The last decade saw many tech companies embracing product-led growth (PLG) and bottoms-up sales strategies, as opposed to traditional enterprise sales, to drive their go-to-market strategies and overall growth.

Many software startups loved (and still love!) the bottoms-up approach. What’s not to like about designing a software product to “sell itself” through viral adoption and word-of-mouth marketing? Bottoms-up and PLG both promise a faster sales cycle at a much lower cost — no more golf and pricey steak dinners on the expense account.

PLG offers other strategic advantages, too: By shortening the feedback loop between users and product teams, it allows early- and growth-stage tech companies to land and expand use of their technology inside corporate accounts, with internal champions driving the sale.

However, as enterprise-tech buyers watch expenses more closely these days, they are also tightening restrictions on self-procurement. This means founders who’ve become highly reliant on bottoms-up need a more robust enterprise-sales strategy, fast.

It’s too soon to pronounce bottoms-up dead, but it’s looking pretty moribund. And “pure” PLG needs to shift rapidly too. Today’s PLG needs to inform both the product and sales teams so they can work smoothly together and clinch the next deal.

Enterprise software spending: Slower deal cycles, more scrutiny

Some clues about this changing face of corporate tech spending can be found in our latest Battery Ventures State of Cloud Software Spending Report, which queried 100 chief technology officers, chief information officers and other large tech buyers across industries ranging from financial services to healthcare to manufacturing.

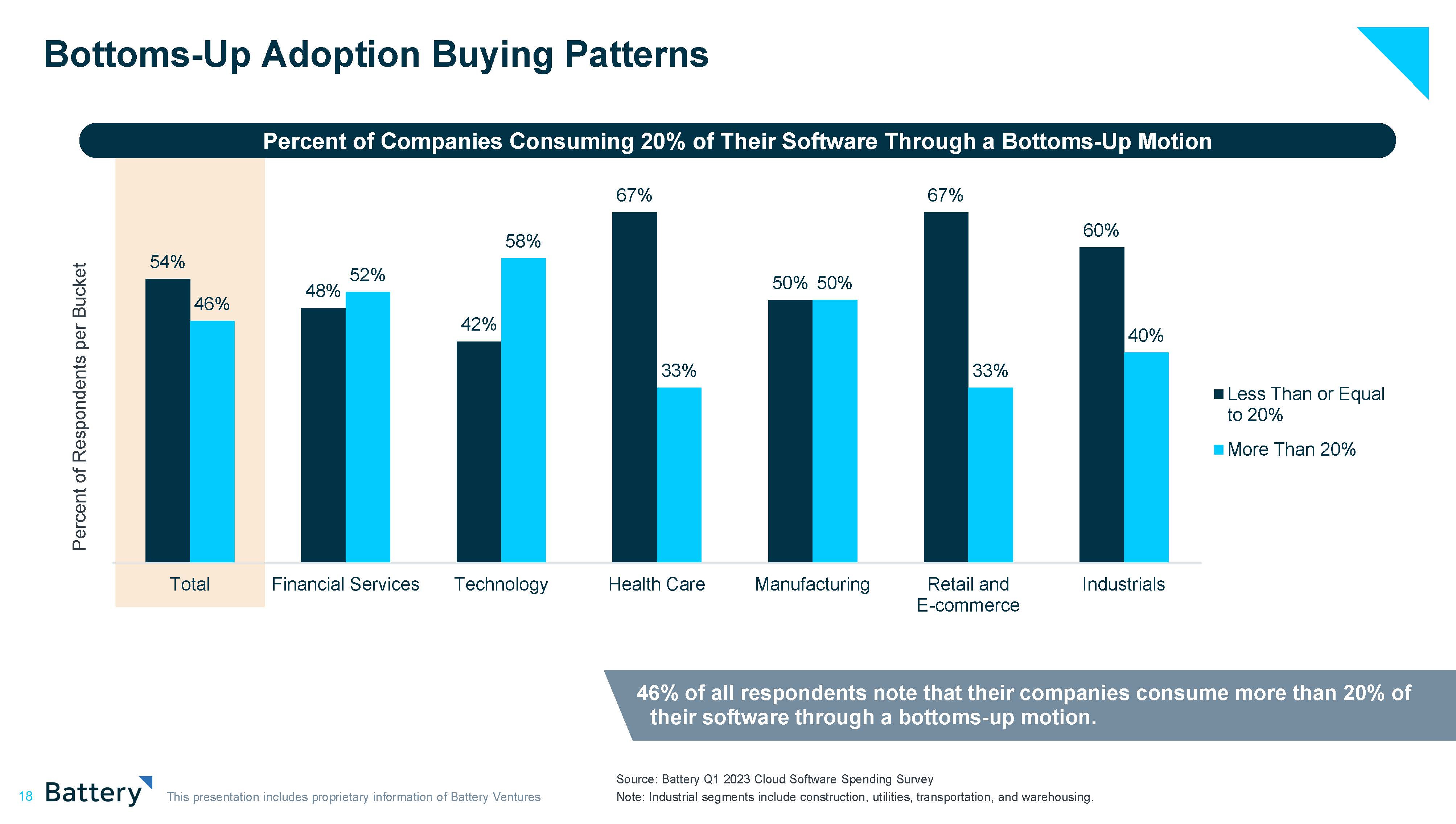

Collectively, the survey respondents represent $30 billion in annual technology spending. Our respondents include a healthy sampling of enterprises that consume software through a bottoms-up/PLG motion, as the slide below indicates.

Bottoms-up adoption buying patterns. Image Credits: Battery Q1 2023 Cloud Software Spending Survey

While almost half of our respondents (46%) expect to increase their total technology budgets in 2023, enterprises are getting more conservative and shifting priorities. Many plan to standardize spending, consolidating vendors to save money and optimizing SaaS licensing. Enterprises are reexamining pricing models to determine if consumption- or seat-based pricing makes the most sense, given how the software is used and choosing vendors partly on that basis.

Today’s PLG needs to inform both the product and sales teams so they can work smoothly together and clinch the next deal.

The sometimes-bureaucratic governance systems within enterprises may function even more slowly in the coming months, as organizations across industries work to become more efficient and to increase spending oversight.

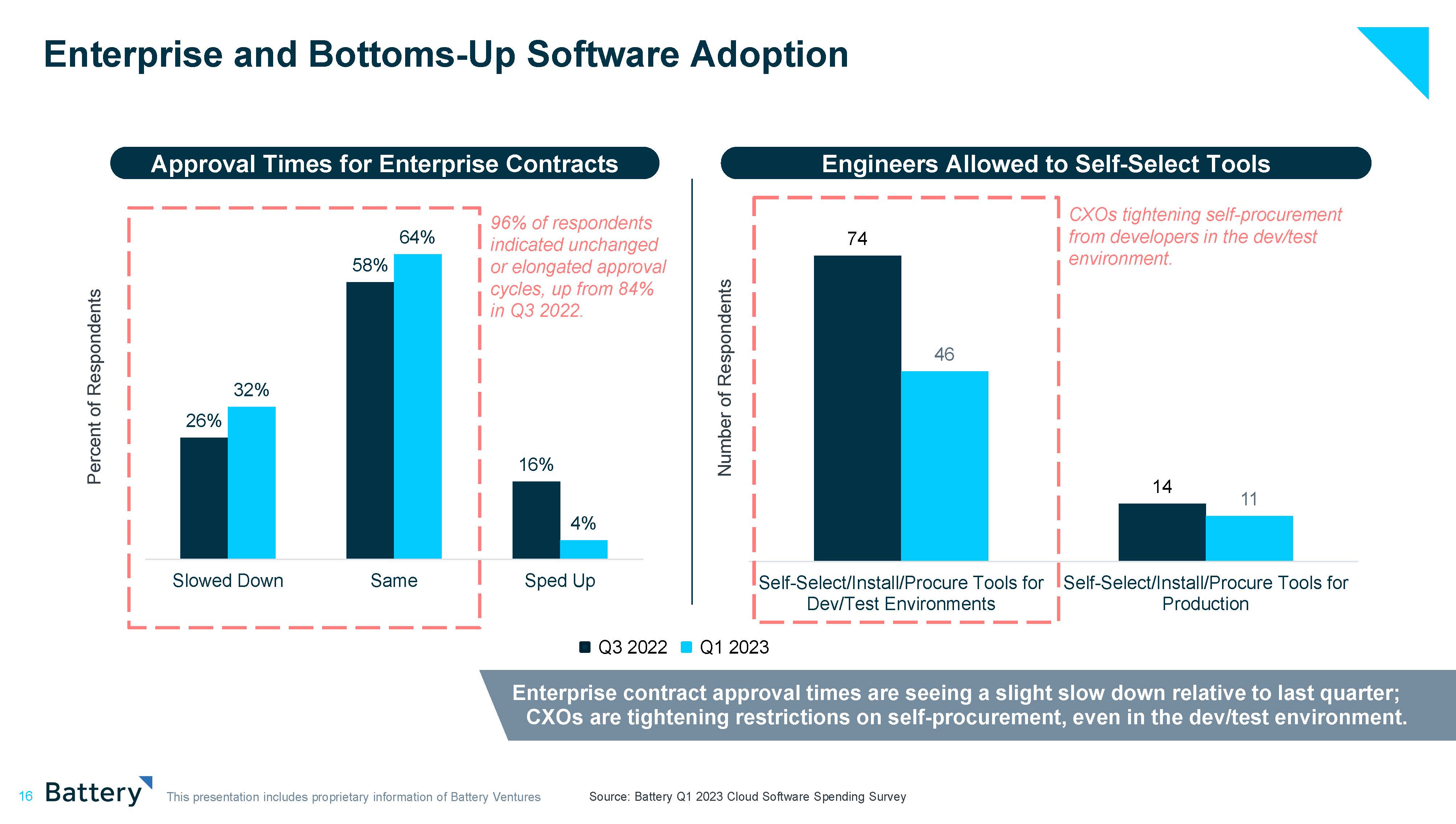

The slide below quantifies our findings that bottoms-up and PLG adoption are slowing down. One example: Only 46% of survey respondents now allow individual engineers to install tools in a “sandbox dev” environment – that’s down from 76% since our last survey in September 2022. The drop for engineer-selected tools deployed into production is significant too: Now, only 11% of enterprises allow this to happen, down 27% from September 2022.

Enterprise and bottoms-up software adoption. Image Credits: Battery Q1 2023 Cloud Software Spending Survey

Our survey also found sales cycles are slowing, as the slide above indicates — but not all the reasons why are obvious from the numbers. Yes, CXOs are scrutinizing vendors more closely in a more difficult economic context. But software sales now have to match an organization’s readiness. As we’ve learned in dozens of recent conversations with IT buyers, software purchases months in advance of project readiness are the single largest contributor to lengthening deal cycles.

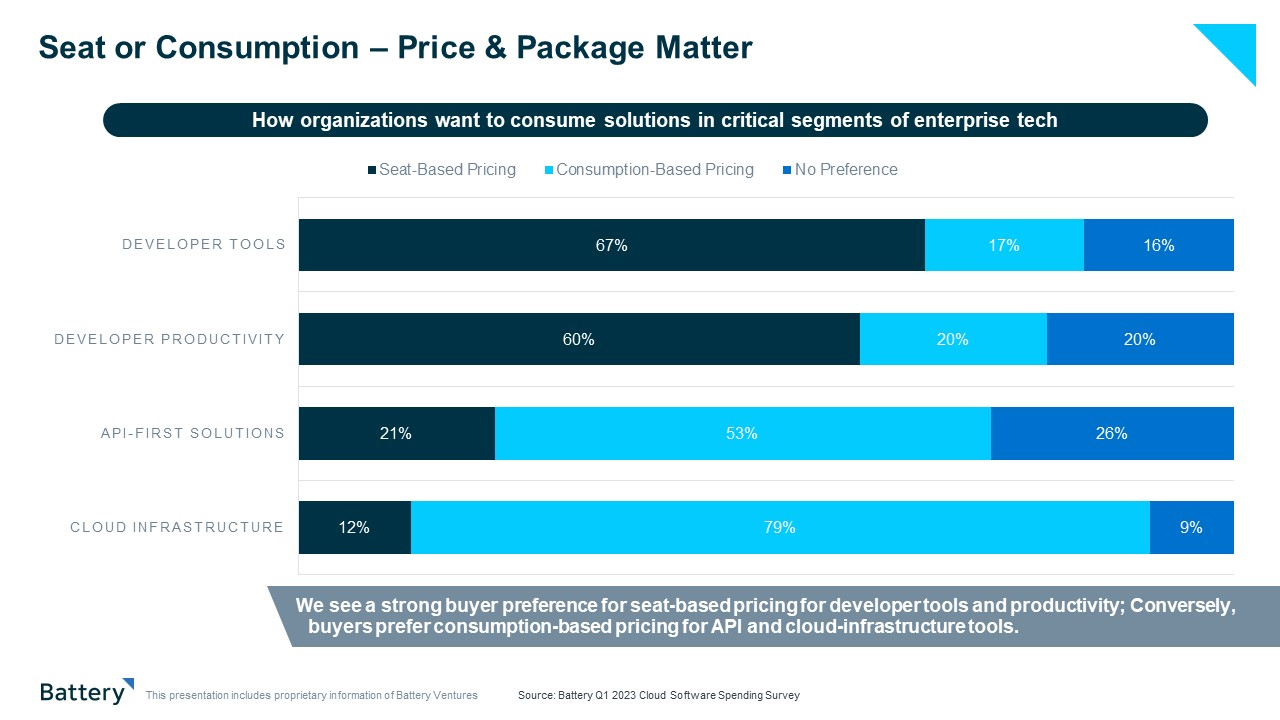

Another factor shifting in today’s selling environment is product pricing. Enterprises expect product pricing to match their consumption patterns and will pay closer attention to this match in lean economic times. For consumption-based software, enterprises will likely reduce their usage (to lower their bills), allow unused credits to build up and then buy fewer credits when it’s time to renew. Similarly, software sold on a seat-basis will shrink simply because fewer seats are required, and nobody will buy extra seats anticipating future growth.

So which model works best with which kind of software product? Survey respondents strongly preferred seat-based pricing for dev tools and productivity software, but the reverse is true for API and cloud-infrastructure tools, for which most enterprise buyers prefer consumption-based pricing. Put another way, seat-based pricing works best in scenarios where individual contributors derive value from the software. Consumption-based pricing maps to software that delivers organization-level value.

What does this mean for software sellers? If your product pricing doesn’t match consumption patterns — if you’re selling a productivity tool on a consumption basis, for instance — buyers may have a problem with that.

IT spending — seat or consumption? Image Credits: Battery Q1 2023 Cloud Software Spending Survey

How should startup GTM and product teams react?

It’s clear that enterprise buyers are becoming more discerning with new and existing B2B software contracts, for both individual and organizational contracts. Here are three key takeaways we suggest startup GTM teams consider to reach sales goals and reduce churn as PLG gets more complicated today:

Bottoms-up and PLG are only one piece of the sales puzzle

PLG and bottoms-up adoption no longer work as an absolute GTM motion — especially when selling into the enterprise. PLG should be considered a top-of-funnel activity at large and established enterprises. Just as organizations have learned to track the conversion of MQLs to SQLs, sales teams need to focus on converting PLG-qualified leads to sales-qualified leads.

Sales cycles within the enterprise are lengthening, but pure PLG-driven organizations may’ve failed to notice that trend. Moreover, the ultimate buyer within an enterprise is not necessarily the primary user – and IT buyers are scrutinizing every purchase. Sales conversations are happening inside enterprises, with or without your team’s involvement. Startups need to coordinate their sales, marketing, products and analytics teams and get the right telemetry in place to influence the outcomes of those conversations towards adoption.

Product usage needs to correlate tightly to an enterprise’s increased efficiency and/or growth

In a tough economy, enterprises need to improve efficiency, grow faster or ideally both. Startups need to make sure their product’s usage data correlates to those goals. Can you prove with data your product improves enterprise efficiency, helps them grow faster or both? That’s the only way to avoid becoming the next IT expense to get cut.

Many companies have gotten really good at using Salesforce to understand their pipeline, deal cycles, decision points and other classic sales metrics. Companies are not as good at identifying the right product analytics and usage metrics that inform the decision to buy, or pinpoint an inflection point where more sales engagement can help close a deal.

Where are customers learning about my product? Are they coming from Slack, from communities, from paid advertising? How well do they convert from each of these channels? Which factors within the product itself make them want to buy? One company we know found that sharing a project with a co-worker was a crucial inflection point, increasing the enterprise’s likelihood to buy by four times. That’s a powerful insight that needs to get captured and shared across sales, marketing and product/analytics.

Stay hyperaware of large players like ServiceNow or AWS that can meet a particular need “well enough.” Enterprises are seeking to consolidate vendors these days, both to save money and streamline IT operations. Your product needs to meet a pressing need in a clear-cut way that’s not approximated by another player with an entrenched platform advantage. Again, product data can make this value — or lack of it — clearer to your purchasers.

Know the difference between buyers and influencers, and how they interact

Before PLG took root, salespeople targeted their efforts primarily at the buyer — that is to say, the budget holder — while staying mindful of engineers as important influencers in that decision. With the advent of PLG, engineers took center stage as both influencers and buyers.

What’s old is new again. The pendulum has swung back to selling primarily to the buyer/budget holder, with the engineer as a key influencer of the buying decision. CIOs are holding the purse strings at enterprises and are watching every penny these days. But a smart CIO will always involve their engineers in evaluating IT software the enterprise might buy. As a seller, you need to harness the engineer’s enthusiasm as well as show economic benefit to the person who will ultimately make the buying decision.

The information contained herein is based solely on the opinions of Scott Goering and Evan Witte, and nothing should be construed as investment advice. This material is provided for informational purposes, and it is not, and may not be relied on in any manner as, legal, tax or investment advice or as an offer to sell or a solicitation of an offer to buy an interest in any fund or investment vehicle managed by Battery Ventures or any other Battery entity.

This information covers investment and market activity, industry or sector trends, or other broad-based economic or market conditions and is for educational purposes. The anecdotal examples throughout are intended for an audience of entrepreneurs in their attempt to build their businesses and not recommendations or endorsements of any particular business.

Content obtained from third-party sources, although believed to be reliable, has not been independently verified as to its accuracy or completeness and cannot be guaranteed. Battery Ventures has no obligation to update, modify or amend the content of this post nor notify its readers in the event that any information, opinion, projection, forecast or estimate included, changes or subsequently becomes inaccurate.