As more consumers look to cut costs and opt for a free streaming experience, services like Freevee, Pluto TV, Tubi, the Roku Channel and Crackle are seeing significant growth. According to Samba TV’s latest State of Viewership report, 1 in 3 U.S. users subscribe to free ad-supported TV streaming (FAST) services.

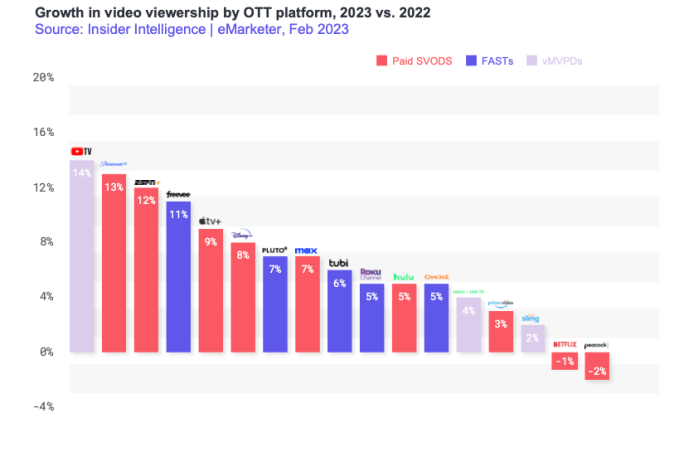

Notably, Amazon’s Freevee saw the highest viewership growth in the first half of 2023 compared to competitors, as it was up 11% year-over-year. Amazon has recently ramped up its focus on the FAST market, bringing hundreds of Amazon Original titles from Prime Video to Freevee, as well as 23 new ad-supported TV channels from Warner Bros. Discovery and MGM.

Meanwhile, Pluto and Tubi were up 7% and 6%, respectively, whereas the Roku Channel and Crackle were both up 5%. Fox-owned Tubi touted in its earnings call yesterday that its total consumption grew by 79%, further highlighting the demand for FAST services among viewers.

When we compared this to SVOD (subscription video-on-demand) streamers, a few major platforms saw declines. For instance, Netflix dropped 1% YoY, and Peacock saw a 2% decrease in viewership (maybe don’t kill your free tier, Peacock). Even Freevee’s sister streaming service, Prime Video, had a mediocre rise in viewership at only 3% YoY.

Cheaper ad-supported streaming options are also being favored over SVOD services. Samba TV reported that 1 in 4 premium streaming subscribers pay for an ad-supported subscription in 2023. Sixty percent of U.S. adults said they would consider subscribing to a “discounted” streaming service if it meant viewing ads, Samba TV added.

The recent findings come less than a year after Netflix and Disney+ introduced their ad tiers. According to the report, 85% of participants who are Netflix and Disney+ subscribers said that they signed up for the ads plan soon after it launched.

Netflix boasted the success of its ad-supported tier during its first Upfront presentation, revealing that, as of May 2023, the plan has nearly 5 million global monthly active users. For the second quarter of this year, Antenna recently reported that 17% to 20% of new Netflix signups were for the ad tier.

Prime Video may also be getting an ad-supported tier, according to The Wall Street Journal, which reported in June that the e-commerce giant apparently considered an option where existing subscribers would automatically get ads and would have to pay more for ad-free content.

“Streaming first hit audiences as an ad-free, content-when-you-want-it replacement to cable,” Samba TV writes. “But, as these a la carte streaming options swell, audiences are open to welcoming ads back in if it lowers their monthly costs.”

If premium streaming services continue to hike up their subscription prices, it won’t be a surprise to anyone if this trend of FAST and ad-supported streaming continues its ascent.