Korean storytelling companies want to kindle the popularity of webtoons and web novels in the West on the back of their success in East Asia.

Serialized digital comics, also known as webtoons in South Korea, are optimized for mobile devices such as smartphones and tablets or websites, which read top to bottom.

Digital comics gained broad popularity throughout South Korea and Japan in the early 2000s and caught on in the U.S. in the 2010s. In 2014, Amazon acquired Comixology, the largest marketplace for digital comics in the U.S., and last year, the largest bookseller in the world incorporated the Comixology app into Kindle, allowing digital comics to be read on their smartphone or Kindle.

Some comic apps, such as Madefire and the Archie comics app, shut down in 2021, while Comixology was affected by Amazon’s recent layoffs.

Still, some big digital comics firms believe switching the medium from print to digital could enable the revival of web- or app-based serialized storytelling like webtoons and web novels. And some South Korea-based Big Tech companies have ambitions beyond the comics and novels world.

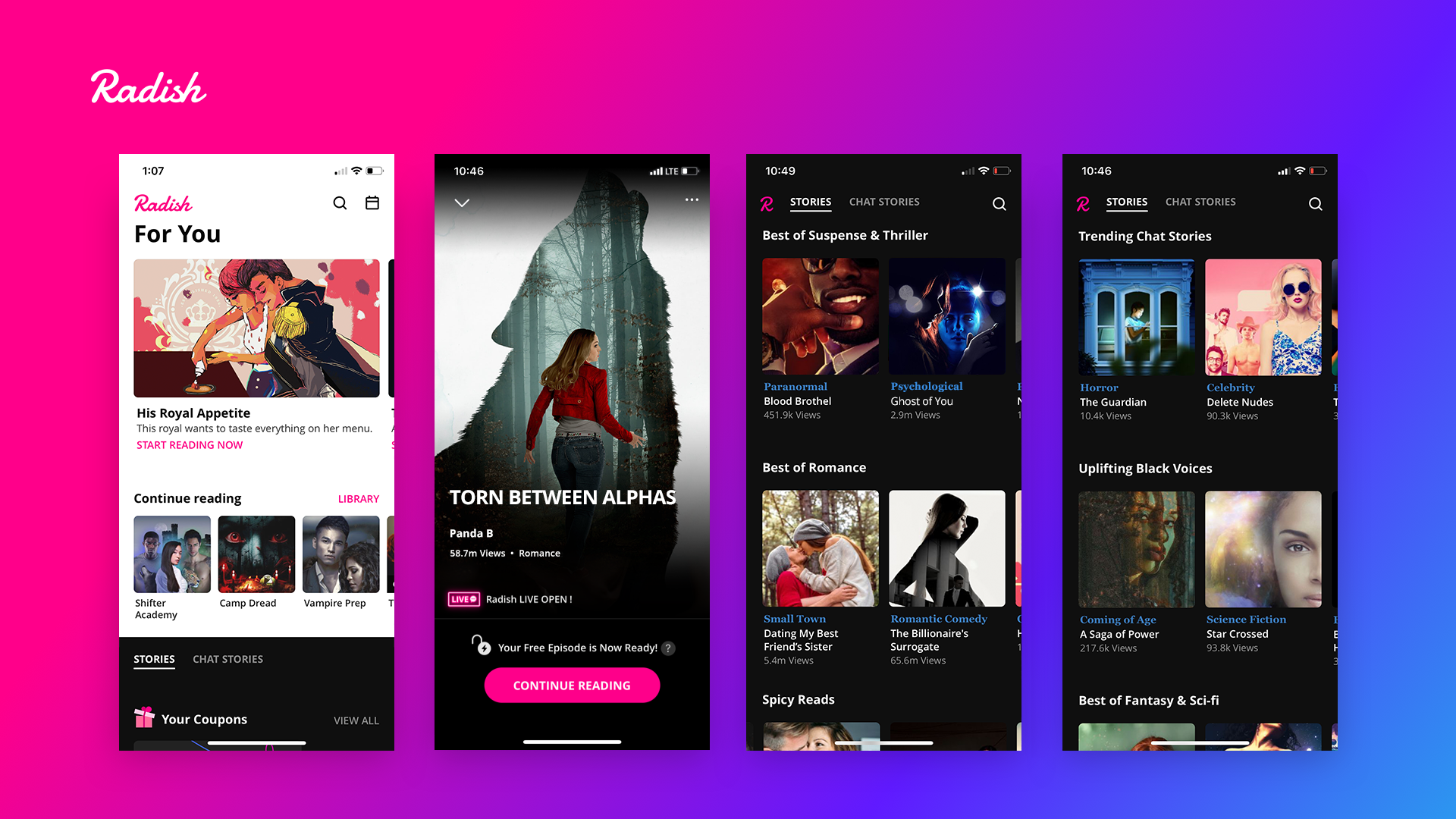

Earlier this month, Kakao Entertainment, which operates storytelling platforms and a music streaming service, announced it received $966 million in funding from sovereign wealth funds, including Saudi Arabia’s Public Investment Fund (PIF) and Singapore’s GIC (Pwarp Investment). The new money will go toward extending its global storytelling content and intellectual properties, around which original series and movies are based, specifically in North America, Kakao pointed out. The funding comes roughly two years after it acquired two U.S.-based storytelling platforms, Tapas and serialized fiction app Radish.

I caught up with industry sources, including Naver-owned WEBTOON global CEO Junkoo Kim, who founded WEBTOON in 2004, and Kakao Entertainment‘s global business director, Jayden Kang, to learn more about the webtoon industry and why they want to bet on the business of storytelling.

Are webtoons the next blockbuster?

Naver and Kakao, the two largest Korean internet firms, believe storytelling platforms could be the next entertainment blockbuster, coming hot on the heels of the global popularity of K-pop boy band BTS and Netflix’s “Squid Game.”

“The webtoon industry is still nascent in countries like North America and Europe,” Kim said. “I think it will take time to increase readership from other media, like streaming services, and build larger webtoon fandom and communities. It’s not like we can take over huge international audiences in a short period of time.”

Naver and Kakao, which had a string of successes at home and in Asia through messaging apps, payment services and more, are still eager to pull off a coup in a bigger market like North America or Europe.

Naver and Kakao have already been leading the serialized digital comics and web novels space in East Asian countries, and now new venture firms are also emerging in Asia.

Drawing in millennial, Gen Z and women audiences

Although the digital comics industry is emerging, fandoms are already being formed overseas, like in the U.S., Kang said. “So, webtoon and web novel publishers/distributors want to go there, wherever the fans already exist, to boost the industry and meet our fans, not just enter any countries we’d like to.”

The fan bases that exist overseas are mostly made up of millennials, Gen Zers and women, according to industry sources.

With younger users, webtoon companies will be able to maintain readership, the industry sources said, adding that, however, they don’t want to neglect older age groups who are avid readers and willing to pay for comics and novels on the web.

Naver says about 75% of its audience is made up of Gen Z and millennials, while women account for about 60% worldwide. Naver’s WEBTOON platform has more than 89 million users globally, including 15 million in the U.S. With its web novel platform Wattpad, which Naver acquired in 2021, Naver’s storytelling platforms have a combined audience of 179 million globally. Its annual total gross merchandise volume (GMV) was $900 million in 2021, Naver said.

Kakao said about 80% of the audience of its webtoon unit Tapas comprises those aged 16 to 24, with around 65% of its audience identifying as women.

“Our audience is [composed] of millennials with income, and the GenZ audience is rapidly growing and expanding,” a Kakao Entertainment spokesperson told TechCrunch.

This trend is also reflected globally: Approximately 67% of Gen Zers prefer reading on their phones to a paper book, per a survey released by Wattpad in December. In comparison, 51% of older generations prefer reading a physical book. That is because, Gen Zers say, web novels, webtoons and e-books have more diverse topics and genres than traditional channels like bookstores.

Younger generations are already more familiar with reading books, comics and news on their phones, just like they watch TV, movies and YouTube and access social media platforms on their phones. One of the storytelling platforms’ strategies is to transform their content into hit TV series or movies, which can help bring consumers to the original webtoons or web novels.

The industry sources say GenZers and millennials are the most significant consumers of storytelling platforms because they use smartphones the most and are more focused on web-based trends than older generations.

Storytelling platforms’ bread and butter: IP

Kim told me that Naver WEBTOON sees streaming service platforms and gaming companies as peers because they’re what consumers use during their leisure time.

Naver WEBTOON, Kakao Entertainment and other digital comics and novels are always searching for opportunities for their stories to turn into streaming TV series, movies or games.

Indeed, IP is the bread and butter for storytelling companies. Naver WEBTOON and Wattpad completed about 300 projects that extended to other media formats, including “Lookism,” “Hellbound” and “All of Us are Dead” on Netflix and “Connect” on Disney+. In addition, WEBTOON’s Lore Olympus print editions have become No. 1 New York Times bestsellers.

Naver’s webtoon unit has partnered with DC Comics, Marvel, Archie Comics and Hybe, the South Korean music agency behind boy band BTS, to maximize its IP use.

Kakao’s webtoon unit, Tapas, partnered with Creative Artists Agency in 2021 to sell IPs to other media.

Kakao said it sealed about 65 webtoon IP licensing deals from 2016 to 2020, but last year alone, Kakao completed approximately 50 IP licensing agreements, and 20% of the licensing sales took place overseas.

Kakao webtoons and web novels have been turned into TV series on streaming platforms like Netflix, Apple TV+ and Disney+. In addition, Kang explained that “Business Proposal,” a hit webtoon and web novel story that morphed into a TV series, now plans to extend to an audiobook and develop a game with the story.

Image Credits: Radish

What’s next?

Naver WEBTOON, which offers its service in more than 10 languages, including English, French, Spanish, German, Korean and Japanese, opened its U.S. office in 2016.

Naver started its business in Korea but didn’t simply want to translate Korean and Japanese webtoons into English and bring them to the U.S. and Europe, Naver WEBTOON U.S. CEO Ken Kim told TechCrunch.

“In the U.S. and Europe, we’d like to focus on recruiting or nurturing local creators to make local content in each region,” Ken said, “For example, in the U.S., most of our [top-ranking] popular content is created by local creators in the U.S.”

Ken also noted that it’s growing fast in the U.S. Its webtoon business grew more than 40% in monthly active users last year compared to 2021, so one of its challenges is how well it supports its creators, estimated to be about 830,000 as of the first quarter of 2022, as well as readers, Ken explained.

Kang also said that one downside to the popularity of webtoons and web novels is the illegal distribution through social media platforms or websites globally. The unlawful distribution causes enormous damage to storytelling creators, Kang noted. Accordingly, Kakao set up a “Global Illegal Distribution Response Task Force” to root out the illegal global distribution of webtoons, Kang added.

One of Naver’s efforts to grow its community is a webtoon canvas service that allows anyone to draw webtoons — and therefore become creators. “Anyone can be a webtoon creator as long as they have a story,” Ken said. “They don’t need professional drawing skills to be a webtoon creator with canvas service.”

It’s similar to how social media platforms, such as YouTube or TikTok, allow anyone to start producing content and become a creator.

Kakao announced earlier this month that the company will make more investments and acquisitions in storytelling platforms to further expand its content and IP in North America.

Kakao Piccoma, a Japan-based webtoon unit and a sister company of Kakao Entertainment, opened an office in France last year to penetrate Europe. Kakao launched its webtoon service in Indonesia in 2019 and in Thailand and Taiwan in 2021.

By providing webtoons and web novels in many different languages, promoting webtoon canvas services, transforming IP into new media formats and making additional investments, Korean vertically scrolling storytelling platforms are set up to succeed in the U.S. and Europe.