Ever since the pandemic hit the U.S. in full force last March, the B2B tech community keeps asking the same questions: Are businesses spending more on technology? What’s the money getting spent on? Is the sales cycle faster? What trends will likely carry into 2021?

Recently we decided to join forces to answer these questions. We analyzed data from the just-released Q4 2020 Outlook of the Coupa Business Spend Index (BSI), a leading indicator of economic growth, in light of hundreds of conversations we have had with business-tech buyers this year.

A former Battery Ventures portfolio company, Coupa* is a business spend-management company that has cumulatively processed more than $2 trillion in business spending. This perspective gives Coupa unique, real-time insights into tech spending trends across multiple industries.

Tech spending is continuing despite the economic recession — which helps explain why many startups are raising large rounds and even tapping public markets for capital.

Broadly speaking, tech spending is continuing despite the economic recession — which helps explain why many tech startups are raising large financing rounds and even tapping the public markets for capital. Here are our three specific takeaways on current tech spending:

Spending is shifting away from remote collaboration to SaaS and cloud computing

Tech spending ranks among the hottest boardroom topics today. Decisions that used to be confined to the CIO’s organization are now operationally and strategically critical to the CEO. Multiple reasons drive this shift, but the pandemic has forced businesses to operate and engage with customers differently, almost overnight. Boards recognize that companies must change their business models and operations if they don’t want to become obsolete. The question on everyone’s mind is no longer “what are our technology investments?” but rather, “how fast can they happen?”

Spending on WFH/remote collaboration tools has largely run its course in the first wave of adaptation forced by the pandemic. Now we’re seeing a second wave of tech spending, in which enterprises adopt technology to make operations easier and simply keep their doors open.

SaaS solutions are replacing unsustainable manual processes. Consider Rhode Island’s decision to shift from in-person citizen surveying to using SurveyMonkey. Many companies are shifting their vendor payments to digital payments, ditching paper checks entirely. Utility provider PG&E is accelerating its digital transformation roadmap from five years to two years.

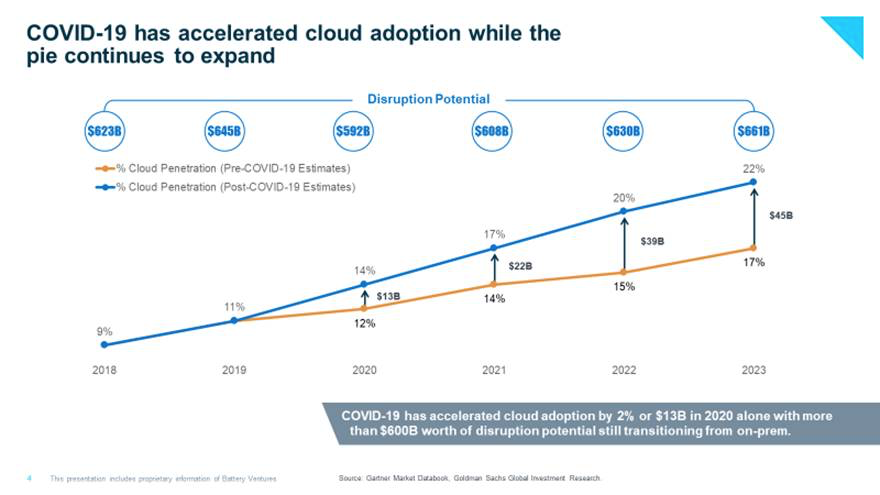

The second wave of adaptation has also pushed many companies to embrace the cloud, as this chart makes clear:

Image Credits: Battery Ventures (opens in a new window)

Similarly, the difficulty of maintaining a traditional data center during a pandemic has pushed many companies to finally shift to cloud infrastructure under COVID. As they migrate that workload to the cloud, the pie is still expanding. Goldman Sachs and Battery Ventures data suggest $600 billion worth of disruption potential will bleed into 2021 and beyond.

In addition to SaaS and cloud adoption, companies across sectors are spending on technologies to reduce their reliance on humans. For instance, Tyson Foods is investing in and accelerating the adoption of automated technology to process poultry, pork and beef.

All companies are digital product companies now

Mention “digital product company” in the past, and we’d all think of Netflix. But now every company has to reimagine itself as offering digital products in a meaningful way.

Examples range far and wide across industries. Let’s start with banks. One case in point: Recently Eric tried to transfer funds overseas online and hit a limit requiring him to visit a physical branch — during a pandemic. His reaction resembles what many consumers would think: wait, why? Banks should add more security safeguards to make this transaction secure enough to happen 100% online.

In Q2, Santander Bank saw a 44% increase in online transactions that would typically occur at a branch — think loan applications and commercial banking tasks. As a result of this spike, Santander doubled down its investments in improving user experience and uptime.

The digital-product push is happening across retail, too. Mobile phone customers don’t want to visit a retail store anymore to upgrade their plan. Sam’s Club had been in the proof-of-concept stage with curbside pickup when pandemic lockdowns hit last spring. They rolled out curbside to all stores in just seven weeks by leveraging AI, according to comments made by the company’s CTO in October at an executive forum. Walmart is investing in technology to make complex procurement simpler and optimize cost savings.

Tellingly, customers are not reverting to older channels during this period when they can’t visit stores easily. If the bank isn’t open, customers don’t reach out to the call center anymore — they turn to the bank’s digital product. That means those products have to offer a great, full-featured customer experience.

The CFO of Walgreens Boots Alliance speaks for many enterprises when he remarked on a recent earnings call: “We will find ourselves dramatically accelerating our digital journey over the next six to 12 months. And what we found is, it’s amazing what technology stuff we could get done in two weeks in a crisis.” Which brings us to the third big trend: speed.

Sales and approval cycles are accelerating dramatically, with deals changing shape too.

Enterprise software sales come in two types: top-down and bottom-up. And both kinds are accelerating.

Top-down sales, authorized by the CIO and promulgated throughout the company, usually take three to six months minimum to complete and often stretch to 12-18 months. Eight months ago, nobody was adding new prospects to the pipeline — yet top-down tech sales haven’t slowed down to the degree many expected. They simply no longer require the same contemplation time. BSI data for Q4 2020 reveals approval times reducing significantly across all industries, with the fastest approval times in the previous 24 months.

This speed is partly explained by the fact that deal sizes are often smaller and consumption-based. Instead of a $10-million purchase that takes 12 months to approve, now a $15,000/month contract might consummate in a month or two.

Bottom-up tech sales cycles are accelerating too. Employees are adopting work tools they need urgently and not waiting for enterprise approval first. They purchase Slack for $15/month or buy Smartsheets and then get reimbursed later. Enterprises see this widespread bottom-up adoption and realize this necessitates enterprise-level deals.

What tech spending trends will we see into 2021?

We anticipate a significant acceleration in tech spending next year and in 2022, despite the current recession. Enterprises have spent the past six months evaluating their options to survive.

That tech spend will be driven by two factors that have already emerged. First, boards are racing to invest in technologies to engage with customers, partners and employees in up-to-date, more-modern ways. Second, bottom-up employees are figuring out better ways to collaborate with a more technologically and geographically dispersed workforce.

We predict the biggest investment in the following three areas:

- Transitioning customer in-person experience to online experiences.

- Evolving manual back-office processes into digital to support a long-term, hybrid WFH workforce.

- Accelerating the replacement of outmoded technology with modern cloud-based infrastructure to support new ways of doing business long term.

There’s never been a clearer example of how crises accelerate change. We don’t believe enterprises or consumers will revert to the old ways of doing things when the pandemic subsides. Welcome to the next phase of tech spending.

Battery Ventures provides investment advisory services solely to privately offered funds. Battery Ventures neither solicits nor makes its services available to the public or other advisory clients. For more information about Battery Ventures’ potential financing capabilities for prospective portfolio companies, please refer to our website.

*Denotes a past or present Battery portfolio company. For a full list of all Battery investments, please click here. No assumptions should be made that any investments identified above were or will be profitable. It should not be assumed that recommendations in the future will be profitable or equal the performance of the companies identified above.

Content obtained from third-party sources, although believed to be reliable, has not been independently verified as to its accuracy or completeness and cannot be guaranteed. Battery Ventures has no obligation to update, modify or amend the content of this post nor notify its readers in the event that any information, opinion, projection, forecast or estimate included, changes or subsequently becomes inaccurate.