Short-form video platform Triller filed to go public last week while your humble scribe was on vacation to visit family. The lesson? Never take time off.

A privately backed tech company going public on the U.S. markets is welcome news. Sadly, while Triller is an interesting business, it may prove too small an offering to fully unlock the domestic IPO market for technology companies. Still, as with the Cava listing, a strong showing could further thaw the IPO market for private companies.

The Exchange explores startups, markets and money.

Read it every morning on TechCrunch+ or get The Exchange newsletter every Saturday.

Triller’s IPO is also interesting because it provides some nuance on the social video boom and the costs of content. However, because this company adopts a multipart approach to its market and has made several acquisitions, any comparisons to its chief competitor TikTok will prove limiting.

So, let’s dig into the company’s S-1 filing to find out how it’s faring and what’s in store in the months to come.

So, let’s dig into the company’s S-1 filing to find out how it’s faring and what’s in store in the months to come.

To work!

A short scroll through Triller

Triller’s S-1 filing is heavy on AI chatter. Calling itself a “global, artificial intelligence powered technology platform,” the app sits between creators, brands and their respective audiences. The company says it focuses on short-form video, “similar to TikTok, Instagram Reels, YouTube shorts” and other related services.

Triller also has loftier aspirations, saying it wants to “rebalance the equation” between creators and platforms, expand the total market for created content, and provide creators with a larger slice of the pie.

The company also appears serious about artificial intelligence, with the S-1 filing clearly stating: “Our proprietary AI and machine learning technology [helps creators] easily mix, edit and distribute music and video content to virtually any digital platform and enables them to understand and engage with their audiences at scale, while retaining control and authenticity.”

When it comes to encapsulating what’s happening in tech right now, that’s spot on.

TikTok has been praised widely for its algorithms’ effectiveness in helping users discover new material pertinent to their interests and so sends users to creators of all kinds. The model works, at least as far as the product is concerned. But Triller is more than just a short-form video app. It has bought a number of other companies in recent years to add services like music battles and mindshare (Verzuz), SMS-based creator-fan communication (Amplify.ai), fighting-related content (BKFC), and a SaaS service to connect brands and creators (Julius) to its business mix.

The Julius acquisition is of particular interest, as Triller has historically earned a vast majority of its revenue from brands. In 2020, 2021 and 2022, for example, brands accounted for 100%, 97% and 82% of the company’s total revenue, respectively. You can clearly see in the declining share of brands’ contribution to the pie that the company is trying to diversify its sources of revenue, but it still has a lot of work left to do.

But how much revenue is Triller bringing in? And what does it cost to pay creators in the manner it aspires to?

Idealism is costly

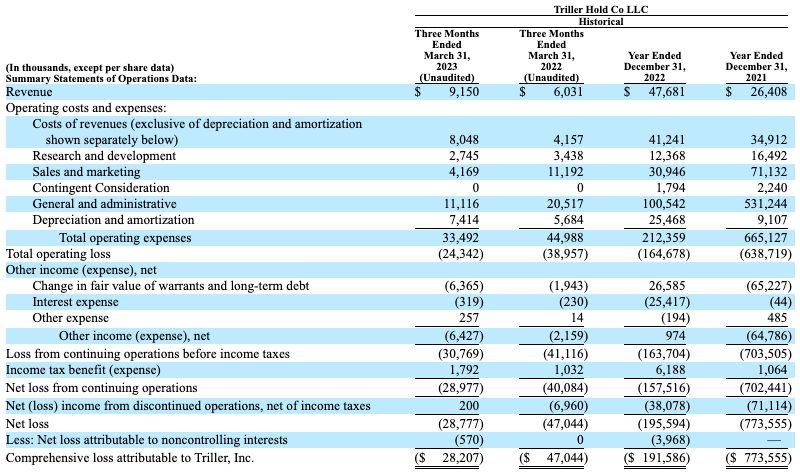

Here’s the core dataset:

Image Credits: Triller

For a company that’s going public, Triller boasts of pretty high revenue growth numbers: In the quarter ended March 31, the company’s revenue rose just under 52% from a year earlier — that’s akin to what some startups tend to report.

However, much of Triller’s recent growth came from acquisitions. In the quarter ended March, revenue gains were “primarily attributable to the acquisitions of BKFC and Julius, which contributed revenue was $2.8 million and $1.2 million, respectively,” the company said. Without those purchases, this growth story would look much more modest. Indeed, the company’s slower pace of creator and brand acquisition may indicate that the core Triller app is struggling to gain market share (data on pages 14, 135 and 136 of the S-1 filing contain more detail).

Turning to profitability, if you compare Triller’s topline with its cost of revenue, we can see that it is not generating much gross margin to fund its own operations.

This is partially due to how creator costs are accounted for. As the company writes (emphasis ours):

Cost of revenue is comprised of fees paid to Creators, performance and agency contracts, including media rights costs, as well as other license and royalty fees paid to third parties, hosting infrastructure and data center operations, personnel-related expenses for our customer implementation teams and contractors, including salaries and other related costs, service fees paid to third parties, and costs to host physical events, including staffing, materials and merchandise for sale.

Triller’s goal of paying creators more for their work does not come cheap, even if it does appear more equitable prima facie than what we see with other companies.

Still, the company is making serious progress in the gross margin department. In 2021, Triller’s costs of revenues were 132% of its total revenue, but that number fell to 86% in 2022. In the quarter ended March, it ticked up to 88%.

Similarly, Triller is slowly becoming more profitable, too. The company’s operating loss narrowed to 345% of revenue in 2022 from 2,419% of revenue in 2021, and in this latest quarter, improved to 266% of revenue.

Summing all that up, while a loss-making machine, Triller is operating in a busy and lucrative market. However, as its growth has lately been driven by acquisitions and its cost base casts long and dark shadows over its revenue, we’re doubtful that Triller’s IPO is the one that startups have been waiting for.

The market needs a bulletproof, name-brand unicorn to kick the IPO window open. Triller doesn’t quite fit the bill.