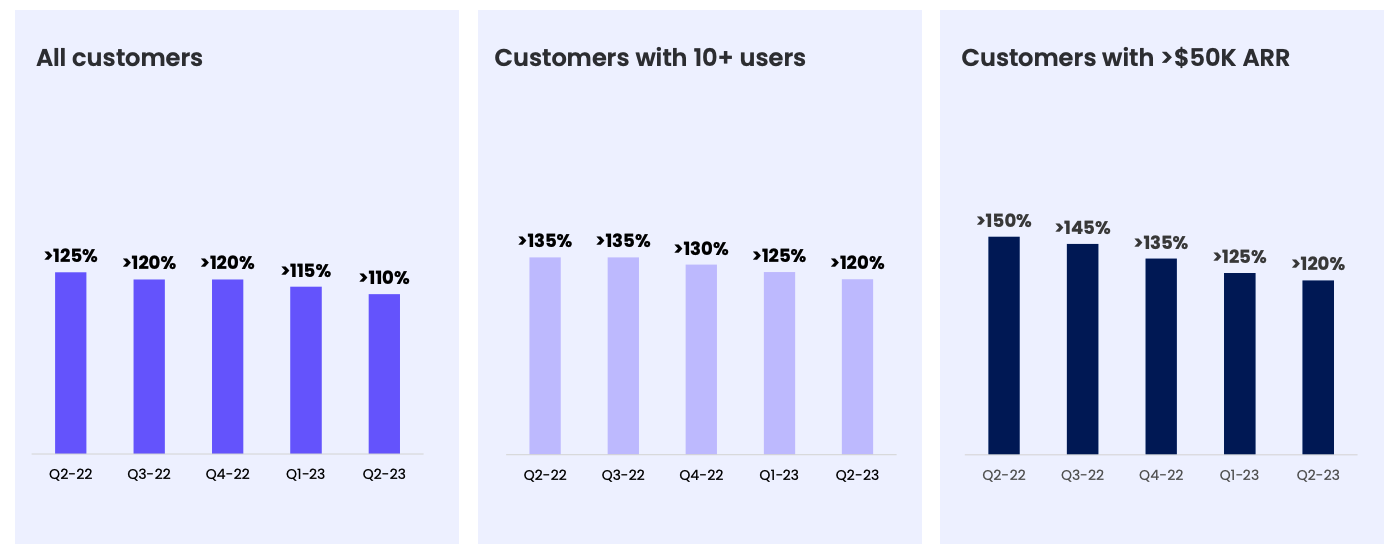

Driving that increase in revenue was net retention of more than 110% across all customers, and net retention of more than 120% at customers that use Monday.com for more than 10 users. Similarly, net retention was over 120% at customers who spend $50,000 or more with Monday.com every year.

Such numbers may look impressive on their own, but they’ve actually declined regularly in the past year:

Image Credits: Monday.com

The company expects net retention to be slightly below the 110% mark for full-year 2023, too, due to a “continued slowdown in customer seat expansions amid the challenging macroeconomic environment.” Considering that the metric is already at 110%, what does that portend for the company’s performance for the rest of the year?

Good news, it appears.

Here’s Monday.com’s CFO Eliran Glazer’s answer to an analyst question on the matter this morning on the company’s post-earnings conference call (emphasis ours):

We continue to expect moderate pressure on NDR throughout the remainder of the year. And by the way, we took it into account in our guidance, and we assume full NDR to be slightly below 110%. To your question, when we are expected to stabilize, so already going into July, we see signs of stabilization and we expect it to level off by the end of the year. Just as a reminder, because it’s a weighted four-quarter average, then there is a lagging effect.

The worst may be behind Monday.com.

It is hard to predict how things will pan out for the wider industry by only considering how an outlier company like Monday.com is doing. Still, when the CFO said that gross retention is stabilizing, you can’t help but hope that other software shops are having similar luck.

If you’re wondering how Monday.com grew so much if its net retention has declined throughout the past year, well, the simple answer is that it landed more customers. According to Glazer, the net retention declines were offset by strong customer acquisition.

To summarize, then, Monday.com is evidence that:

- It is possible for tech companies to post strong results even in an environment that’s not entirely conducive to increasing net retention.

- It is possible to do so without lighting bales of cash on fire.

Monday.com sets the bar high, sure, but it has shown that it is possible to achieve a good result in a difficult macroeconomic climate. Startups should take note and not allow themselves to be content with lesser metrics if a company at scale is doing this well. The good news is that sufficient product-market fit can make even a tough climate more than tolerable.

The lesson here is pretty simple: If a startup today wants a trailing revenue multiple over 10x, like Monday’s 12.66x, all it has to do is report better-than-expected top and bottom lines, generate lots of cash, consistently reduce expenses, and achieve GAAP gross margins of nearly 90%. That’s it. Easy-peasy.

Or not. But it is possible.