The U.S. is weighing additional restrictions on AI chip export to China amid rising concerns over the use of advanced semiconductors for military modernization.

The Wall Street Journal reported Tuesday that the U.S. Department of Commerce could prohibit shipments of chips from manufacturers including Nvidia to customers in China as soon as early next month.

The latest move is part of the U.S.’s broader strategy to limit China’s progress in AI, particularly in the military sphere. However, these measures are also having an adverse impact on the commercial AI sector in China, where many firms operate with teams that span both the U.S. and China.

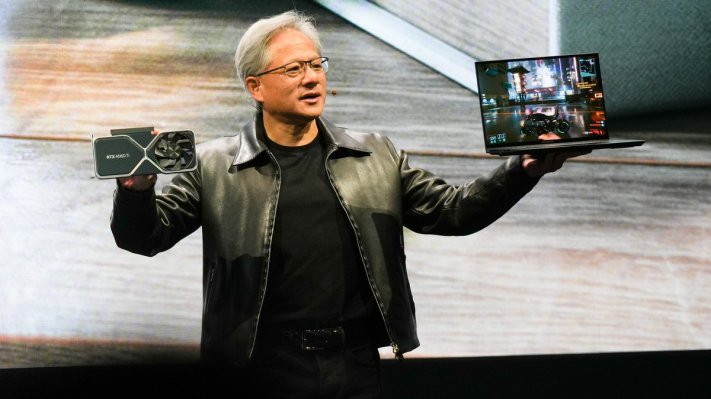

The development is an update to the export controls implemented in September, which limited the sale of Nvidia’s cutting-edge A100 and H100 chips, designed for high-performance computing, to China. In response, Nvidia came up with a less powerful AI chip, the A800, as a workaround to the export restrictions. But now even this chip might be subject to further restrictions, potentially requiring an export license before shipping to China, according to the WSJ report.

Nvidia declined to comment on the report.

As large language models such as GPT-4 continue to drive up the demand for computational power, Chinese tech firms have been stockpiling Nvidia’s AI chips in anticipation. ByteDance, for instance, is reported to have placed orders for over $1 billion worth of GPUs from Nvidia this year, per a report by Chinese outlet LatePost.

According to Reuters, the banned A100 is sold for as much as $20,000 a piece on the black market in China, double the regular price.

The U.S. government is also considering limiting the leasing of cloud services to Chinese AI companies, the WSJ reported. This would deal a blow to the Chinese firms that are using such arrangements to circumvent the chip bans. But the broad definition of “AI companies” could potentially result in collateral damage to a great number of Chinese tech companies caught in the crossfire of the ongoing chip war.

In their global expansion, Chinese companies often choose American cloud providers over homegrown options like Alibaba or Tencent, as Western regulators grow increasingly wary of Chinese services. Limiting access to U.S. cloud services could make it difficult for Chinese firms to meet local data storage regulations, adding even more complication to their expansion plans.