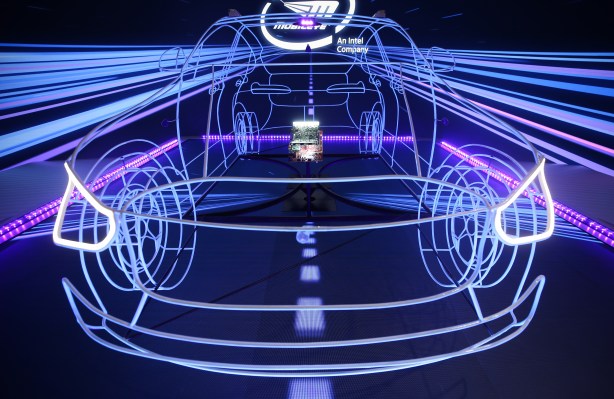

Mobileye, Intel’s automated driving division, filed Friday for what is expected to be the year’s largest IPO, but its success is far from guaranteed.

The Israeli company, acquired by Intel five years ago for $15.3 billion, touts a broad vision: An autonomous future “where congestion is seen only in history books.” But its S-1 filing with the U.S. Securities and Exchange Commission underscores its precarious position in the ever-evolving self-driving vehicle industry.

Founded in 1999, Mobileye has benefited from its first-mover advantage, supplying automakers with computer vision technology to power their advanced driver assistance systems (ADAS). Now, as Mobileye expands its business model, it faces a proliferating number of rivals — from every side — in the wild and woolly world of automated vehicle technology.

The company’s list of competitors in its S-1 extends beyond the “Tier 1” suppliers in its core business to now include robotaxi developers like Argo AI, Aurora, Auto X, Baidu, Cruise, Momenta, Motional, Waymo and Zoox, as well as what it describes as “consumer AV” competitors Apple, Sony and former customer Tesla.

TechCrunch pored through the S-1 to identify the speed bumps and bright spots in its pursuit to dominate autonomous driving.

Vertical integration

In the filing, Mobileye warned that its historical reliance on a handful of automaker partners may jeopardize future revenue. For the first six months of the year, Mobileye reported that 76% of its revenue was derived from eight automakers. But now big spenders such as General Motors and Mercedes-Benz are starting to develop their own autonomous driving systems in-house.

Mobileye operates across a range of ADAS and autonomous technologies. More than 117 million vehicles on the road use Mobileye’s EyeQ system-on-chips (SoC), which Mobileye describes as the brain behind its ADAS and self-driving technology, the S-1 filing showed. The company expects to deploy its system in another 266 million vehicles by the end of the decade.

Mobileye’s business has branched into different autonomous driving technologies over time, including high-precision mapping, safety hardware and software, and autonomous mobility as a service (AMaaS) for consumers, fleet customers and automakers.

Though the rollout has helped Mobileye acquire “one of the world’s largest repositories of transit and mobility data,” it acknowledges that its 8.6 billion miles of road tests could prove a doubtful advantage in the future. Mobileye said in the filing that it remains vulnerable to “companies that are able to develop products that may not require the massive datasets upon which our technologies currently rely while still achieving the same effectiveness of algorithms.”

The company is getting either more or less profitable, depending on how you compare its historical performance. Mobileye ran a $36 million operating deficit in the first half of 2022, leading to a $67 million net loss for the period. That compares with $7 million in operating profit and $4 million in net income for the first half of 2021.

But Mobileye is far less unprofitable than it was in 2020, when its net loss clocked $196 million. The overall financial picture reveals a gross margin in flux: 48% in 2019, 39% in 2020 and 47% in 2021, a figure that the company managed to replicate in 2022.

Supply chain

Meanwhile, Mobileye warned of shrinking gross margins as it incorporates more third-party hardware into its systems and continues to suffer from a shortage of the semiconductors needed to produce EyeQ SoCs.

“We have entered 2022 with significantly lower inventories of our EyeQ SoCs as a result of the limited supply during 2021, and, due to continuing supply chain constraints, we are operating with minimal or no inventory of EyeQ SoCs on hand,” the company said in the filing.

The global supply chain crunch coincides with the arrival of new competition on a number of fronts.

The filing named AMaaS competitors such as Argo AI, Aurora, Cruise, Motional, Pony.ai, Waymo, Yandex and Zoox, as well as China’s Auto X, Baidu, Deeproute.ai, Didi Chuxing, Momenta and WeRide. It also noted competition from behemoth suppliers such as Bosch, Continental and Denso, and silicon providers including Qualcomm, Huawei and Nvidia.

Bright spots

Mobileye is looking to other partnerships as more automakers develop their ADAS software stack in-house. The company said that long-term partnerships with China’s Geely, Great Wall Motors and SAIC, and Indian automakers such as Mahindra & Mahindra position it for growth in an emerging market.

Intel acquired Moovit, an Israeli journey planner app that crowdsources mapping data, for $900 million in May, and Mobileye plans to parlay Moovit’s MaaS platform and global user base into business-to-business partnerships with fleet operators.

Of course, Mobileye’s strongest partnership remains intact. After the IPO, Intel will continue to serve as a “strategic partner” and hold a majority of the voting power of Mobileye’s common stock. Intel CEO Patrick Gelsinger previously said the conglomerate will use proceeds from the IPO to fund chip plants, including two $20 billion factories in Ohio and Arizona, easing Mobileye’s supply shortage.