When engaging with our portfolio companies as well as with new investment opportunities, we’ve noticed that “profitability” and “efficiency” are two words that are often grouped with “growth” in every sentence.

Three months into 2023, investors continue to use buzz words like “responsible growth,” “business efficiency” and “quality marketing” when explaining how VC-backed companies should do business this year. That may be true, but there is no textbook for how a company can actively reduce its budget without slowing down growth in the near term.

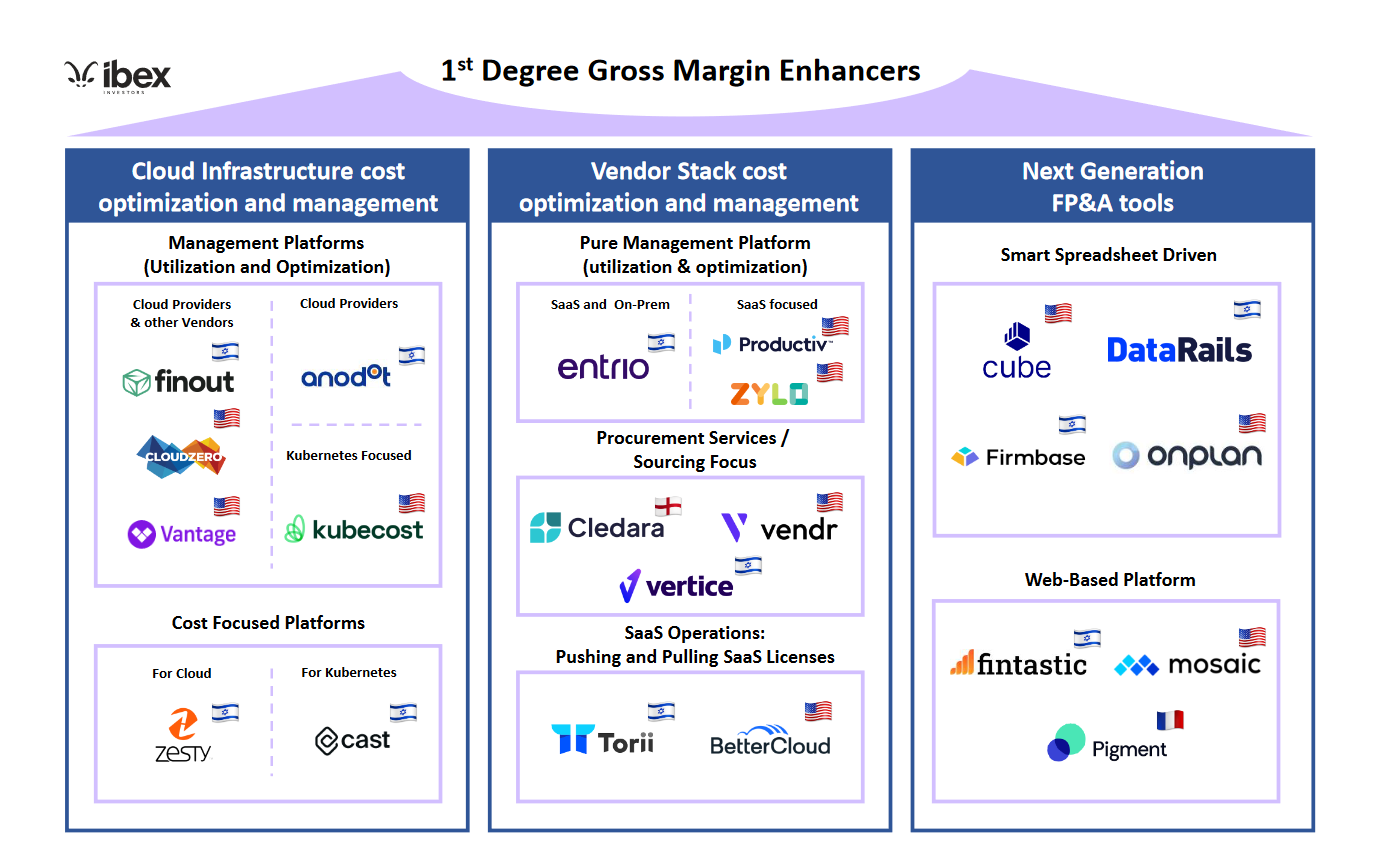

Over the past few months, we have examined, demo’d and reviewed over 30 companies that we define as “first-degree, gross-margin-enhancing businesses.”

What does this mean? The “first-degree” part of that has to do with the now. Investors are knocking at the door to see improvements every quarter. Companies that can help you with long-term efficiencies will not help you when you next look to raise money in six, 12 or 18 months.

The “gross-margin-enhancing” part of this definition is important because simply reducing costs in lieu of growth will not work. Likewise, maximizing growth with little sensitivity around costs won’t work in 2023.

Image Credits: Ibex Investors

In this article, we’ll look at emerging companies that can efficiently and effectively support organizations in their efforts to deliver growth while optimizing and managing costs in the near and long term.

Given the market right now, investors want to see companies following forecasts more than ever.

The value proposition of the companies in this mapping is to help businesses continue their growth journey while optimizing and reducing costs in their current business structure. That said, there is no-one-size-fits-all solution. For this reason, we have defined three key categories of gross margin enhancement:

- Cloud infrastructure cost optimization and management.

- Vendor stack cost optimization and management.

- Next generation FP&A tools.

Cloud infrastructure cost optimization and management

There is a constant struggle to balance stepping on the gas to improve product (i.e., raise cloud spend) and pushback from the CFO’s office when it is time to cut back.

CTOs and technical leads know how to cut cloud costs, but it can be difficult to pinpoint to what degree a certain change can negatively impact a company’s top line, not to mention the time it takes to execute reduction and optimization requests repeatedly. Companies want to continue to grow and do it rapidly, but they simply cannot allow themselves the freedom to flex their cloud spend like in past years.

Several companies are solving these problems with different focuses: Finout, Cloud Zero, Vantage and Anodot support both enterprise and middle-market end users and offer solutions to manage the cloud as well as Kubernetes. Some of these players provide solutions not only to support key cloud providers but also other cloud infrastructure vendors (such as Data Dog and Snowflake).

Other companies focus on more specific use cases. For example, Kubecost focuses on Kubernetes management. There are also companies that aim to help you cut costs: Zesty (for cloud) and Cast (for Kubernetes) fall in this space.

Putting aside the specific use cases, the companies mentioned here are creating true actionability tools that help you make immediate changes backed by predictions and insights. This is where cloud infrastructure management is going.

Vendor stack cost optimization and management

Vendor stack management is not a new topic by any means. But this has been on the back burner over the past two years for most growing or VC-backed companies, as the focus was on growth and limited attention was paid to the multitude of vendors and the dollar size of contracts.

The companies in this space are seeing a real shift as we transition to 2023. Software companies now need to:

- Get a grip on optimizing where they should continue to spend and where they can cut.

- Provide tools to make efficient and educated decisions on where new spending will be most effective and how much.

We see several companies tackling the issue from various angles for different customer types. Entrio has homed in on supporting enterprise customers throughout the stack, from SaaS to on-prem and other technology assets. With many companies still holding a healthy number of on-prem vendors, the solution offers holistic visibility and the ability to lower costs and minimize risk throughout the stack.

On the other hand, there are players that target pure SaaS stack management, such as Productiv and Zylo. They aim to help companies manage and reduce costs for mission-critical solutions with tools that provide visibility and insight into numerous key SaaS providers. Cledara, Vendr and Vertice have built businesses that have a procurement-service side, with which they source, price and execute SaaS contracts for their clients.

Lastly, we see companies like Torri and BetterCloud, which have built automation and technological solutions to help with the “pushing and pulling” of SaaS licenses.

Decisions on vendor spending can become extremely challenging when the IT department and CFO office are not aligned with the rest of the organization. The solutions that have emerged and are still emerging throughout this category allow for vendor insights to be democratized throughout fast-scaling companies.

As organizations scale, they need true visibility into how much and why they are spending on tools. They can no longer rely on the isolated opinions of specific divisions.

Next-generation financial planning and analysis (FP&A) tools

Countless companies in 2022 missed on both their top line as well as budget targets. Growing companies need to find a way to synthesize all their 2023 objectives and plans while sticking to numbers.

Given the market right now, investors want to see companies following forecasts more than ever.

It is not enough to use specific departmental tools that reduce cost or manage spend. Every company deals with the butterfly effect: A small change in the marketing department can cause a tornado six months later in the sales department and then a disaster for the finance department by the year’s end. This is why FP&A teams need to be aware and have visibility into each action, at each department and the potential effect on other teams.

The companies leading this space have engineered bullet-proof platforms that let FP&A teams organize, plan, communicate, pull actual data and execute financial plans. The companies in one subgroup — Firmbase, Datarails, Cube and OnPlan — have built intelligent solutions around smart spreadsheets.

Others, such as Fintastic, Pigment and Mosaic, are web-based platforms with their own calculation engines. Some of these also generate risk-derived optimization plans according to targets set by the platform user.

Optimizing costs without sacrificing near-term growth will affect companies both in up and down markets. To the best of our knowledge, generative AI cannot solve this (yet). We believe that first-degree gross margin enhancers can provide the necessary tool kit to support and ensure that companies can successfully do what is needed in the climate of 2023 and the time to follow.

Whether it be in cloud infrastructure, vendor stack or next-gen FP&A management, there is one common denominator: The businesses identified in this mapping support and provide the necessary technical framework to ensure transparency and alignment across the complex and differentiated departments within each organization.