It has been a bumpy six months for the global startup ecosystem. It has been equal parts exciting and alarming to see the advancement of generative AI conversations with the breadth of applications increasingly understood.

It’s our view that we are coming to the end of the hype cycle, and startups, even those that previously didn’t have any generative AI plans, are beginning to look at immediate uses rather than just the moonshots and associated disruption it can cause, including in schools and workplaces.

Exploring immediate uses will help us make the micro-adjustments over time that ensure disruption is minimized once the longer-term projects begin to materialize. This theme has been well explored by others, so let’s turn to other developments in H1 2023.

We had the fall of Silicon Valley Bank, which caused significant discomfort but had limited meaningful, long-term scarring on the ecosystem, particularly in Europe, given the actions of partners and governments. In the U.K., this respite was provided by HSBC, which stepped in to ensure stability for thousands of startups across the country, but minimal disruption was felt in the European Union, given the bank’s limited presence in the markets.

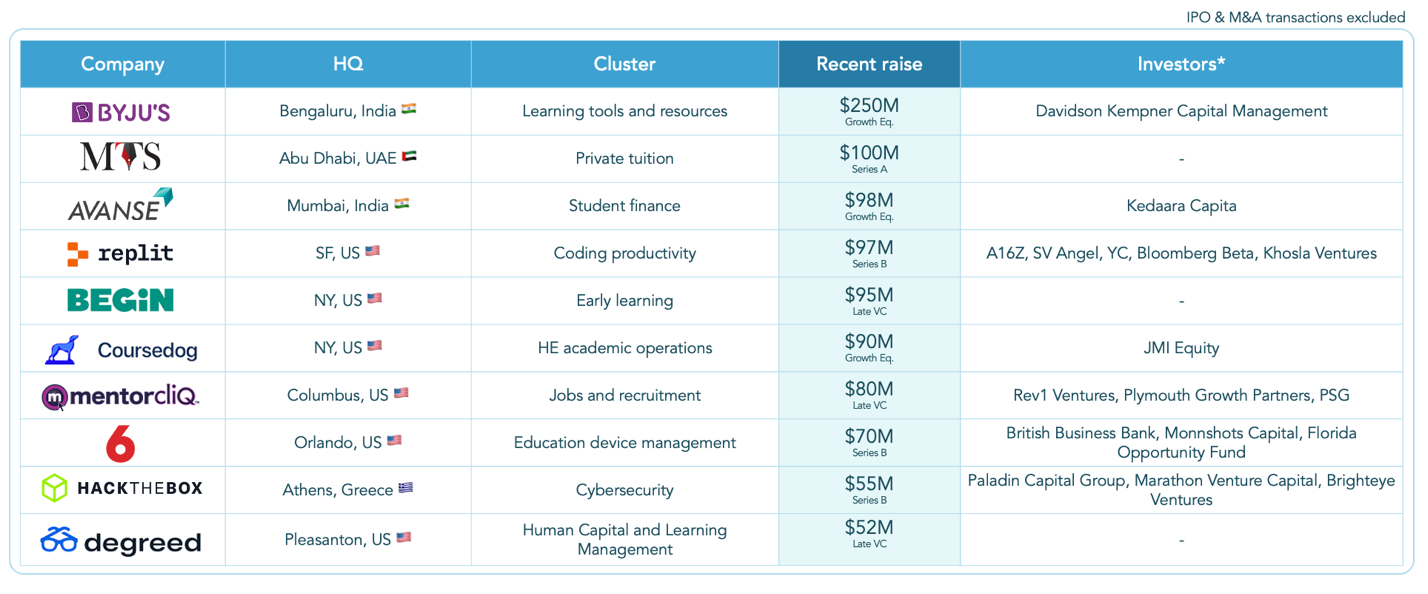

Edtech companies that raised rounds in H1 2023. Image Credits: Brighteye

Turning now to global edtech, the market has continued to stutter, exemplified by Chegg’s fluctuating valuation, kicked off not by unexpectedly negative results but by merely acknowledging the risks of generative AI to the business.

Let’s take a closer look at what happened in the European edtech ecosystem. Here are our five key takeaways.

Using this segue into Europe, the announced $1.7 billion privatization of Norway/U.K.-based Kahoot by a Goldman Sachs–led group presents a bright start to H2 2023, with the compelling cash offer representing a greater than 10x multiple on revenue. The deal spotlights a trend we anticipated in our annual report in January — growing M&A activity as companies begin to favor exits over raising down rounds and risking becoming zombies.

Overall, however, we expect a minor increase in European activity in H2 2023. H1 2023 saw increased funding than the previous period in H2 2022 and many of the companies that raised big rounds in early- to mid-2021 will be coming back to the table to raise more funding.

This should not be seen as signs of health in the ecosystem, however — what will be more telling will be:

- The basis on which these companies are raising (to seize opportunities or to stay afloat).

- Whether these companies are raising more or less funding than their previous rounds.

Let’s take a closer look at what happened in the European ecosystem. Here are our five key takeaways:

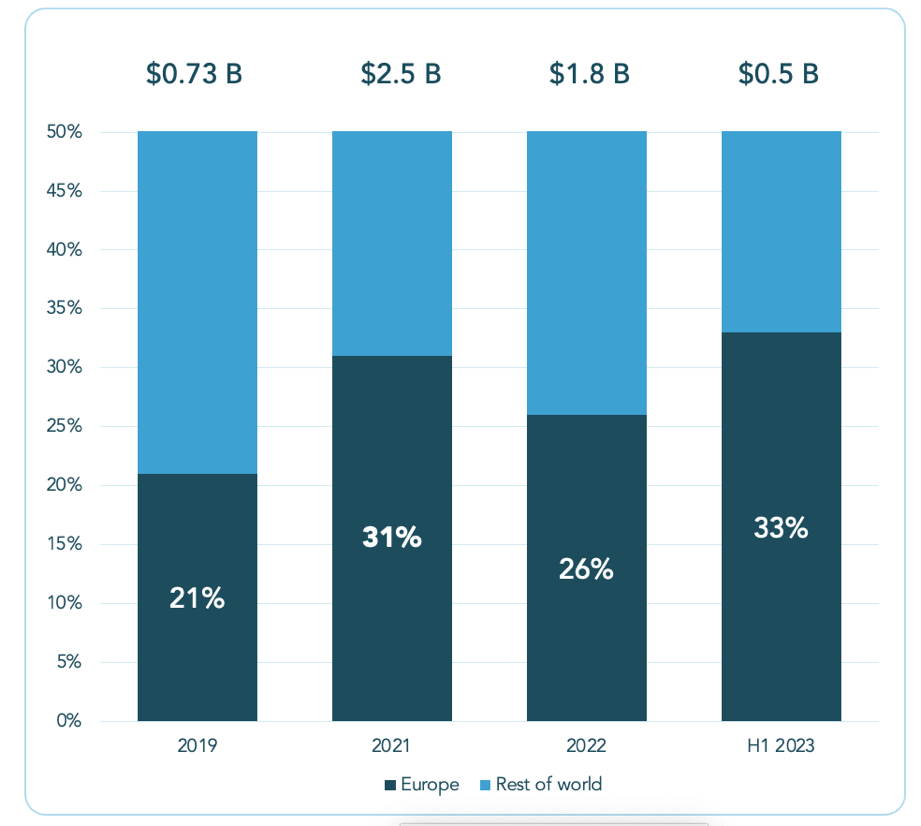

One-third of global edtech deals done in Europe

It’s positive to see the European edtech market holding firmer than other major markets in North America and Asia in terms of deals activity, but activity by funding and deal count is down across the board.

European edtech has a larger portion of a smaller pie:

European edtech has a larger portion of a smaller pie. Image Credits: Brighteye

H1 2023 saw more funding and higher average deal size than H2 2022

Though the pie has gotten smaller, the European ecosystem has had a better H1 2023 than its H2 2022, with more funding and higher average deal size than the prior period. In H2 2022, the European edtech sector secured $0.4 billion, but this marginally increased to $0.5 billion in H1 2023, despite few large deals.

This can hardly be described as a jumpstart, however: The increase is significant, though not enough to signal a rebounding market.

Only one $250 million+ deal, largest European deal only $55 million

As mentioned in earlier remarks, gone are the mega deals. Only one company raised more than £250 million globally in H1 2023, and this deal was relatively unusual in that it was a growth round for Byju’s rather than a company raising a mega-round to massively lift its growth.

The slowdown in mega-deals is even more acute in Europe, with the largest deal being Hack the Box’s $55 million raise.

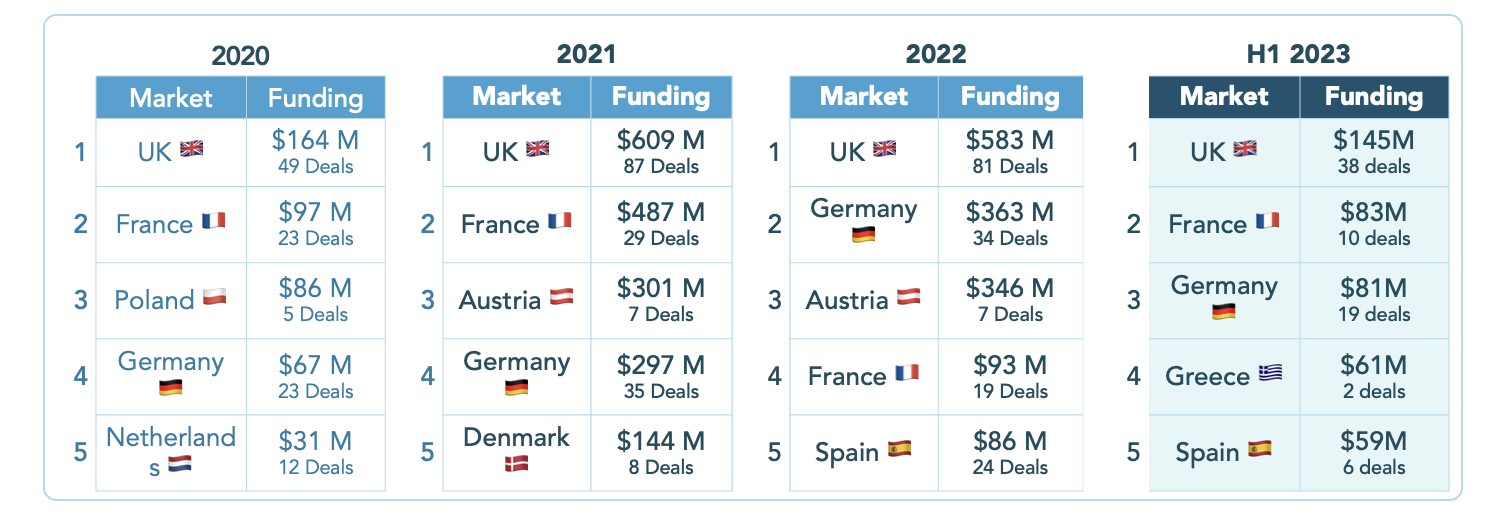

U.K. maintains top spot in Europe

Interestingly, in the face of the funding and deal slowdown, the prominence of specific European markets mirrors previous boom periods. The U.K. maintains its prominence as being the market with the most funding and most deals, maintaining its typical distance to Germany and France, which are in second and third, respectively.

It’s positive to see increasing momentum in Southern Europe, too, with Greece and Spain making up the top five (Greece largely propelled to prominence by Hack the Box).

Top five European edtech startups by funding, 2020–2023. Image Credits: Brighteye

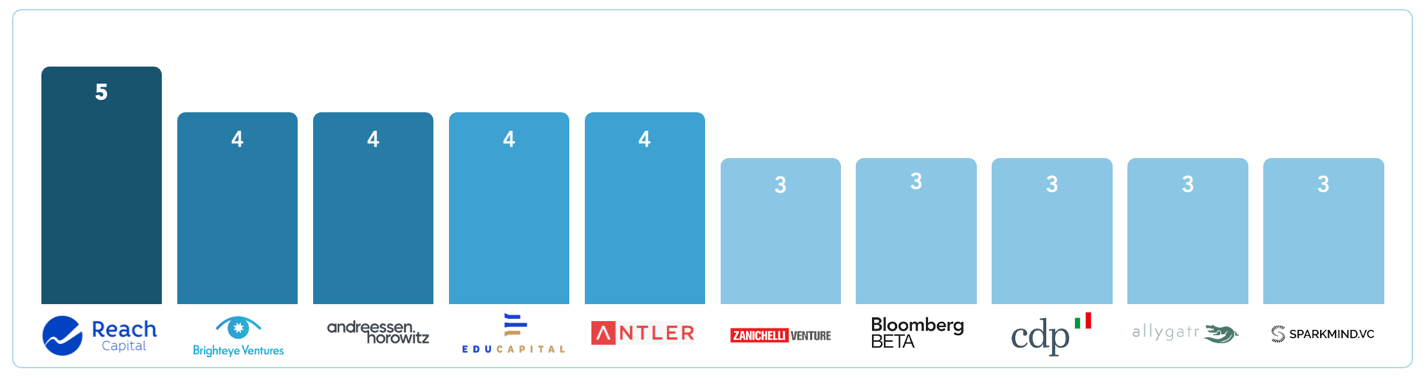

A period for edtech specialist investors

Both globally and at the European level, specialist investors have been significantly more active than generalists. This is unsurprising in the face of uncertainty, when investors need to be more convinced of their thesis than ever! That said, it’s intriguing to see Andreessen Horowitz occupying joint-second place in the most active edtech investors globally, having done the same number of edtech deals as Brighteye.

The most active edtech investors globally in H1 2023. Image Credits: Brighteye