Amid all the news of the last few days, you might have missed that eToro, an Israeli consumer stock-trading service, is going public in the United States via a SPAC.

Don’t worry about the SPAC bit: If you want a rundown of the deal itself, Mary Ann has you covered. What matters for our purposes is that eToro competes with Robinhood in the United States, though it retains a strong European user base. And, thanks to the fact that it is SPACing itself onto the public markets, we now have lots of its financial data to play with.

The Exchange explores startups, markets and money. Read it every morning on Extra Crunch, or get The Exchange newsletter every Saturday.

You can see where we’re going with this. With Robinhood somewhere between a sheaf of lawsuits and an IPO, the eToro data could provide an interesting insight into the world in which its zero-cost trading competitor operates. If we want to better understand Robinhood, perhaps eToro can provide some clarity.

We’re going into the eToro investor deck, first asking ourselves what we think of its numbers and financial health and valuation. Then we’ll compare what we learned against what we know about Robinhood’s own business. Let’s go!

We’re going into the eToro investor deck, first asking ourselves what we think of its numbers and financial health and valuation. Then we’ll compare what we learned against what we know about Robinhood’s own business. Let’s go!

eToro is going public

The eToro-SPAC deal is a big one, weighing in at over $10 billion in calculated value. Whether the markets will support the valuation isn’t clear, but the debut matters for the Israeli startup market and the returns of a goodly number of venture capitalists and other capital pools.

What do its SPAC-backers see in eToro that could be worth so much? Let’s get into the deck, which you can open up here.

To illustrate both its recent growth and also how relaxed the rules are on what companies can share in their SPAC presentations, eToro has included its full-year 2020 results and its January 2021 results. Why? Because, like Robinhood and others, it had a big start to the year. So, eToro wants to show off how well.

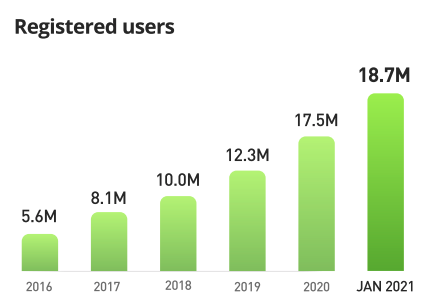

For example, this chart shows that eToro had a good 2020, and an incredible start to 2021:

Image Credits: eToro

Impressive, right? eToro later breaks the 2020/2021 split into numbers, noting that it recorded an average of 192,000 registrations per month in 2019, 440,000 per month in 2020 and 1.223 million in January 2021. The implication the company is trying to impart on investors is obvious: If you like our past growth, just look at what this teaser 2021 data point could mean!

The company also reports a falling cost to acquire users (CAC) through the start of 2021, numbers that declined from $52 in 2019 to $41 in 2020 and $31 in January of this year.

But what’s interesting about eToro is that it doesn’t appear to make much money — if any — from payment for order flow (PFOF). Instead, the 37th slide in its deck details that it generates 87% of its revenues from “trading revenue,” which it says is generated from “the spread, which is the difference between the Buy and Sell prices of a certain asset” across stocks and crypto assets. Robinhood, in contrast, told Congress recently that PFOF is its majority revenue stream.

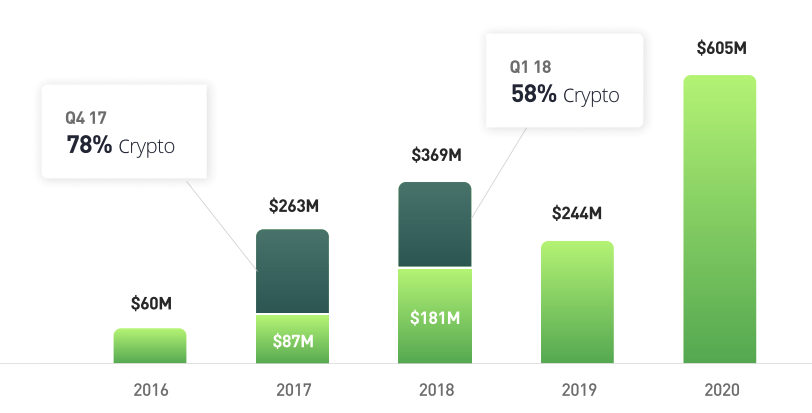

The company’s blended asset-based revenue — both trading incomes and interest — has changed its base over time. In 2017, 63% of eToro’s revenue from trading and interest came from crypto assets. By 2020, it was 32% from commodities and 44% from stocks. What drove the large crypto incomes? The 2017/2018-era bitcoin mania.

Indeed, when discussing its historical revenue growth, eToro tries to highlight that while its revenue dipped in 2019 compared to 2018, if you extract some crypto incomes from particular periods things are a bit more even:

Image Credits: eToro

Investors who are crypto bulls won’t mind this chart. Investors who are not are probably more comfortable with its greater equity revenue results. So, it’s hard to find too much weakness in the above chart, apart from noting it’s not merely Coinbase in the market that benefited from the last crypto mania, later enduring a crypto lull.

Doing the math, eToro at $10.4 billion and $605 million in revenue is worth around 17.2x its 2020 revenues. If you believe the 2021 hype that eToro imputes via its January growth numbers, its revenue falls; we lack Q1 2021 data, but the quarter is nearly over, mind, so the company’s first-quarter is effectively a baked cake at this point. We’re looking at December-era results.

The company’s run-rate multiple is lower than our 17.2x figure, though we can’t tell from this distance precisely how much lower.

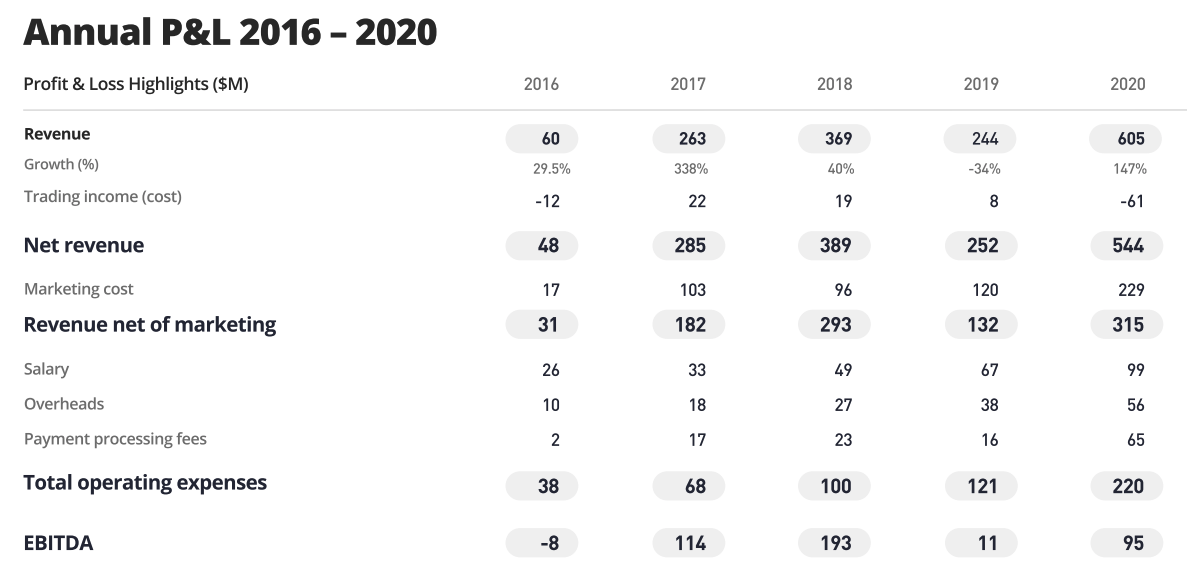

Supporting its multiple, whichever number you prefer, is a history of adjusted profitability. Here’s eToro’s number-set:

Image Credits: eToro

Even when eToro saw its revenues fall in 2019, it still managed to generate unadjusted EBITDA! Not bad indeed. While the company’s 2018 profits were not beaten in 2020, the company’s growth was impressive enough that investors probably won’t mind, given the present-day markets climate that favors growth over other metrics.

The company is not focused on near-term profits. Indeed, on slide 44, it notes that it intends to spend $392 million on marketing in 2021, up from $229 million in 2020. That’s 71% more. Sure, eToro expects those users to pay back their CAC in under a half-year, but it’s still quite a lot of spend.

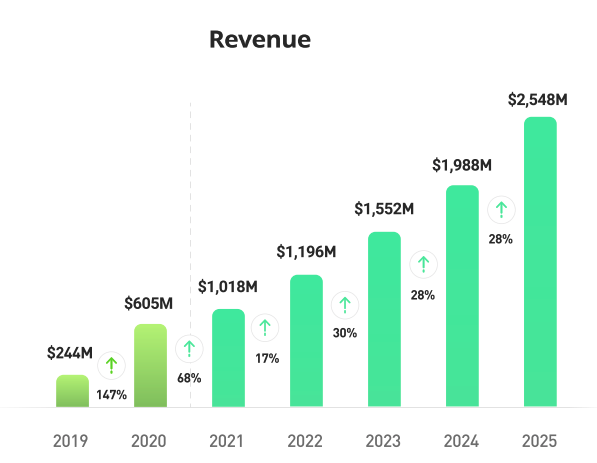

What will eToro get from 40% of a billion dollars in 2021 marketing spend? Projected revenue growth:

Image Credits: eToro

The company anticipates a modest 17% growth rate in 2022, followed by roughly 30% expansion in the following years. Everything past 2020 is made up, of course, but if you buy into the company at its SPAC-deal price, you are anticipating paying around 10x projected 2021 revenues.

That’s a more reasonable number for a firm that has a history of revenue declines outside of its control; how much control eToro has on its revenue growth is another interesting question. The trading firm also expects slim profits in 2021, with EBITDA expectations falling to a near break-even level. Starting in 2022, however, it projects regular growth in adjusted profitability. We’ll see.

So what have we learned? The following:

- Trading incomes from diverse assets can prove incredibly variable as the market’s focus changes and consumers favor different investing opportunities. This is akin to what the Coinbase S-1 showed us, though in a slightly different format as eToro supports more asset classes.

- There’s both lots of global demand and revenue in the zero-cost trading game, which means that there won’t be a single winner. And as we can see from the eToro growth story, largely focused on the European market, there may be regional winners. That could mean more limited upside for Robinhood as it tries to fend off both domestic upstarts and expand internationally, and the same for eToro in terms of its market stature in Europe.

- You can support free trades profitably sans PFOF.

- And you probably won’t get a software-multiple for trading incomes.

To some degree, trading platforms are being valued more like high-margin video games than software stocks. And with good reason; video games and the companies that build them have notoriously variable revenues. So, investors do not award them the same multiples that software companies — especially in the SaaS era, such as we are — command. By that logic, eToro should get a subsoftware multiple even though it has attractive growth, attractive economics and a proven history of operating leverage.

Applying what we’ve learned, I have two questions concerning Robinhood:

- What revenues can Robinhood generate from crypto trading? Are those sums material compared to its known — and lucrative — PFOF incomes? If Robinhood is more diversified than we think, it could be a larger and healthier business than anticipated, and thus more valuable.

- Does Robinhood expect a software multiple or a trading-shop valuation? Robinhood does have some recurring revenues via its subscription plans, but surely those do not constitute more than a dusting of revenues compared to its rising PFOF top line. Its valuation expectations should bear that in mind.

A healthy, growing company, eToro’s documents and valuation tell us quite a lot about its market — and perhaps even its competitors — as will its early trading. More when that happens.