At Index Ventures, we view the emergence of vertical SaaS (vSaaS) — cloud-based software tailor-made for specific industries — as part of a broader trend of end users increasingly demanding superior technology products.

Consumers want solutions-oriented software made specifically to solve their exact business problems. In an environment where we are inundated with software, narrow and specific is well positioned versus broad and generalized.

The concept is not new: Even the largest horizontal tech companies verticalize their sales organizations and product features when they have enough scale within each vertical for that to be a sensible approach.

Cloud giants AWS, Azure and Google Cloud Platform prominently feature vertical industry solutions with dedicated sales teams, as do other large platforms like Salesforce, ServiceNow, Snowflake and Workday.

These tech leaders verticalize their offerings over time because it’s a high-quality experience for customers and end users when a technology vendor deeply understands the industry, has sales and support reps attending the same conferences as users and is rapidly evolving the product to suit customer needs.

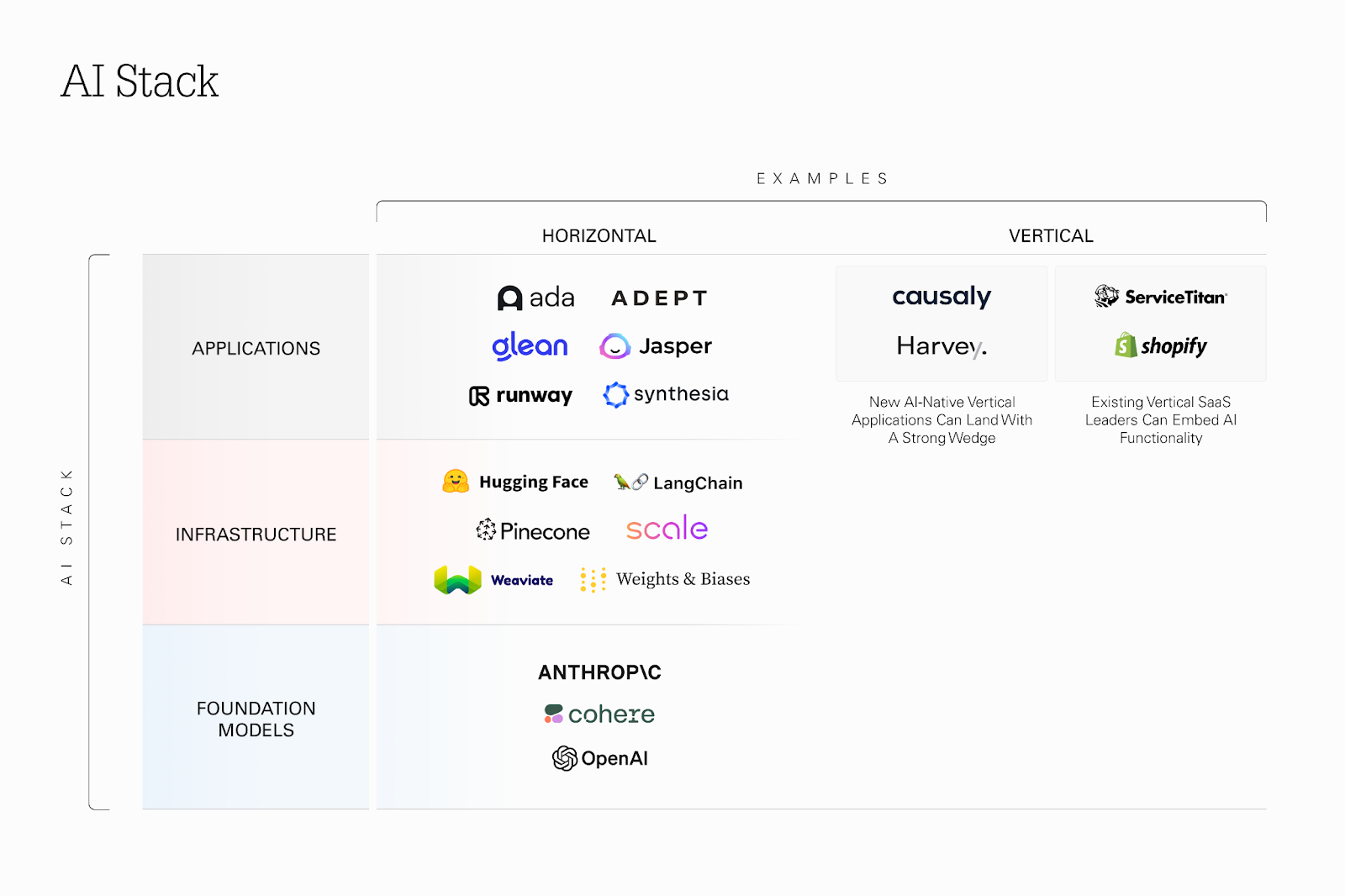

The AI category is rapidly evolving but developing into three layers: foundational models, AI infrastructure and AI applications.

With the AI platform shift upon us, we believe that the next logical iteration of vertical SaaS will be vertical AI – vertically focused AI platforms, bundled alongside workflow SaaS, built on top of models that have been uniquely trained on industry-specific datasets.

Why vertical AI?

The AI category is rapidly evolving but developing into three layers: foundational models, AI infrastructure and AI applications.

Examples of AI stack startups. (Index Ventures is an investor in Causaly, Cohere, Scale, ServiceTitan and Weaviate.) Image Credits: Index Ventures

Foundational models are the bedrock of the AI stack. Leaders in this space include Anthropic, Cohere and OpenAI. It’s likely there will be a limited number of vendors in the foundational LLM space given the high capital requirements to build and train models.

The “picks and shovels” of AI sit at the infrastructure layer, a catch-all that includes a variety of categories including data enhancement, fine-tuning, databases and model-training tools. For example, vector databases like Pinecone and Weaviate are gaining significant adoption.

Other companies like Scale are being used for data generation, labeling and training. Hugging Face has emerged as a leader for model discovery and inference. Weights & Biases is widely recognized within MLOps. LangChain is an open source development framework used to simplify the creation of new applications using LLMs. These are a few of many companies that are helping companies transform models and data into products.

Foundational models and infrastructure are enabling an explosion of AI business applications. These AI-powered applications could be used by any end user, in any industry, to accomplish an array of tasks.

Some of these applications will be broadly horizontal, meaning they can be used by customers in any industry. For example, we’re seeing a number of companies like Ada pursuing AI-enhanced customer support. Digital assistants like Adept are also taking a horizontal approach, with the ability to serve all end markets. The same can be said for copywriting focused companies like Jasper, or AI-enabled search companies like Glean. RunwayML is shaping the next era of art and entertainment through generative AI for video. Synthesia is enabling companies of all sizes to create professional video content through text to speech.

But many AI applications will also be vertical, or industry-focused. AI-enhanced software applications will be most powerful when they have deep underlying knowledge of end-user workflows and access to valuable industry-specific training data.

With that framework in mind, we see two clear opportunities ahead for Vertical AI:

New AI-native vertical applications can land with a strong wedge

There are workflow software incumbents sitting within most major verticals. In some verticals those incumbents are legacy, on-premise providers, whereas other verticals have more contemporary cloud SaaS. In both cases, AI-specific features are still nascent and that creates a window of opportunity for new AI-native vertical applications to emerge.

AI can serve as a powerful wedge into a vertical market because it’s a new technology that buyers and users are receptive to and AI-powered features can deliver automation, which delivers value quickly. If you’re trying to sell a customer their tenth piece of software, there’s less urgency in the buying process. But with everybody clamoring to use AI, technology buyers are receptive to new pitches and experimentation right now.

We are seeing new AI-native vertical applications emerging across all of the world’s largest sectors but they are particularly becoming prevalent in knowledge work categories where routine processes can be digitized, giving back hours of highly valuable time.

Causaly is an AI-enhanced search platform for biomedical research. Previously, pharmaceutical companies spent hours searching millions of scientific documents and clinical trial databases to answer complex research questions. Even though software platforms did exist in the space, none had a killer AI-specific feature.

Law firm Allen & Overy recently announced a partnership with Harvey, a vertically focused chatbot that can help lawyers with contract analysis, due diligence, litigation and regulatory compliance.

Both the biopharmaceutical and the legal industry have existing software vendors serving a variety of functions, but these companies are coming to market with a highly specific and strong wedge that is not currently being served by incumbents in the market.

Existing vertical SaaS leaders can embed AI functionality

When compared with new AI-native vertical applications, vertical SaaS leaders have the benefit of preexisting distribution, customer relationships and proprietary data that startups don’t have access to. We believe this will be a great setup for those who are able to successfully embed AI features and functionality into their platforms.

ServiceTitan focused on developing AI features, including a smart dispatch tool to allow for more intelligent technician routing, local price insights to enable pricing optimization and AI-enhanced ad budgeting and analytics.

Shopify recently announced AI-generated product descriptions that can be generated, revised or expanded from anywhere on a mobile app. More efficient product description generation will help Shopify’s two million merchants transact even more seamlessly with over 560 million unique online shoppers.

Existing vSaaS leaders with high customer affinity have earned the right to extend their platforms into the AI realm.

Who will win: New AI-native apps or existing vertical SaaS leaders?

Vertical AI winners will ultimately be those who can access proprietary industry data, effectively train large language models against those datasets, package those models via applications and ultimately deliver tremendous utility with fast time-to-value for customers.

For some industries it will be new AI-natives who will be best positioned whereas in other industries it will be vertical SaaS incumbents. For the latter, we do believe there will be risks for incumbents who ignore this tidal wave and fail to adapt in this rapidly changing environment.

There is also the risk of innovator’s dilemma — AI-native companies may offer new and disruptive ergonomics and pricing models, which incumbents may need to get out in front of today. For instance, if your pricing model is levered to the number of customer seats but customers anticipate reducing end-user seat count, it may be important to assess if you can realign your pricing to coincide with the customer value being generated.

In all instances, our recommendation is twofold: First, technology companies serving specific verticals must work to generate proprietary, industrywide datasets. If you can provide unique insights to your end customers that help them increase their revenues or decrease cost, that will ultimately provide a high degree of differentiation and competitive moat.

Secondly, vertically focused companies must work to gain distribution by owning direct and high-NPS relationships with end customers. Product matters but so does distribution, which is often predicated on establishing deep and long-lasting customer relationships. Proprietary data and distribution will be a winning combination in the race to build both horizontal and vertical AI applications.

Disclaimer: Index Ventures is an investor in Causaly, Cohere, Scale, ServiceTitan and Weaviate.