InvGate, a SaaS platform offering information technology service management and IT asset management products, raised $35 million in a growth round to help it continue expanding globally.

The company was founded in 2009, and this is its first institutional funding round. The new investment comes after consistent 60% year-over-year growth for the past three years, Ariel Gesto, co-founder and CEO of InvGate, told TechCrunch.

“This year, we are on the same track for growth,” Gesto said.

The round was led by Riverwood Capital with participation from Endeavor Catalyst, a firm that Gesto said he has had a relationship with for years prior to the investment.

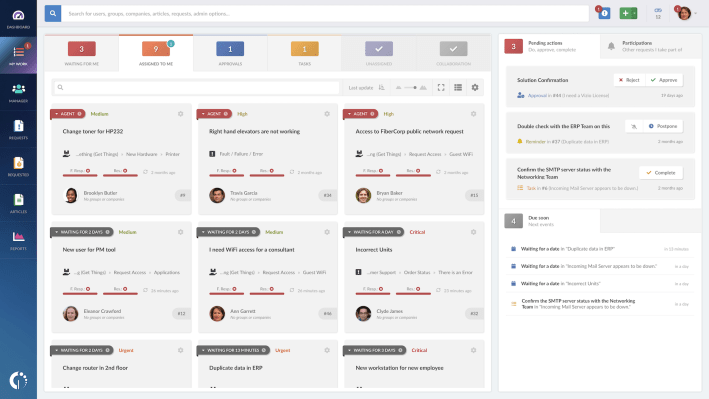

InvGate works with enterprise and midsize companies with a headcount of between 50 and 50,000, offering a SaaS solution to streamline their IT operations — for example, internal help desk, security compliance and financial planning — with new automation, low-code and AI-powered capabilities.

The company now has customers in 57 countries and has amassed a client list that includes the U.S. Army, NASA, Globant, KPMG, Toyota, Arcos Dorados and Grupo Coppel. A majority of the customers are in Latin America and the United States, but InvGate also had local operations in Buenos Aires, Mexico, the U.S. and the United Kingdom.

After being bootstrapped for 14 years, Gesto felt InvGate’s products were at the point where it made sense to scale the business.

Gesto intends to deploy the new capital into that global expansion, which will include further customer acquisition and implementation of local offices, as well as new hires to continue product and technology development.

“We’ve been creating our products to be ready for this moment,” he said. “We’ve been adding different types of technology in order to be prepared for the global expansion that we want to do. And on top of that, in the last few years, many of our customers who love the product have asked us why we have remained virtually unknown in the market. That insight said, ‘Okay, now is the time to find the right capital partner for us in order to grow and scale our business.’”