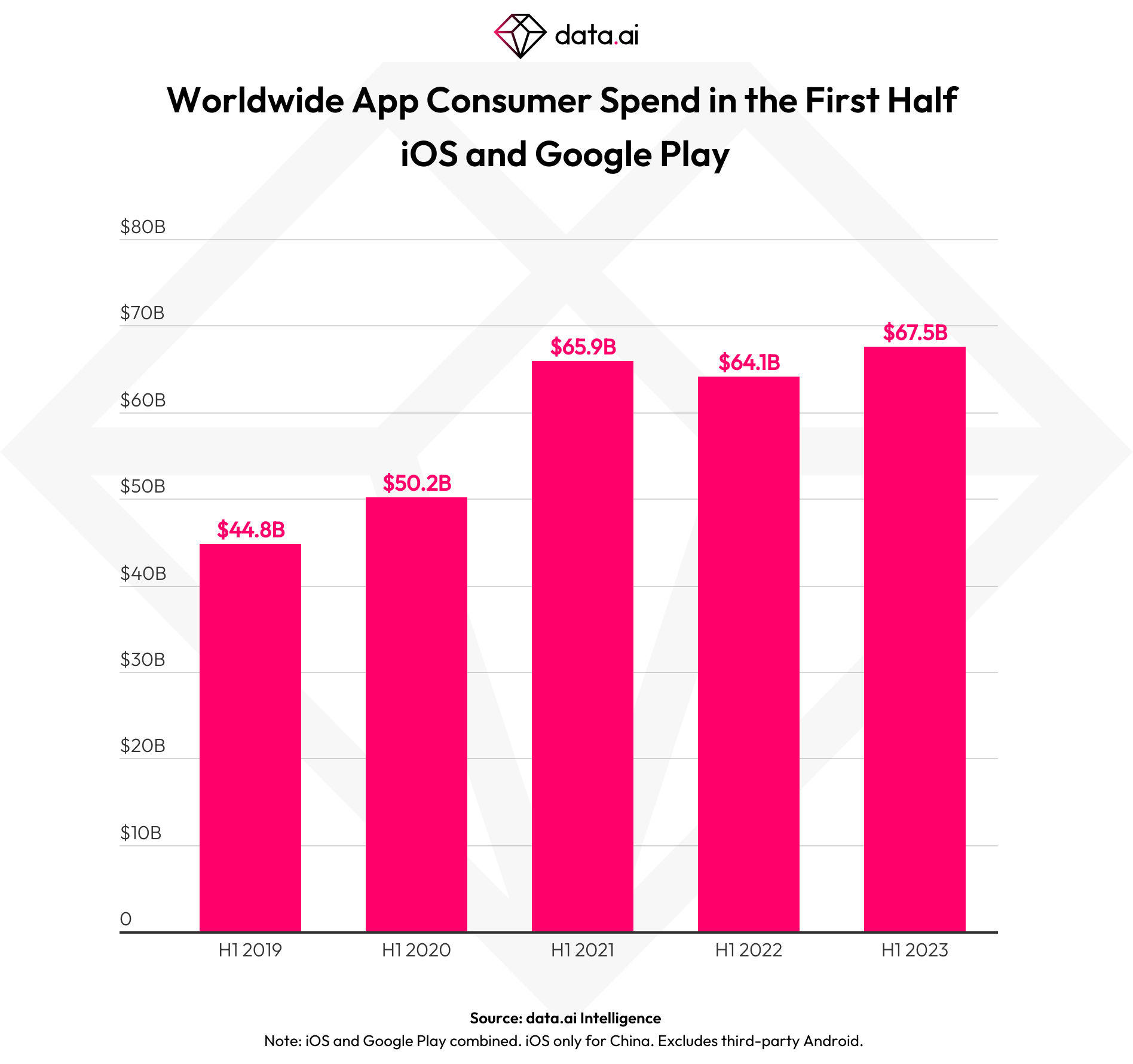

After a slowing of the app economy that saw consumer spending drop for the first time in 2022, things are starting to look up. According to a new report on in-app spending for the first half of 2023 from app intelligence provider data.ai, there’s once again positive growth in mobile consumer spending. The firm reports global in-app spending has rebounded with 5.3% year-over-year growth so far this year, reaching a record $67.5 billion for the first half of 2023. Downloads were also up by 3.2%.

That’s good news for app developers, publishers and marketers who rely on the app ecosystem’s revenues to sustain their businesses.

Image Credits: data.ai

Data.ai now attributes last year’s decline to consumers “battling inflation,” which had created a “temporary blip” in the long-term sustained growth of the mobile app market, as opposed to something more endemic to the app ecosystem itself — like global markets reaching a point of saturation in terms of consumer spending, for example.

Last year, consumer spending had declined by a slight, but worrying, 2% to $167 billion. It was the first slowdown since the launch of the App Store and came a year after the app market had seen 19% year-over-year growth in 2021. Data.ai’s 2022 findings were based on consumer spending across all app stores, including third-party Android app stores in China, including paid app installs, in-app purchases and subscriptions.

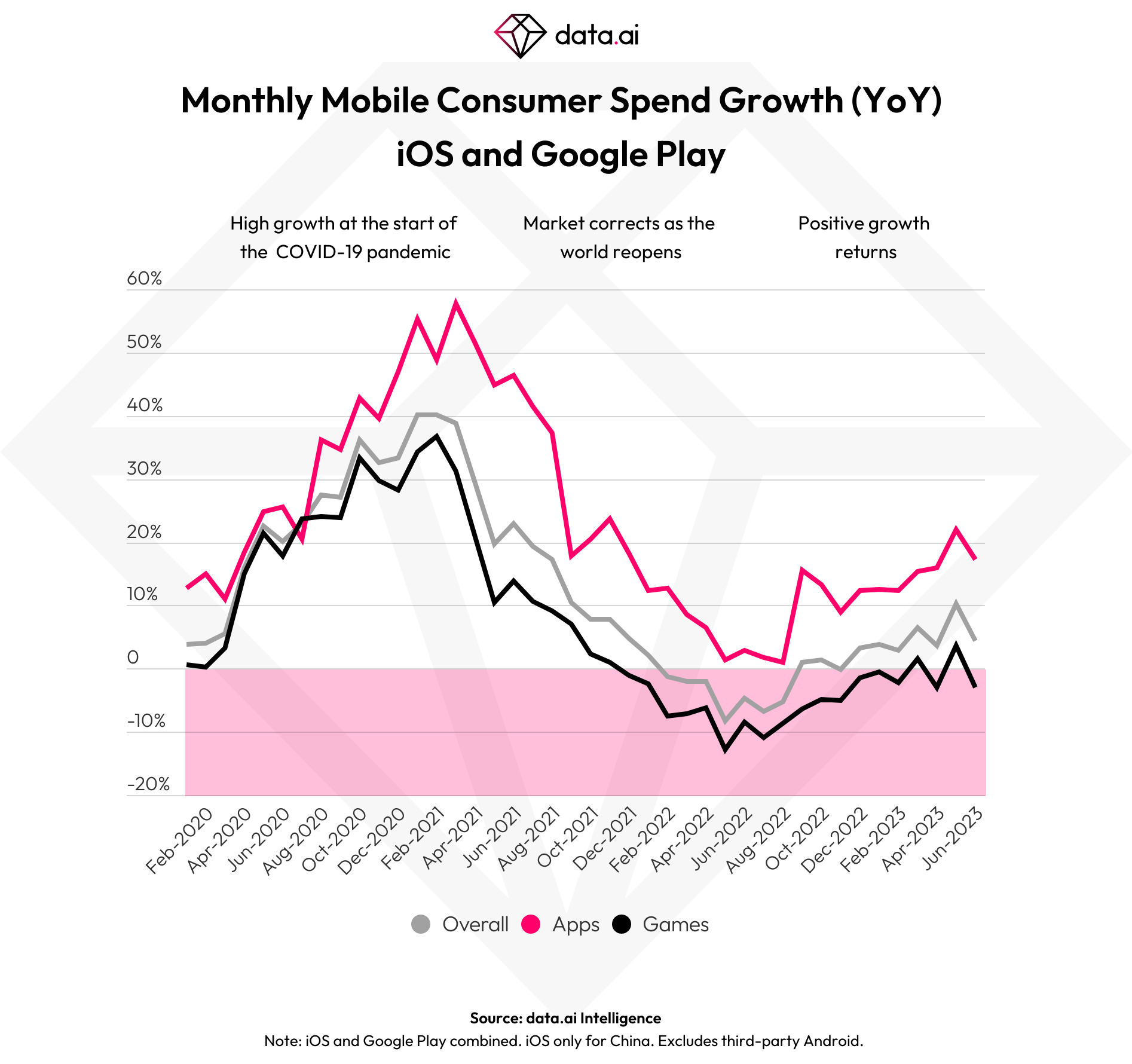

At the time, data.ai CEO Theodore Krantz remarked how “macroeconomic factors” had been “dampening growth in mobile spend.” However, it wasn’t clear if the decline had been a short-term correction to the rapid growth following the COVID-19 pandemic or a sign the market had peaked, data.ai today explains. The new analysis proves it appears to be the former which — combined with other factors, including inflation — had tightened consumers’ wallets.

The positive growth in consumer spending actually began in late 2022, as is typical around the holiday season as people buy new phones and tablets as gifts and have more free time on their hands to download, use and spend on mobile apps and games.

Image Credits: data.ai

That growth continued into the first half of the year as consumers spent a record $67.5 billion on apps and downloaded 76.8 billion apps globally across the iOS App Store and Google Play. (This analysis does not include the third-party app stores as the full-year report does, we should add.)

Consumer spending was up 5.3% year-over-year during the first half of 2023 with 16% growth in apps, while spending in mobile games remains roughly even, data.ai says. While the lack of growth in games could be concerning, the firm believes growth is likely to soon return to this segment of the market as positive growth had already been seen in March and May 2023 after an earlier low point of -13% in May 2022. The current growth rates for games look similar to that at the start of 2020, ahead of the COVID-19 pandemic, in fact.

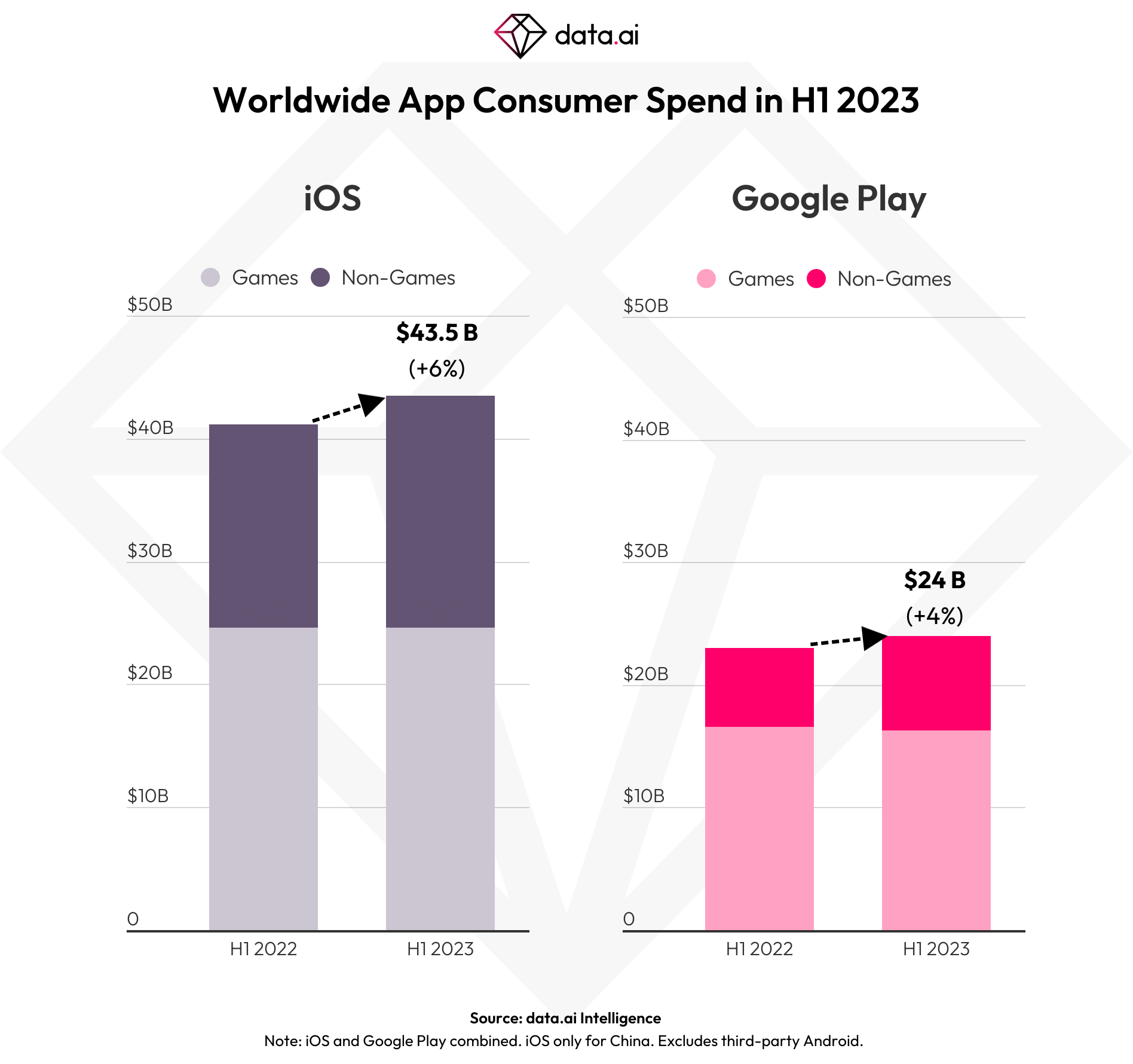

iOS growth was also ahead of that of Android, as consumer spending on the App Store was up 5.8% year-over-year in the first half of 2023, while Google Play grew 4.3%. That works out to $43.5 billion in consumer spending on iOS and $24 billion on Android. In addition, iOS accounts for nearly 65% of the total app store spending combined, and even higher in non-gaming apps, where it’s 71% of the spend.

Image Credits: data.ai

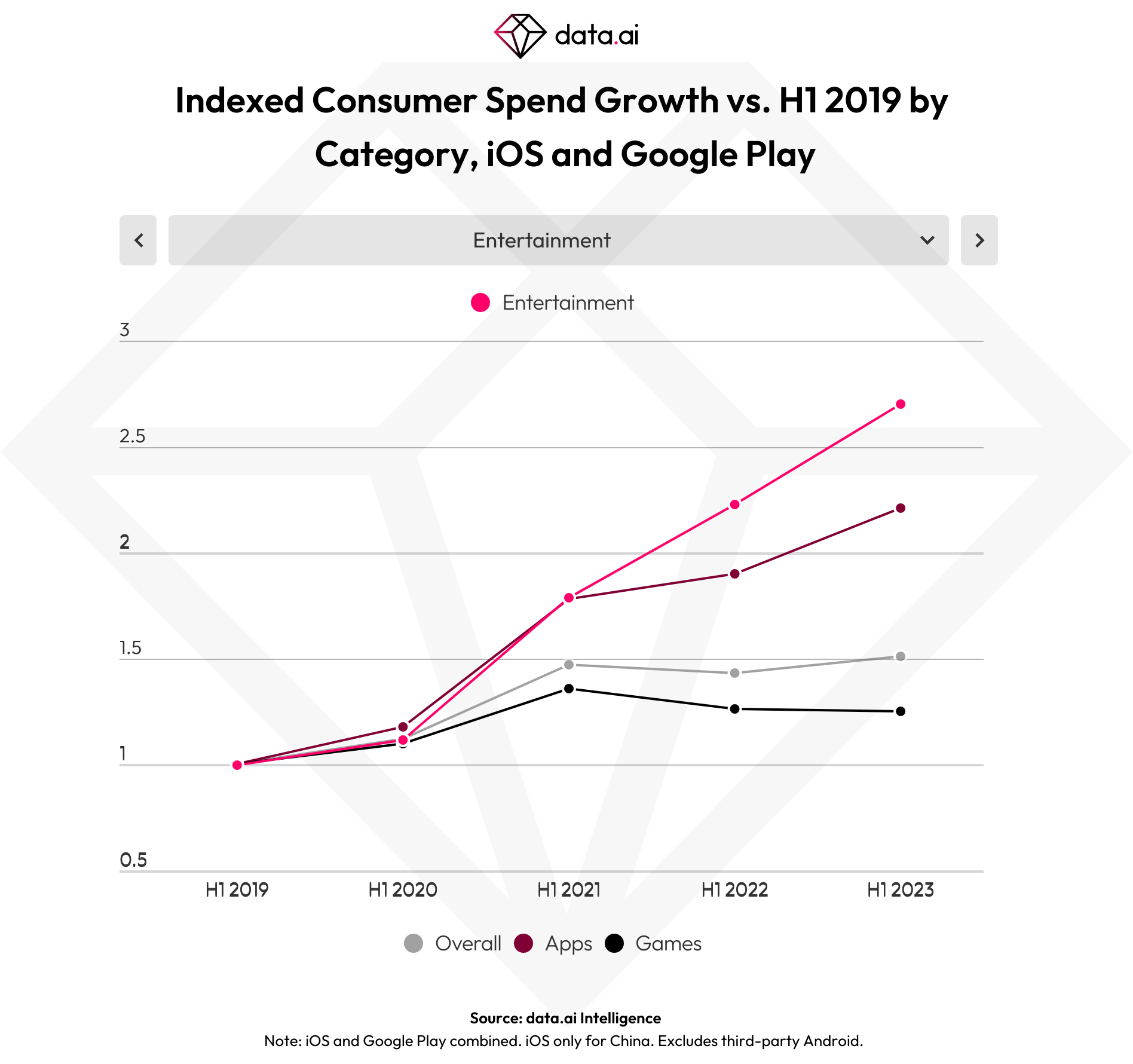

TikTok, for example, is a top app for consumer spending with 31% year-over-year growth. It also became the first app to surpass $2 billion in a half year, with $2.1 billion in consumer spending this year so far, up from $1.7 billion in the first half of 2022. Other top non-gaming apps across iOS and Android include Disney+, YouTube and Duolingo, at 33%, 29% and 48%, respectively. (YouTube doesn’t monetize through Google Play, however, data.ai notes.)

Max (combined with HBO Max) also did well, with 3% growth in consumer spending compared with the second half of last year, and lifetime consumer spending of $3 billion.

More broadly, top categories for consumer spending included Games, Entertainment and Social across iOS and Google Play. Other categories delivering at least half a billion in consumer spending also included Productivity, Business and News & Magazines, which saw strong growth of 32%, 27% and 25%, respectively.

Image Credits: data.ai

Top markets for consumer spending so far this year included the U.S., China and Japan on iOS and the U.S., Japan and South Korea for Google Play.

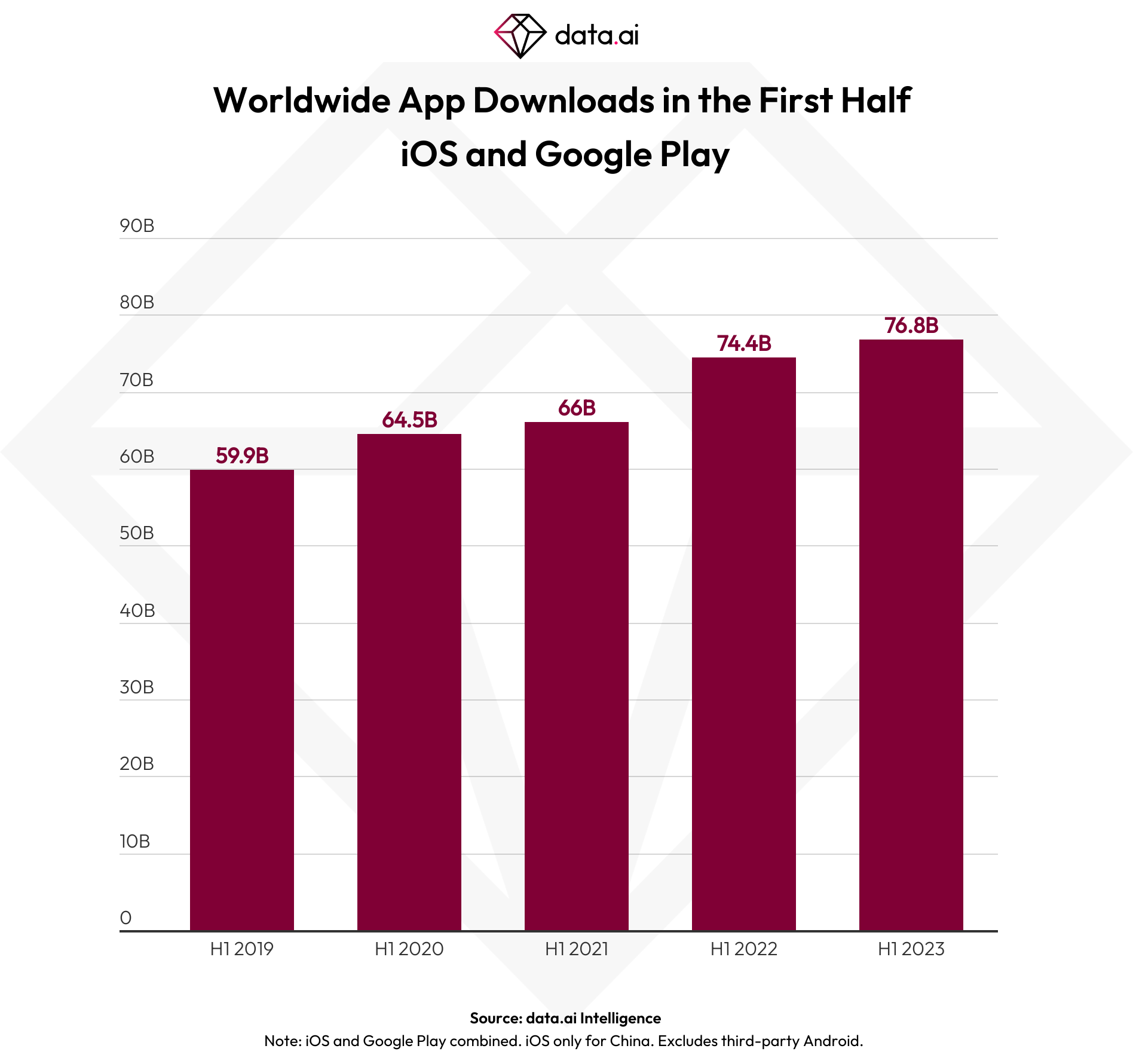

Another metric for app ecosystem health is mobile app and game downloads. These have continued to see growth with 76.8 billion new installs this year so far, which would be even with the second half of 2022 and up 3.2% year-over-year.

Image Credits: data.ai

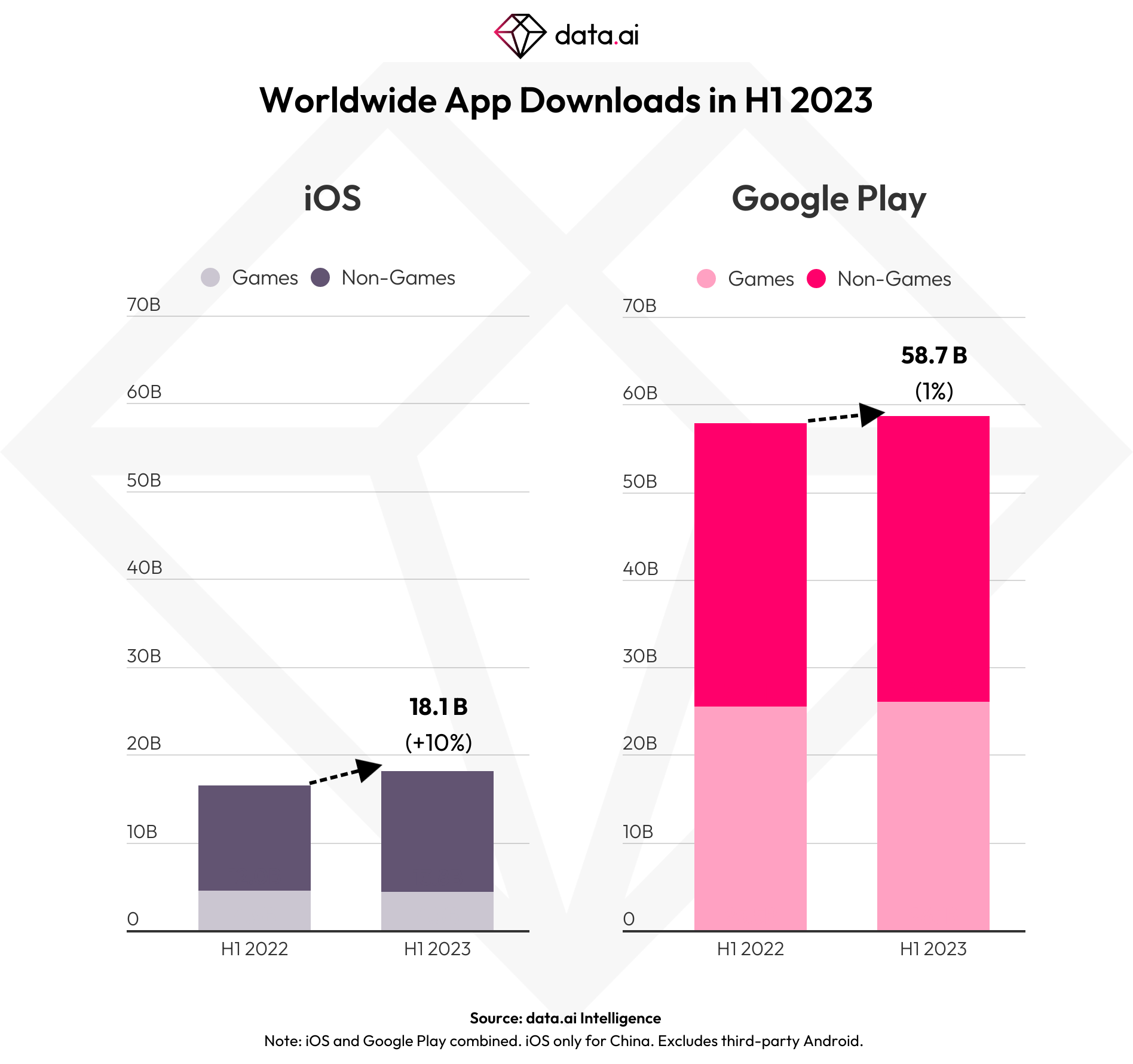

Thanks to Android’s traction in emerging markets like India, Brazil and Indonesia, Google Play accounts for more than 3x the number of downloads than iOS. Turkey, Russia and Indonesia, meanwhile, posted the most growth since the second half of 2022.

Image Credits: data.ai

Download growth is faster on iOS, however, as installs grew 10% year-over-year to 18+ billion, while Google Play installs grew 1.4% year-over-year to 58.7 billion. China, the U.S. and Japan delivered the most iOS downloads, but in terms of growth, Brazil, China and the U.S. were the markets that delivered.

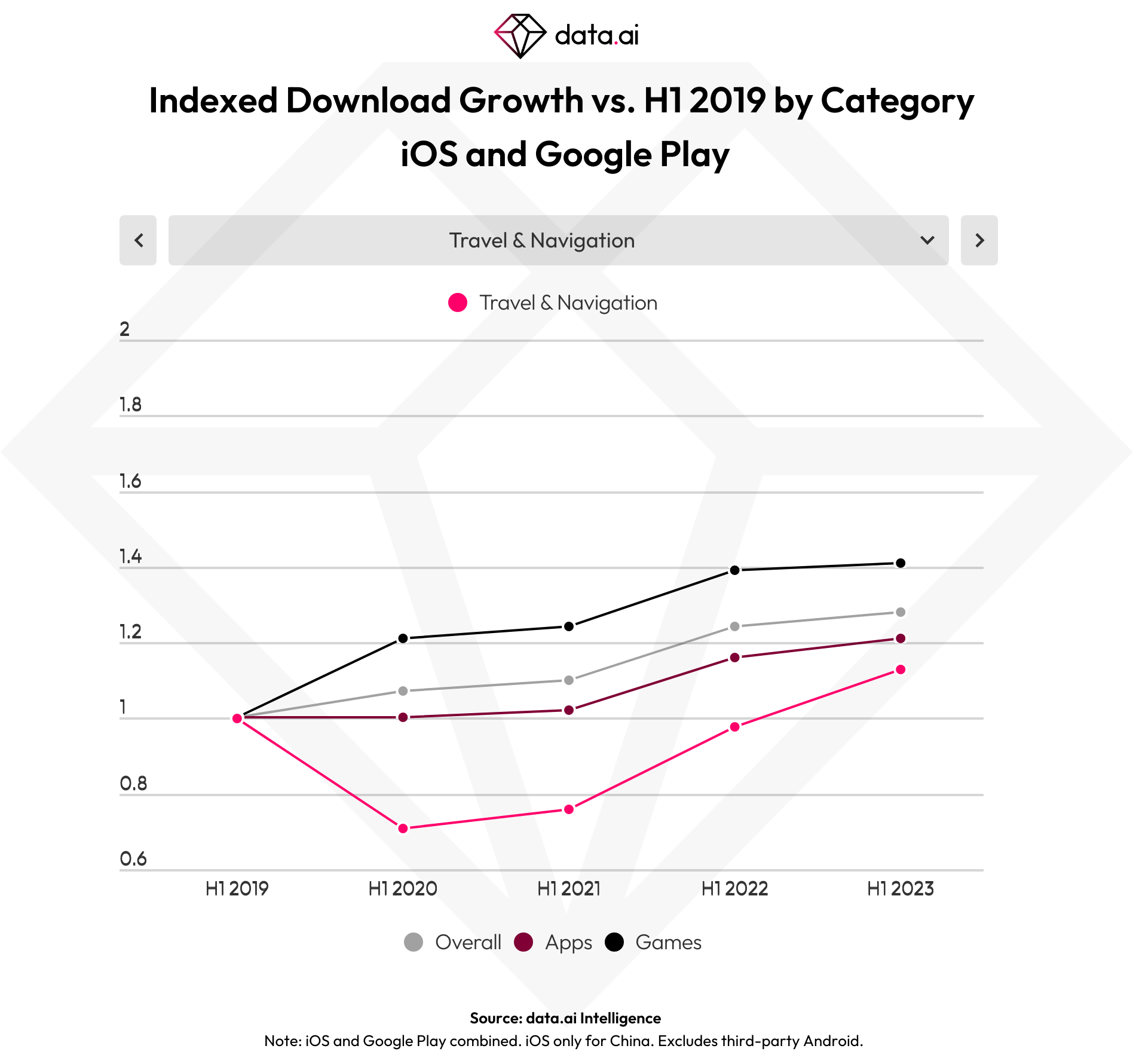

Games, Tools and Social were the largest categories by number of downloads, while Games, Productivity and Tools saw the most growth in absolute downloads. Other top categories included Productivity, Books & Reference and Health & Fitness, growing 16%, 7% and 5%, respectively, from the first half of 2022 to the first half of 2023. Travel & Navigations app downloads also grew 19% from the first half of 2019, but this is outpaced by the overall (non-game) app growth of 21%.

Image Credits: data.ai

The top apps by downloads globally across both app stores included TikTok, Instagram, Facebook, WhatsApp, CapCut, Snapchat, Telegram, Messenger, WhatsApp Business and Spotify.

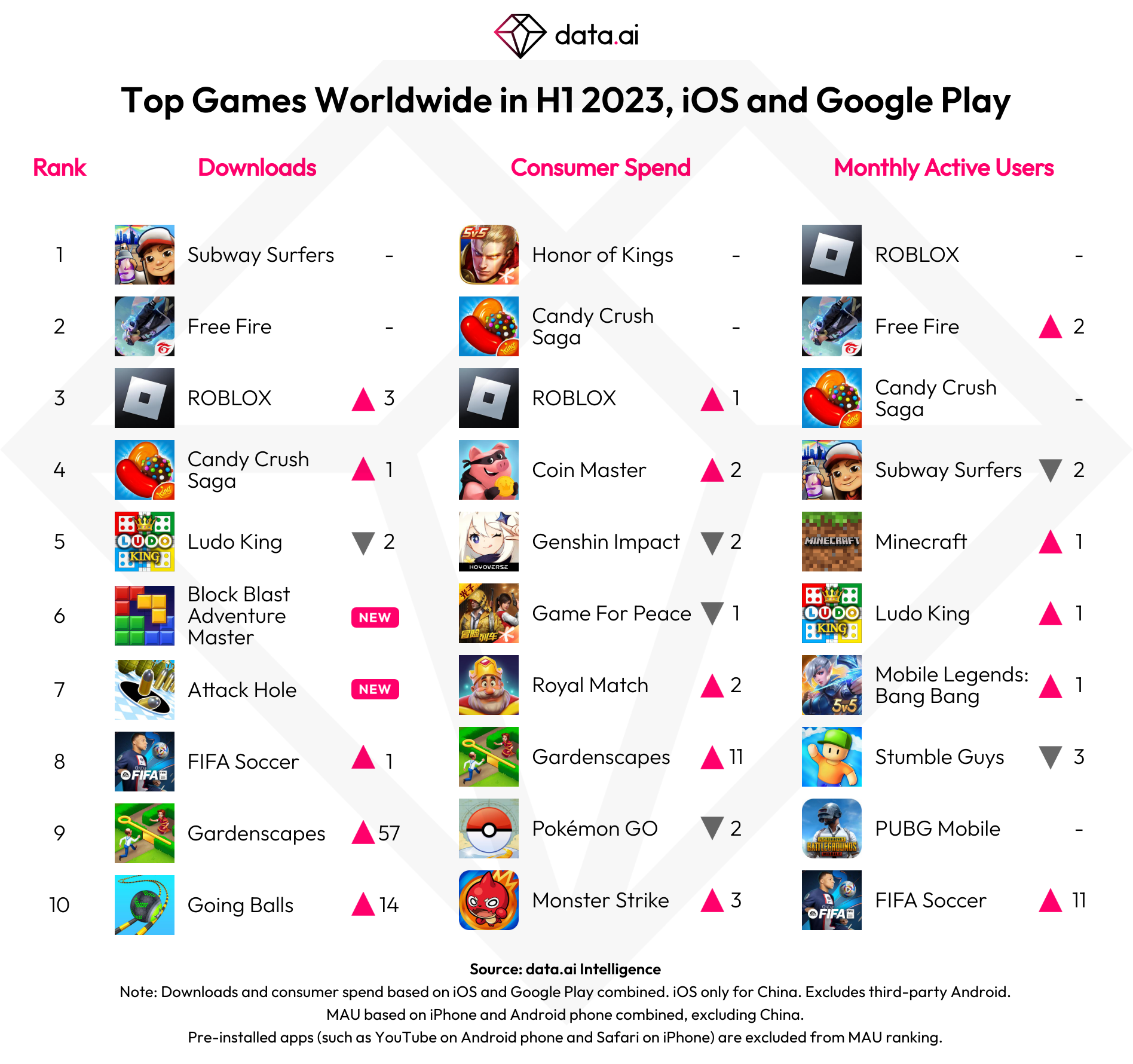

Image Credits: data.ai

Top games were Subway Surfers, Free Fire, Roblox, Candy Crush Saga, Ludo King, Block Blast Adventure Master, Attack Hole, FIFA Soccer, Gardenscapes and Going Balls.

Image Credits: data.ai