Charging an electric vehicle on a road trip these days can be challenging, but it doesn’t hold a candle to what fleet managers have to deal with.

Imagine dozens of trucks arriving back at the yard at the end of the day, all needing to be recharged by the next morning. Do you stagger the start times? That’s the cheaper option, but if a charger fails to start on cue, you’ll be down a truck the next day. Or do you start them all before you leave, ensuring availability but incurring thousands in demand charges?

These aren’t hypothetical cases. Katie Siegel and Sashko Stubailo, the founders of Flipturn, heard many such stories from fleet managers on the cutting edge of electrification.

“Fleets ultimately care about their bottom line and their cost per mile,” Siegel, the company’s CEO, told TechCrunch+. Electric trucks have lower fuel and maintenance costs, but managers can’t operate them the same way they run their diesel trucks. “There are a lot of problems that people immediately run into,” she said.

In the long run, some of the U.S.’ heavy-duty trucks may be powered by hydrogen fuel cells, but for short-haul operations like delivery and drayage at ports, batteries are likely to win out. Those trucks run very similar schedules, which means they are all likely to be plugged in at the same time.

The problems we touched on are just the beginning — as more fleets add more electric trucks, problems are bound to multiply.

But they don’t have to. One of the nice things about EVs is that both the vehicles and their chargers are packed with computer chips. Topping up an EV doesn’t mean pouring fossil fuels from a dumb hose. Chargers can be turned on and off remotely, which lends a significant amount of flexibility to fleet management.

To make the most of that flexibility, though, you’ll need software to manage those computer chips. That’s where Flipturn is hoping to come in. The company recently raised a $4.5 million seed round led by Accel, TechCrunch+ has exclusively learned.

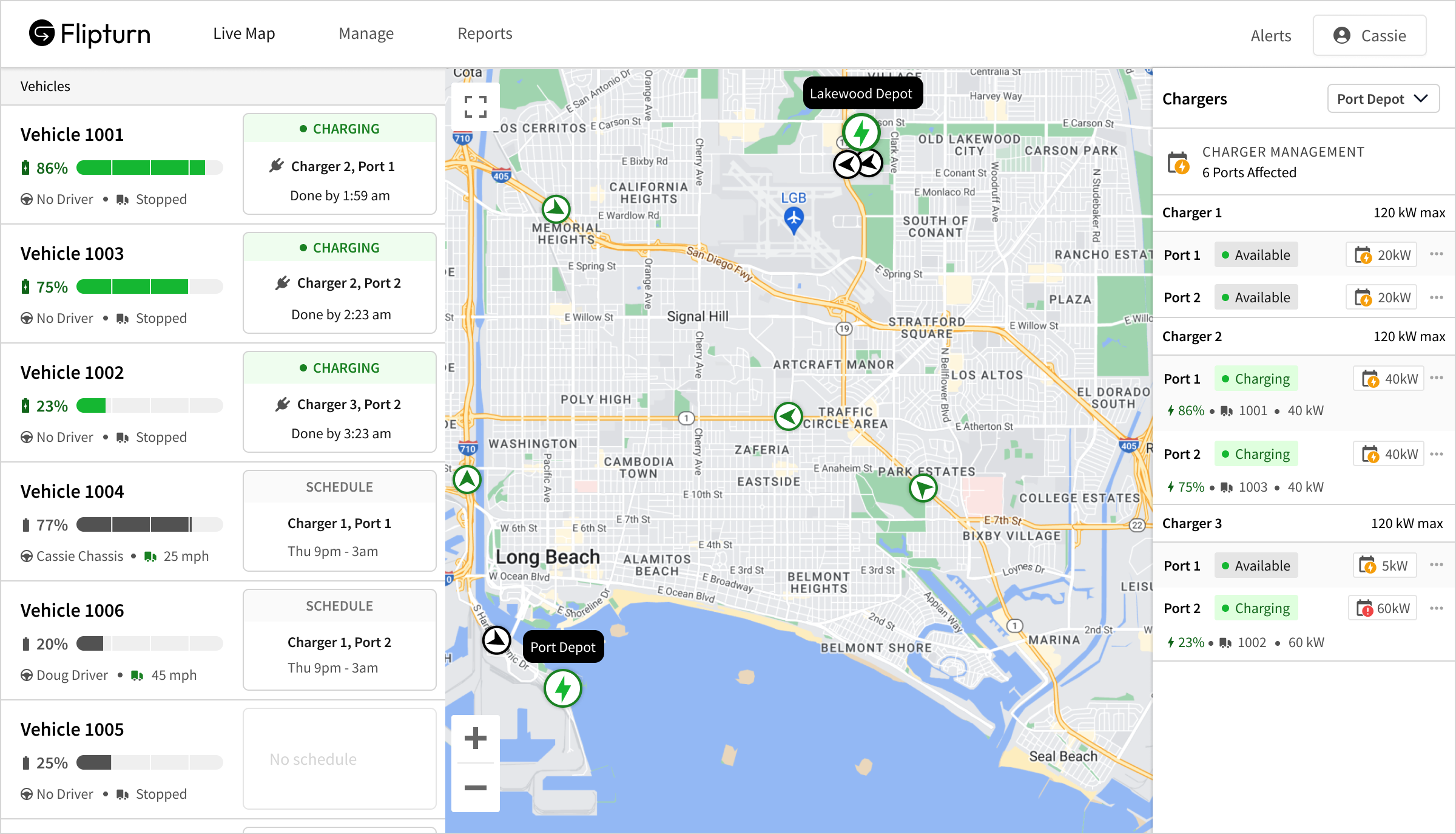

Flipturn Connect, the startup’s software platform, works with trucking companies’ existing systems, including telematics and chargers, and their utility data. It integrates that data to determine when trucks should be charged both to ensure their readiness and to lower operating costs.

Image Credits: Flipturn

The team is planning to make its platform compatible with existing fleet maintenance and routing software packages, as well as on-site distributed energy resources (like solar and batteries). “We’re not trying to replace those. We integrate with them,” Siegel said.

“No fleet is going to buy only one type of vehicle or one type of charger,” Siegel said. Remaining agnostic “is really important for the end user, our fleet customer.”

In addition to helping fleets optimize their charging schedules, Flipturn can determine their per-mile costs for both fossil fuel and electric trucks. Using telematics data and utility costs, the software can determine which routes are prime candidates for electrification.

Currently, the company is working with a number of fleets, including 4 Gen Logistics, a drayage company in Southern California that’s at the forefront of electrification, and Knight Transportation, one of the largest trucking companies in the U.S.

Siegel, formerly an engineer at fleet-management startup Samsara, clearly understands that fleet operators prefer to have some flexibility. Knight, for example, operates trucks from a range of manufacturers. It’s not too much of a stretch to imagine that preference extending to electric trucks and their chargers.

Flipturn’s agnostic approach contrasts with that of other, bigger players. Take Ford’s Ford Pro division, for example. The automaker recently acquired Electriphi, a software startup that supports a range of vehicle manufacturers. But the underlying tension is that Ford would be happiest if all Ford Pro customers bought Ford vehicles.

The same is true on the other end of the equation: Panion, a partnership between AWS and ABB, the Swiss company that makes EV chargers, is also hardware agnostic. But at the same time, ABB would probably prefer that Panion customers buy ABB equipment.

An independent outfit like Flipturn hopefully has no such conflict. The electric transition isn’t going to happen overnight in trucking — it’ll happen slowly, with fleet operators searching for the best deals. It’s hard to imagine brand loyalty playing a significant role in such buying decisions.

If Flipturn can seamlessly integrate the various players, it might be the one to garner some brand loyalty instead.