You’d be forgiven for expecting public fintech companies that facilitate consumer trading to be under pressure this week. And yet, after reporting earnings, the share prices of two pandemic-era highfliers gained ground. Coinbase and Robinhood up? In this economy? Yes.

Of the out-of-fashion tech sectors, consumer trading has to be among the most out of favor. And yet.

TechCrunch wanted to better understand investor response to results from both Coinbase (crypto-focused) and Robinhood (equities-focused) to figure out what drove each company’s shares higher in the wake of their reports. The answers, it turns out, are partially related.

The Exchange explores startups, markets and money.

Read it every morning on TechCrunch+ or get The Exchange newsletter every Saturday.

In an ironic twist, some of the forces that have made consumer trading less attractive are the very same impulses helping the two companies derive more revenue from a previously less-critical part of their business. The Federal Reserve taketh away, and the Fed also giveth some back.

Today, we’re pulling apart top-level results from both companies and then looking at how key their interest-based revenues were in the period. It turns out that sitting on cash when suddenly cash has more value is valuable!

Today, we’re pulling apart top-level results from both companies and then looking at how key their interest-based revenues were in the period. It turns out that sitting on cash when suddenly cash has more value is valuable!

Robinhood’s Q3 results

In the third quarter, Robinhood posted more revenue than expected ($361 million compared to what Yahoo Finance calculated as an average analyst expectation of $357.7 million) and a smaller loss per share than was anticipated ($0.20 instead of $0.27).

But while the company’s numerical results were better than expected, Robinhood shed users again, posting yet another quarter of sequential active user declines since a Q2 2021 peak of 21.3 million monthly active users; MAUs dropped to 12.2 million in Q3 2022. So, the company did better than expected, despite what we could consider another decline in a key revenue-facilitating metric.

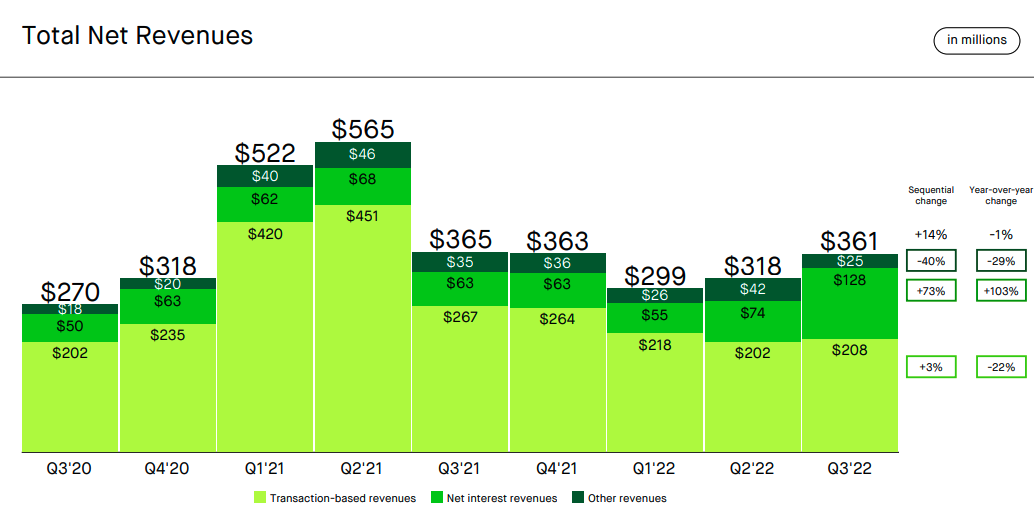

Shouldn’t fewer users mean that Robinhood is struggling with revenues, instead of beating expectations? Pardoning our massive oversimplification of the company’s business, the answer is kinda yes. So how did Robinhood beat expectations? Interest! Observe the following from Robinhood’s investor deck:

Image Credits: Robinhood

Keep your eye on the net interest revenues part of the bars, and how it doubled from the year-ago period. Sure, overall Robinhood net revenues are down modestly from year-ago results, but it’s worth noting the company’s revenue mix shift over the same time period.

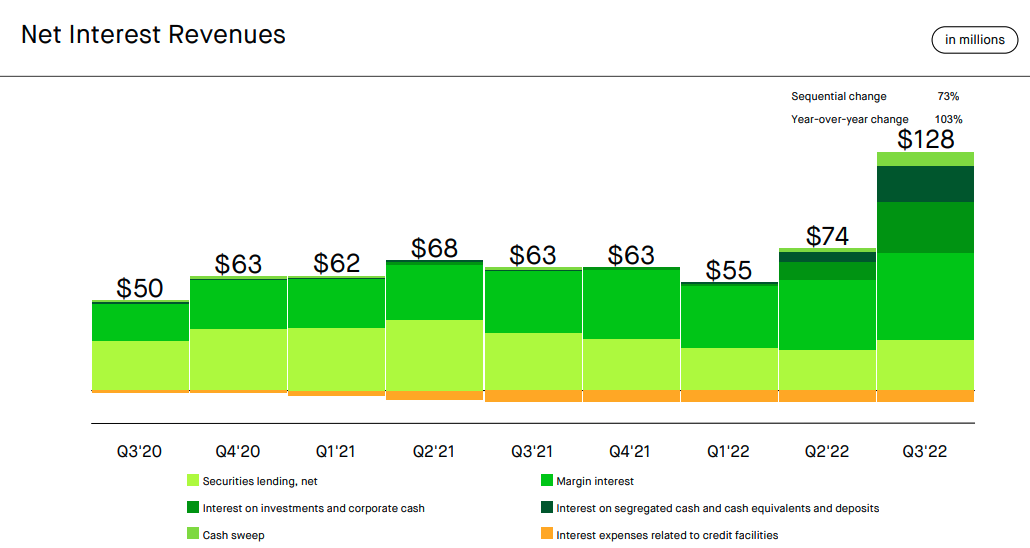

Here’s just the company’s interest revenues over time:

Image Credits: Robinhood

Impressive! And what changed? The Fed raised rates, and up went the revenue line item. Looking at Robinhood’s earnings call, there’s even more room for this income source to grow. Per Robinhood CFO Jason Warnick (Emphasis: TechCrunch):

Looking at net interest revenues, which is a growing part of our revenue mix, it reached a new high of $128 million in Q3, up over 70% from Q2 and driving over 35% of total revenue as the Fed continued to increase rates. [ … ] Looking ahead to Q4, we’re encouraged by what looks likely to be another quarter of net interest revenue growth. As we consider what we see today for the forward Fed curve, customer balances and deposit rates, as well as a decrease in our margin book and securities lending so far in the quarter, we anticipate Q4 net interest revenues will be up by roughly $25 million from Q3.

The fact that the same force (rising rates) is likely dampening Robinhood trading incomes while also bolstering another part of its revenue mix means that the company has a shock absorber of sorts in hand when the macro money market changes. That’s good news for the company, and investors have taken note.

Coinbase’s Q3 results

Coinbase’s Q3 2022 net revenue was $576 million, down 28% from Q2’s $802.6 million tally. The decrease is even sharper year on year — 53%.

Compared to expectations, things aren’t great, either, as the company missed on revenue estimates. “However,” Yahoo Finance noted, “it retained users and lowered expenses better than analysts predicted.”

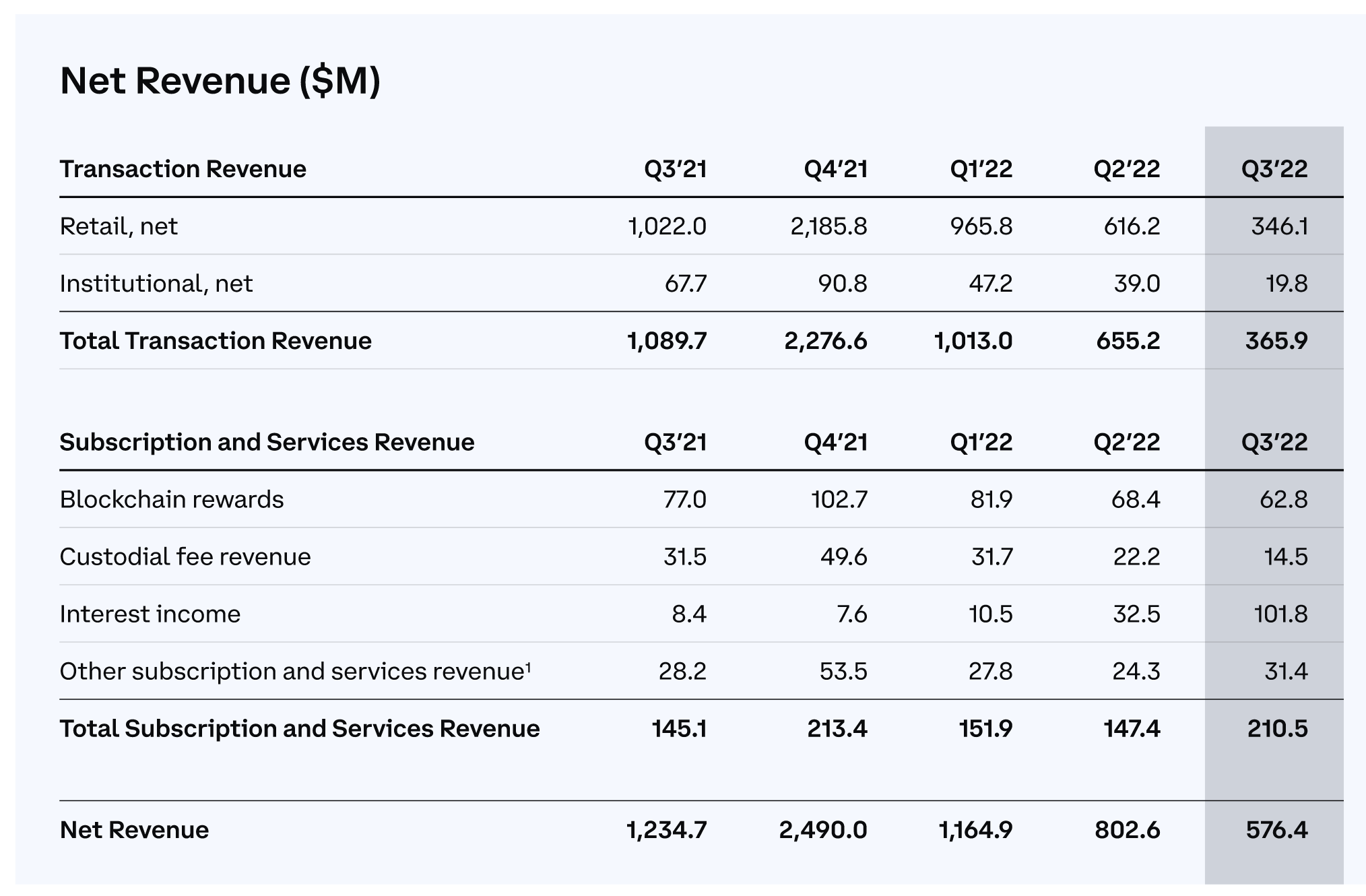

Out of its Q3 net revenue, Coinbase said, “$366 million was transaction revenue and $211 million was subscription and services revenue.” This is worth noting: Coinbase’s net revenue breakdown in Q3 was quite different from previous quarters.

Image Credits: Coinbase

In Q3 2021, transaction revenue accounted for 88% of net revenue; subscription and services revenue made up the remaining 12%. But last quarter, transaction revenue fell to a 63.5% share, while the proportion of subscription and services revenue kept on rising over time until it reached 36.5%.

Within subscription and services revenue, a data point called our attention: That interest income rose from a negligible $8.4 million in Q3 2021 to $101.8 million last quarter. In percentage, it went from less than 1% of net revenue to a noteworthy 17.7%. Headwinds have turned into tailwinds and vice versa.

Is it enough?

Nope, it is not enough to get the companies back to peak revenue. But with rates rising thus far in Q4 2022, and set to rise more in the coming months and quarters, the same incomes that are currently bolstering the two firms could continue to expand. That alone could trim losses and make the two companies more economically viable in the near term, from a profit and loss perspective (each company is cash rich and in no apparent danger of anything other than continued deficits until trading picks back up).

What’s the startup lesson in our work today? That while some of the tailwinds that provided a good boost to trading activity are down, sure, there are other revenue sources for fintech companies that could prove salubrious as tech shops combat falling valuations for their businesses.

So is the above good news? Qualified good news, yeah. For fintech in late 2022, that’s about as bullish as it gets.