To get a roundup of TechCrunch’s biggest and most important stories delivered to your inbox every day at 3 p.m. PST, subscribe here.

Hello and welcome to Daily Crunch for Monday, December 13! The theme of today is crypto, or web3 if you prefer that rebranding. Why? Because it turns out that an NFT project is making a game, a new startup wants to bring crypto and no-code together and there are several other bits of web3 startup news on our pages today.

Yes, we also have our normal run of funding rounds, unicorn exits and the like. But, strap in for some token talk! —Alex

The TechCrunch Top 3

- Chinese AI IPO on hold: The SenseTime IPO was set to raise around $767 million in a Hong Kong listing. However, after finding itself on an American technology blacklist as of Friday, the IPO is on hold. As Didi looks to delist from the American markets, seeing such a high-profile Hong Kong debut on hold is not a great look for Chinese tech liquidity.

- Bored Ape Yacht Club game? If you aren’t a fan of the Bored Ape Yacht Club NFT series — I am not, for what it’s worth — you may not be hype to hear it, but there’s a game coming from the image collection. If this is a hit, expect many games to be built atop other NFT IP. Quickly, I wonder what the market size is for this game, given that there are only 10,000 images in the series.

- UK taking look at Microsoft-Nuance deal: A $19.7 billion deal between Microsoft and “speech-to-text specialist Nuance,” as TechCrunch put it, has picked up regulatory scrutiny by a U.K. watchdog. This is the prelude to an investigation, it appears, but the fact that Microsoft is even getting a second look could chill other large buys by the megacorps of the technology world.

Startups/VC

A few themes are obvious today, including the startup exit market and crypto. We’ll take those on first, and then close with the rest of the startup news of the day.

Exits:

- So much for that IPO pop: A number of 2020 and 2021 IPOs had super strong first-day performances and early trading gains. This led to much complaining that tech offerings were being mispriced on purpose, to the benefit of banking customers. Well, we took a look back, and the numbers with a little time are far less clear than they once seemed.

- Robot company Symbotics to go public via SPAC: After securing greater commitment from huge American retailer Walmart, Symbotics has decided to pursue a public listing via a SPAC, or blank-check company. Notably the deal will see the robot firm link with Softbank Investment Advisers’ SVF Investment Corp. 3.

- E-motorcycle company LiveWire to go public via a SPAC: Have you ever heard the pneumonia-rattle of a Harley-Davidson motorcycle? Well, it turns out that the company also makes electric bikes. Who knew! The deal, per TechCrunch, will allow Harley to hold onto a good stake in the company while also injecting capital into the business. We’re just glad that the company is making bikes that don’t sound like their engines are filled with used dentures.

And then, crypto:

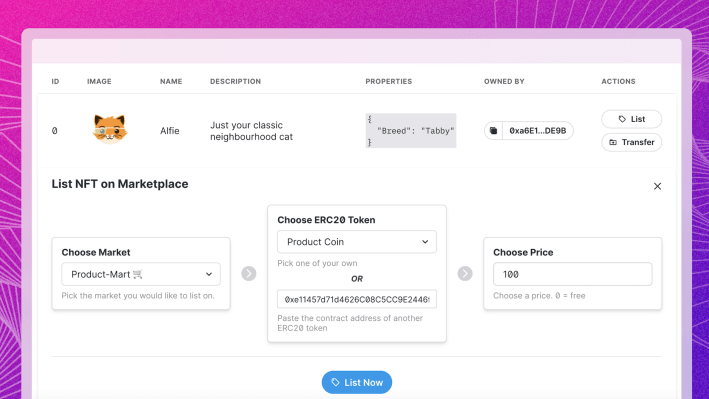

- Thirdweb raises $5M for the union of crypto and no-code: What Thirdweb is doing sounds cool. TechCrunch reports that the company’s software helps “developers build, launch and manage their web3 projects without writing any lines of code.” Anything that makes tech more generally accessible is fine by us, including, yes, crypto.

- Fractal is an gaming NFT marketplace built on Solana: Did that make sense to you? If not, let me help. Fractal is a company that is building a market to sell gaming-related non-fungible tokens on the Solana blockchain, which rivals Ethereum and Bitcoin. How does gaming come into the speculative world of NFTs? Well, there are now play-to-earn games out there, where players are rewarded with NFTs instead of, say, internet points. So you can trade those on Fractal, I suppose.

- NBA Top Shot takes another shot: Dapper Labs became known as the team behind the NBA Top Shot NFT series that was hot a while back. Now the company — worth some $7.6 billion — is back with its next product called The Warehouse. I can’t really improve on what our own Lucas Matney wrote, so here it is: The Warehouse is “an ambitious NFT storefront that the startups hope will serve as a hub for web3 digital identity, allowing users to create animated avatars and outfit them with crypto accessories.” As with all crypto projects, I have no idea if this is going to be a hit or a flop.

The rest of it:

- Prior head of Twitter India is starting an edtech startup: Twitter and India get along about as well as any authoritarian government does with the social network. But now the company’s former head in the country, Manish Maheshwari, is “leaving the firm to launch an edtech startup, according to nine people familiar with the matter.” Something to keep an eye on.

- SnapLogic now worth $1B: The NFT world may get more headlines than enterprise software lately, but that hasn’t stopped the more staid parts of startupland from still doing business. SnapLogic is indicative of that fact, raising $165 million at a new, higher valuation. The new unicorn helps companies bringing their work into the digital realm connect their various data sources and workflows.

- Weird startup names are still here: Say hello to Whym, founded by ex-Snap employees. The startup is working on mobile e-commerce, a part of the larger digital purchasing world that could still use some work. I say that as someone who, at times, buys things on his phone and has dealt with all the fun that it entails. Whym just raised $4.3 million.

- Notus wants to help you find the right influencer for your brand: The world of influencer marketing has become mature enough that finding one’s next in-market avatar is now a business. Notus has raised $1.25 million to build a software service to help brands of all sorts find whom they should hire to rep their stuff. Neat!

Conversational UX: The missing piece in your chatbot strategy

Image Credits: krung99 (opens in a new window) / Getty Images

We don’t run many TechCrunch+ articles that are focused on basic best practices, but we make exceptions when it comes to posts about emerging technology — in this case, conversational UX.

It’s notoriously difficult for software to mimic human conversation. Many chatbots are so inept, it makes one long for the days of press 0 for an operator.

“Though chatbots are largely meant to handle simple customer service tasks, there is an opportunity to scale both customer service and sales messaging,” writes Raghu Ravinutala, CEO and co-founder of Yellow.ai, a conversational CX platform.

(TechCrunch+ is our membership program, which helps founders and startup teams get ahead. You can sign up here.)

Big Tech Inc.

- Reply to that Instagram with a TikTok Reel: TechCrunch noted today that Instagram, the Meta-built photo-sharing app, has introduced “Reels Visual Replies.” The feature will allow Instagram users to create short-form video replies to other posts. So it’s like personal gifs, I reckon. Which is cool if people use them. Let’s see.

- Mozilla is a huge business: Sure, we moved to Chrome, but not everyone did. So many people, in fact, still use Mozilla products that the company should generate around $500 million this year. Not bad! And good news for browser competition.

TechCrunch Experts

Image Credits: SEAN GLADWELL / Getty Images

Are you all caught up on last week’s coverage of growth marketing and software development? If not, read it here.

TechCrunch wants you to recommend growth marketers who have expertise in SEO, social, content writing and more! If you’re a growth marketer, pass this survey along to your clients; we’d like to hear about why they loved working with you.