The impending Coinbase direct listing is a fintech debut to watch. The cryptocurrency-focused consumer trading concern is set to become a public company on the back of a strong 2020, and a particularly strong final quarter.

And it appears that the company is also having a strong kickoff in 2021. What Coinbase is worth is therefore hard to guess, though some are trying, as we’ve noticed.

The Exchange explores startups, markets and money. Read it every morning on Extra Crunch, or get The Exchange newsletter every Saturday.

But Coinbase is hardly the only company enjoying a crypto bounce: Robinhood, another American consumer fintech we’ve spent too much time discussing in recent weeks, is also riding a wave in its users’ cryptocurrency activity.

Between both companies, we’re seeing signs of the sort of growing consumer interest and trading volume that has historically come with sustained periods of bitcoin price expansion. But Coinbase charges fees for trading, while Robinhood doesn’t. And transaction-fee-based income is the vast majority of Coinbase’s revenues — 96% in calendar 2020, for example.

Between both companies, we’re seeing signs of the sort of growing consumer interest and trading volume that has historically come with sustained periods of bitcoin price expansion. But Coinbase charges fees for trading, while Robinhood doesn’t. And transaction-fee-based income is the vast majority of Coinbase’s revenues — 96% in calendar 2020, for example.

The situation sets up an interesting contrast.

This morning, let’s see what we can learn about Coinbase’s recent trading volume before looking into Robinhood’s. And finally, we’ll remind ourselves of how Coinbase talked about Robinhood in its S-1 filing. Is Robinhood crypto a possible threat to Coinbase’s consumer trading volumes? Let’s tinker.

An argument called forever

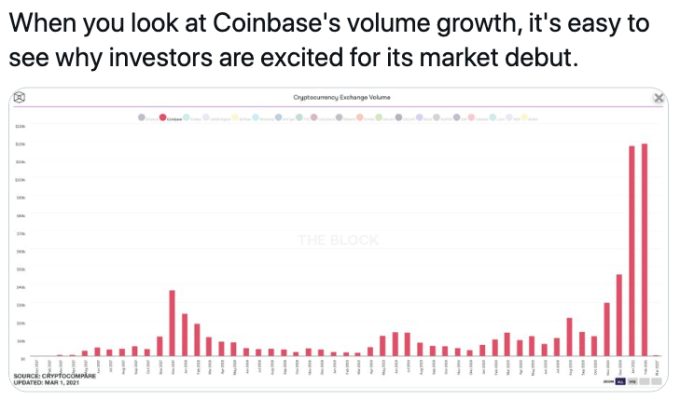

Kicking off with Coinbase, The Block’s Frank Chaparro got us thinking this morning by tweeting the following chart:

You can see why the chart caught our eye. Now, we can’t reproduce the same chart on CryptoCompare, as the tool required sits behind a locked door. But we can, however, leverage other services to confirm the gist of the image.

Other data agrees: Historical trading information via Nomics shows a steep rise in 2021 bitcoin trading on Coinbase Pro, a piece of the larger Coinbase empire. And Bitcoinity shows similar gains for Coinbase trading volumes over the same time period.

Chaparro is correct that the data paints a compelling Q1 2021 revenue story for Coinbase. But it’s not the only company that is seeing crypto demand spike.

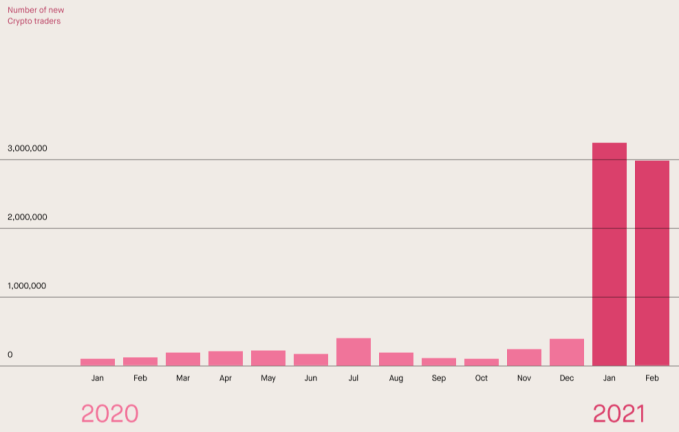

The famous/infamous equities trading platform Robinhood has long supported cryptocurrency trading at zero fees, much like its other services. And the company dropped a post last week that shows off its own growth in “new” users trading crypto on its platform.

Here’s a snip from the chart the company shared:

Image Credits: Robinhood

Per Robinhood, it gained more than 2.9 million new crypto traders during each of the first two months of 2021. That’s a pretty incredible influx of new traders. A separate chart also showed that the size of an average crypto buy was also trending higher in 2021 compared to 2020, another good sign.

More users, more volume and larger buys? That all adds up to material growth in Robinhood’s crypto efforts.

But as Robinhood crypto costs nothing and Coinbase makes its living from trading fee income, it feels like the first company is possibly set to spoil some of the sun on the latter’s picnic. Right?

We are not exaggerating the size of the question. Here’s Coinbase in its public filing on how it makes money (emphasis: TechCrunch):

We generate substantially all of our total revenue from transaction fees on our platform in connection with the purchase, sale, and trading of crypto assets by our customers. [ … ] We also generate total revenue from our subscription products and services and, while revenue from these products and services have not been significant to date, most of this revenue will also fluctuate based on the price of crypto assets. As such, any declines in the volume of crypto asset transactions, the price of crypto assets, or market liquidity for crypto assets generally may result in lower total revenue to us. [ … ]

The increase in value of Bitcoin from 2016 to 2017 was followed by a steep decline in 2018, which adversely affected our net revenue and operating results. The price and trading volume of any crypto asset is subject to significant uncertainty and volatility[.]

All of that you already knew; it’s why you were not surprised that Coinbase is doing as well as its S-1 shows. But how far does the Robinhood effect spread in time? Could Robinhood undermine Coinbase in 2021 with zero-cost crypto trading?

The fee-impact of Robinhood’s business model on its stock-trading rivals was rapid and near complete. As the then-startup scaled its customer base on the back of no-fee trading, its traditional rivals had no choice but to fall in line. Trading incomes that once buoyed the results from Charles Schwab and others dropped sharply. After Robinhood proved that PFOF-funded consumer trading was a hit, one could no longer expect consumers to pay the cost of a few coffees to effect a digital trade in traditional securities.

So why hasn’t Robinhood had the same impact on Coinbase? Well, the soon-to-be-public company has an explanation. Via its S-1:

For retail users, we compete with traditional financial technology and brokerage firms like Square, Robinhood, and PayPal, who have recently introduced crypto products and services. These companies have varying business models and focus areas and offer an overlapping, but limited, feature set, which includes buying and selling a subset of the crypto assets supported on our platform.

Coinbase is wagering that a tech advantage is enough to defend its fees. That is its moat. I wonder. Its fees are not modest. They actually feel somewhat material when reading through the price list. That leaves lots of market room for Robinhood to step into, right?

Only sorta, so far! Sure, Robinhood is kicking the hell out of its former in-house crypto records, but as we saw first, it’s hardly looking like Coinbase is struggling. In fact, it could be seeing new record results itself.

It would be wild if the Robinhood Effect that we saw so cleanly in equities trading didn’t replicate itself inside of the crypto-world. But Coinbase is betting on the idea, as are its investors. We’ll see!

(Also Robinhood, keep the data coming, but more, and more frequently. Thanks!)

TC Early Stage: The premiere how-to event for startup entrepreneurs and investors

From April 1-2, some of the most successful founders and VCs will explain how they build their businesses, raise money and manage their portfolios.

At TC Early Stage, we’ll cover topics like recruiting, sales, legal, PR, marketing and brand building. Each session includes ample time for audience questions and discussion.

Use discount code ECNEWSLETTER to take 20% off the cost of your TC Early Stage ticket!