Why can we see all our bank, credit card and brokerage data on our phones instantaneously in one app, yet walk into a doctor’s office blind to our healthcare records, diagnoses and prescriptions? Our health status should be as accessible as our checking account balance.

The liberation of financial data enabled by startups like Plaid is beginning to happen with healthcare data, which will have an even more profound impact on society; it will save and extend lives. This accessibility is quickly approaching.

As early investors in Quovo and PatientPing, two pioneering companies in financial and healthcare data, respectively, it’s evident to us the winners of the healthcare data transformation will look different than they did with financial data, even as we head toward a similar end state.

For over a decade, government agencies and consumers have pushed for this liberation.

This push for greater data liquidity coincides with demand from consumers for better information about cost and quality.

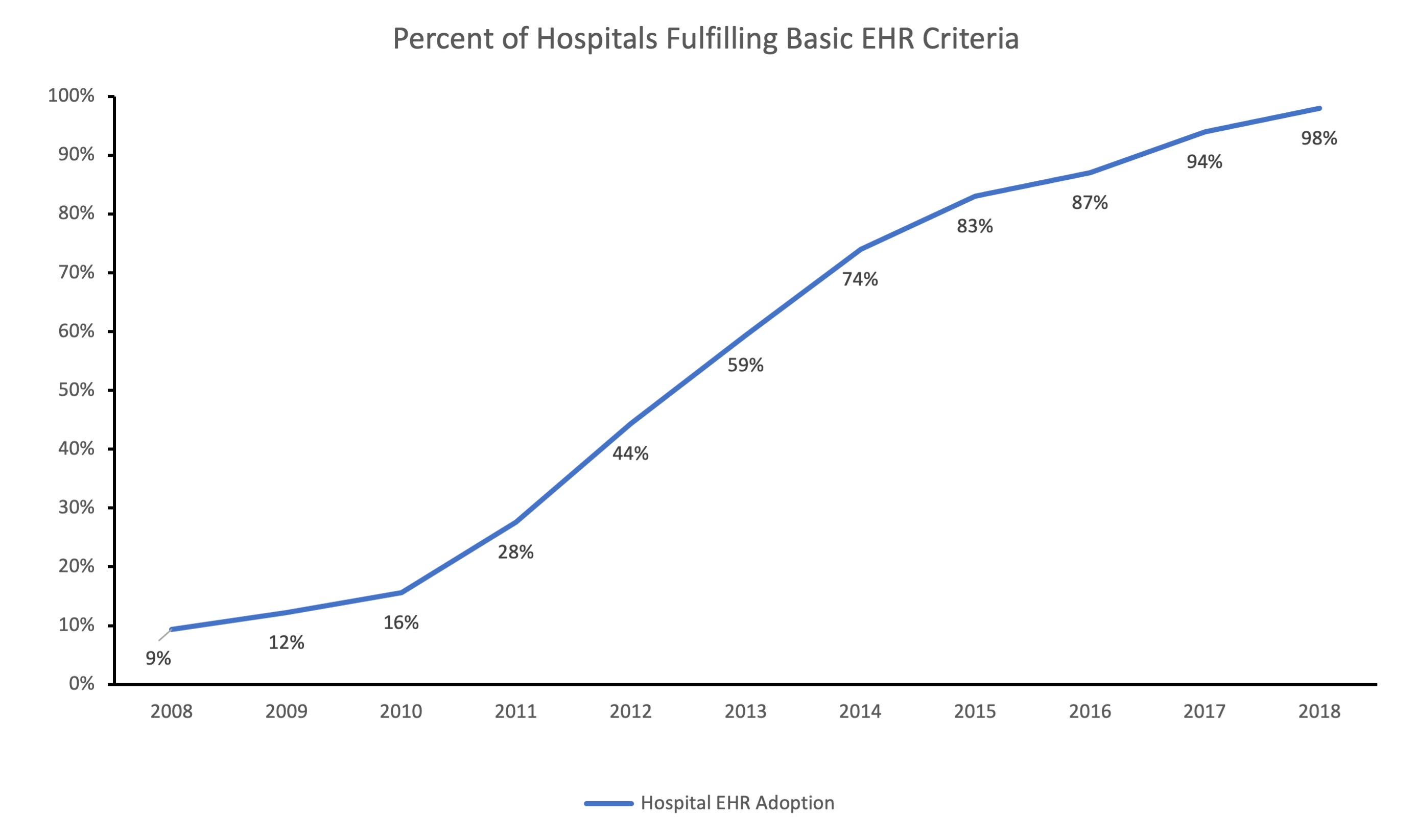

In 2009, the Health Information Technology for Economic and Clinical Health Act (HITECH) gave the first big industry push, catalyzing a wave of digitization through electronic health records (EHR). Today, over 98% of medical records are digitized. This market is dominated by multibillion‐dollar vendors like Epic, Cerner and Allscripts, which control 70% of patient records. However, these giant vendors have yet to make these records easily accessible.

A second wave of regulation has begun to address the problem of trapped data to make EHRs more interoperable and valuable. Agencies within the Department of Health and Human Services have mandated data sharing among payers and providers using a common standard, the Fast Healthcare Interoperability Resources (FHIR) protocol.

Image Credits: F-Prime Capital

This push for greater data liquidity coincides with demand from consumers for better information about cost and quality. Employers have been steadily shifting a greater share of healthcare expenses to consumers through high-deductible health plans — from 30% in 2012 to 51% in 2018. As consumers pay for more of the costs, they care more about the value of different health options, yet are unable to make those decisions without real-time access to cost and clinical data.

Image Credits: F-Prime Capital

Tech startups have an opportunity to ease the transmission of healthcare data and address the push of regulation and consumer demands. The lessons from fintech make it tempting to assume that a Plaid for healthcare data would be enough to address all of the challenges within healthcare, but it is not the right model. Plaid’s aggregator model benefited from a relatively high concentration of banks, a limited number of data types and low barriers to data access.

By contrast, healthcare data is scattered across tens of thousands of healthcare providers, stored in multiple data formats and systems per provider, and is rarely accessed by patients directly. Many people log into their bank apps frequently, but few log into their healthcare provider portals, if they even know one exists.

HIPPA regulations and strict patient consent requirements also meaningfully increase friction to data access and sharing. Financial data serves mostly one-to-one use cases, while healthcare data is a many-to-many problem. A single patient’s data is spread across many doctors and facilities and is needed by just as many for care coordination.

Because of this landscape, winning healthcare technology companies will need to build around four propositions:

- Winning over the app developer ecosystem is necessary. Startups need to take an API-first product strategy and foster third-party developer support with well-designed API endpoints that abstract away the complexity of accessing and synthesizing healthcare data. Successful startups will provide elegant API documentation and efficient testing sandboxes and over time add pre-built analytics. Put another way, the tools we ultimately need have not been built yet, so the platform that caters best to the entrepreneurial ecosystem will benefit by enabling and then scaling with those innovators.

- Serve the providers and payers that hold the data first. As exciting as this is, it will take several years to aggregate healthcare data and even more for consumers to elevate their expectations of using it. The “build it and they will come” model is a recipe for burning a lot of capital. Instead, software startups that emulate Snowflake will be the winning models in healthcare. They will lead the transformation by helping providers and payers aggregate, standardize and display their own data in secure ways both for internal users and for consumers. Winning six- and seven-figure annual SaaS contracts along the way will fuel positive feedback loops for areas of innovation, investment and adoption.

- Aggregators will be essential, but few will be truly differentiated. No single aggregator will be able to connect to all providers and payers like Plaid. Healthcare data seekers will connect to one aggregator API, which will then progressively “waterfall” through the other aggregators until they have accessed all the data they need. This is a far less valuable position, but early recognition of the industry difference is crucial.

- This is not a winner-take-all market, but there are strong network effects leading to a winner-take-most endgame. The strongest network effects will occur among payers and their in-network providers who already have extensive data-sharing needs and will only grow with risk-sharing schemes. Winning over major payers like Aetna, Cigna and Humana will be the strongest play, but attention must be paid to providers like Partners Healthcare and Intermountain, which also have extensive networks with natural network effects. Startups that help payers and providers aggregate and share their own data will be well positioned to become the primary aggregator later.

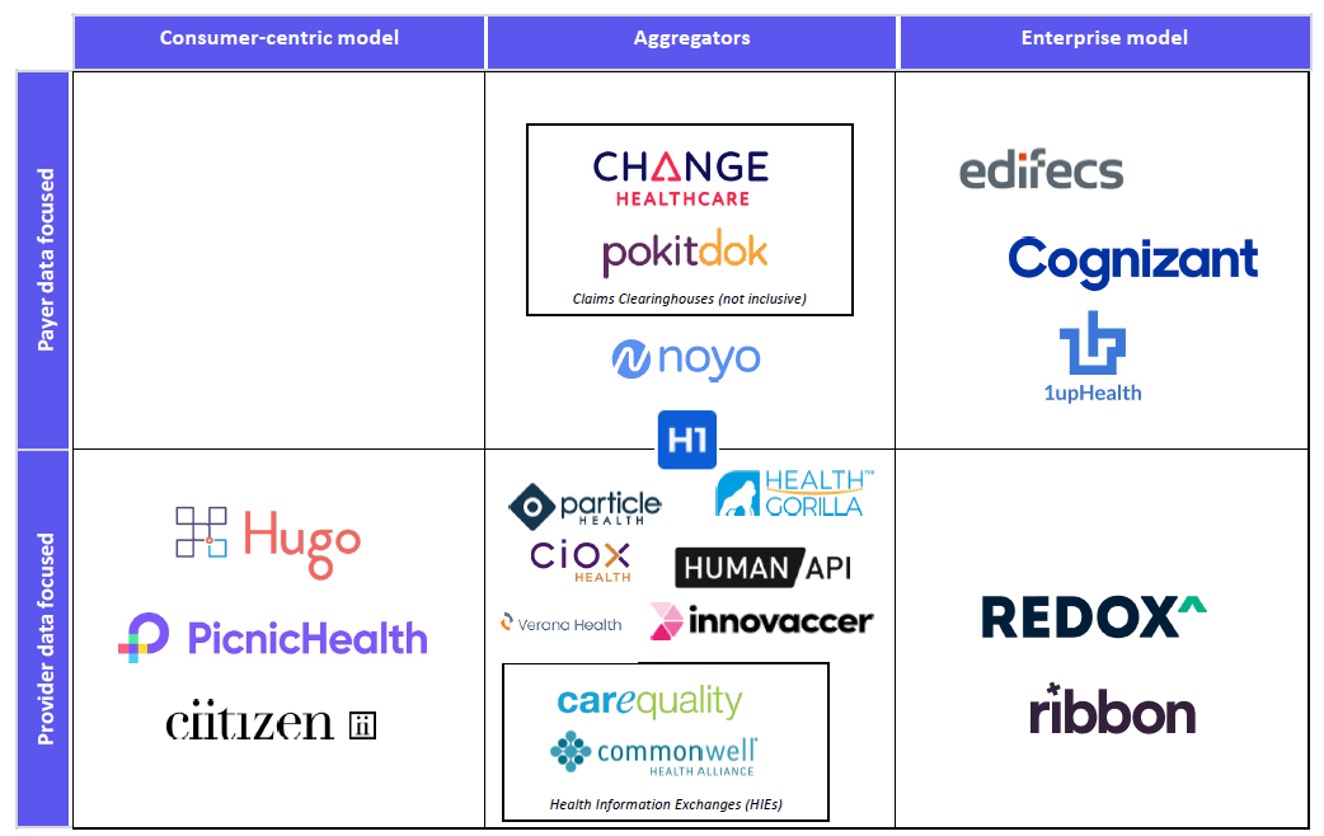

The current competitive landscape reveals three business models built around either healthcare provider or payer data. Startups like Citizen and PicnicHealth that focused on consumer-centric horizontal use cases have the chance to serve certain patient populations extremely well, including highly valuable chronic disease management and pharmaceutical trial cohorts and will do well should consumer demand for healthcare data emerge quickly.

The aggregator vertical will be essential, but again, these companies will have a very tough fight for differentiation in a crowded market.

Finally, enterprise software players like 1upHealth (an F-Prime portfolio company) and Redox that initially focused on payers and providers, respectively, are well positioned for both the early chapters of liberating healthcare data, advancing analytics and building third-party developer platforms, the endgame. As investors, this enterprise category feels like a great place to begin to address this enormous opportunity.

Image Credits: F-Prime Capital

The liberation of healthcare data will not only save money and improve consumer experiences, but more importantly, it will save and extend lives.

Over the next decade, most U.S. consumers will pay significantly more for healthcare as employers shift them to high-deductible plans. At the same time, they will finally be able to access quality cost and data information before visiting a doctor and have all their medical records afterward.

While not having to fill out yet another doctor’s intake form might be progress enough, we are excited to see the industry enable and accelerate the potential for so much more. Very soon, with the emergence of new market leaders, we’ll be able to access our health records as easily as our bank statements.