Telehealth, or remote, tech-enabled healthcare, has existed for years in primary medical care through companies like Teladoc (NYSE: TDOC), Doctors on Demand and MDLIVE.

In recent years, the application of telehealth had rapidly expanded to address specific chronic and behavioral health issues like mental health, weight loss and nutrition, addiction, diabetes and hypertension, etc. These are real and oftentimes very severe issues faced by people all over the world, yet until now have seen little to no use of technology in providing care.

We believe behavioral health is particularly suited to benefit from the digitization trends COVID-19 has accelerated. Previously, we’ve written about the pandemic’s impact on online learning and education, both for K-12 students and adult learners. But behavioral health is another area impacted by the fundamental change in consumers’ behavior today. Below are four reasons we think the time is now for behavioral health startups — followed by five key factors we think characterize successful companies in this area.

Telehealth can significantly lower the cost of care

Traditional behavioral healthcare is cost-prohibitive for most people. In-person therapy costs $100+ per session in the U.S., and many mental health and substance-use providers don’t accept insurance because they don’t get paid enough by insurers.

By contrast, telehealth reduces overhead costs and scales more effectively. Leveraging technology, providers can treat more patients in less time with almost zero marginal costs. Mobile-based communications enable asynchronous care that further helps providers scale. Access to digital content gives patients on-going support without the need for a human on the other side. This is particularly useful in treating behavioral health issues where ongoing support and motivation may be necessary.

Technology unlocks supply in “shadow markets” of providers

Globally, we face an extreme shortage of behavioral health providers. For example, the United States has fewer than 30,000 licensed psychiatrists (translating to <1 for every 10,000 people). Outside of big cities, the problem gets worse: ~50-60% of nonmetro counties have no psychologists or psychiatrists at all.

Even when providers are available, wait times for appointments are notoriously long. This is a huge issue when behavioral health conditions often require timely intervention.

We are seeing new platforms build large networks of certified coaches, licensed psychologists and psychiatrists, and other providers, aggregating supply in what has historically been a scarce and a highly fragmented provider population.

Behavioral/mental health issues are losing their stigma

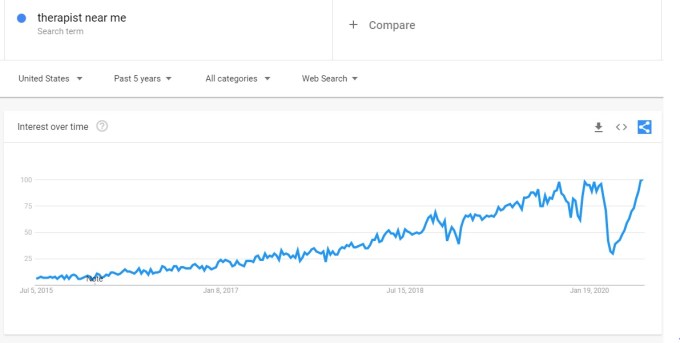

We believe the stigma associated with mental illness and other behavioral health conditions is dissipating. More and more public figures are speaking out about their struggle with anxiety, depression, addiction and other behavioral health issues. Our zeitgeist is shifting fast, and there’s an all-time high in people seeking help as the Google Trends data below demonstrates.

Image Credits: Google

Note: The anomalous dip in March/April ’20 was driven by mandatory shelter-in-place due to COVID-19.

Policy and regulations are changing quickly

The COVID-19 pandemic has forced the health care industry to rethink how care is delivered and accelerated change on the regulatory side. Insurers and payers see telehealth as a top priority, accelerating the credentialing process for new players. New ACA laws mandate that telehealth reimbursement rates become on a par with in-office visits. Practicing interstate is becoming more accepted, too.

All of these factors encourage providers to adopt teletherapy to meet a patient population with ever-heightening needs for support. McKinsey finds consumer adoption skyrocketing: from 11% in U.S. consumers using telehealth in 2019 to 46% as of May 2020. They further predict up to $250 billion of current U.S. health care spend could go virtual.

It’s not difficult to see how COVID-19 is accelerating these trends. We see the confluence of these factors democratizing access to care, improving efficacy and outcomes, and unlocking significant value over traditional healthcare.

Five success factors for behavioral health startups

We know the world has moved in this direction and we’re firm believers that these changes will stay. What do these trends mean for entrepreneurs? We generally look for five success factors:

1. A holistic solution focused on proactive care

The needs of every population are complex and nonbinary. We think the businesses most likely to succeed have solutions across the acuity spectrum. Individuals should be triaged into the appropriate level of care based on their circumstances and severity of their symptoms. This might mean psychotherapy, coaching or meditation content. Early intervention is also crucial for positive outcomes and cost containment. Companies should leverage data and signals to identify issues before they become severe and urgent.

A good example is Modern Health, which provides virtual counseling, coaching and evidence-based digital tools to help employees protect their mental well-being before they reach a crisis point. Another company, Vida Health, leverages behavioral science and offers personalized digital programs to tackle underlying behavior and address comorbid chronic health conditions.

2. Measurable and demonstrable ROI

Showing demonstrable ROI and efficacy is critical in acquiring customers, retaining them and maintaining pricing defensibility. In behavioral health, this can come in various forms:

- User metrics: sign-up rates, utilization rates, engagement, NPS, etc.

- Clinical metrics: PHQ-9 (depression), GAD-7 (anxiety), MDQ (bipolar disorder), etc.

- Financial metrics: medical/health care cost savings.

- HR metrics: productivity, absenteeism, turnover, etc.

We think the ability to monitor, track and show this data is critical as buyers become more sophisticated and the category grows with more competition.

3. Leveraging data to personalize treatment and improve patient experience

Digital health produces a wealth of data that can be leveraged to customize the patient experience. Enriched by AI/feedback loops, data can improve the platform’s efficacy in real-time. Livongo (LVGO), which helps diabetes patients manage their conditions, is a good example. Livongo combines hardware that tracks blood glucose levels with personalized coaching and a mobile app to fit a patient’s routines and needs.

Longer term, we believe there is potential for innovation in the underlying data collected. Historically, patient outcomes are measured with traditional diagnostic methods like PHQ-9 for depression, GAD-7 for anxiety or MDQ for bipolar disorder. These measures are self-reported by patients and thus inherently subjective. We think there is a real opportunity to rethink outcomes and efficacy by using new sources of data and biomarkers. One exciting example is Mindstrong, which uses patients’ smartphone behaviors to measure cognition and emotional shifts in real-time.

4. Understand the difference between your buyer and your end-user, and how this affects your go-to-market strategy

With most individuals in the U.S. covered by some form of health insurance, there is a certain expectation that one shouldn’t need to pay for their own health care costs.

As a result, many companies in the space adopt B2B go-to-market strategies, where the buyer is an employer or health plan, but the end-users are employees or member populations. Examples include Livongo, Lyra Health, Modern Health, Ginger.io and others. These can be lucrative and high-value deals, but they typically have longer sales cycles with a high-touch sales process. The need to demonstrate meaningful ROI, as discussed above, is critical in this type of sales strategy where the stakes are high. The benefit is that once locked in, renewal rates tend to be quite healthy so long as the product proves its efficacy.

In the last few years, we have witnessed the rampant consumerization of behavioral health, with a handful of highly effective B2C strategies proven out. Companies like Calm, Headspace and Talkspace have demonstrated that companies can grow very quickly and reach a meaningful scale by selling directly to the user. In the B2C model, products are typically offered at lower price points but can scale quickly through viral, organic distribution. For example, Calm saw a huge boost after being voted Apple’s 2017 “Best App of the Year” and now effectively owns the consumer sleep category, with their sights on broader mindfulness and mental health. A key consideration with the B2C approach is that acquisition costs can be exorbitant, and churn high, given most of these players rely on private-pay models (e.g., users pay out-of-pocket versus reimbursed by their insurance plan). This balance needs to be carefully managed.

Understanding the nuances of both your go-to-market strategy and the underlying micro or unit economics are critical for long-term success.

5. Operational “preparedness”

Health care is among the toughest industries for disruptors, given the ecosystem’s overall complexity.

New behavioral health businesses will generate and capture significant amounts of data that can be incredibly valuable in illuminating unknowns in the traditional care model. The ability to monitor, log and analyze care in real-time creates a feedback loop to providers that can improve outcomes over time. However, this requires stringent compliance to consumer data privacy like HIPAA.

Beyond consumer privacy there are myriad considerations, including regulatory requirements, billing/reimbursement policies and more. You can’t skip this necessary work when working with insurers, so come prepared to meet the challenge.

We believe there’s an enormous opportunity to digitize behavioral health right now — and COVID-19 is only making it bigger.

Battery Ventures provides investment advisory services solely to privately offered funds. Battery Ventures neither solicits nor makes its services available to the public or other advisory clients. For more information about Battery Ventures’ potential financing capabilities for prospective portfolio companies, please refer to our website.

Content obtained from third-party sources, although believed to be reliable, has not been independently verified as to its accuracy or completeness and cannot be guaranteed. Battery Ventures has no obligation to update, modify or amend the content of this post nor notify its readers in the event that any information, opinion, projection, forecast or estimate included, changes or subsequently becomes inaccurate.