The cloud market is coming into its own during the pandemic as the novel coronavirus forced many companies to accelerate plans to move to the cloud, even while the market was beginning to mature on its own.

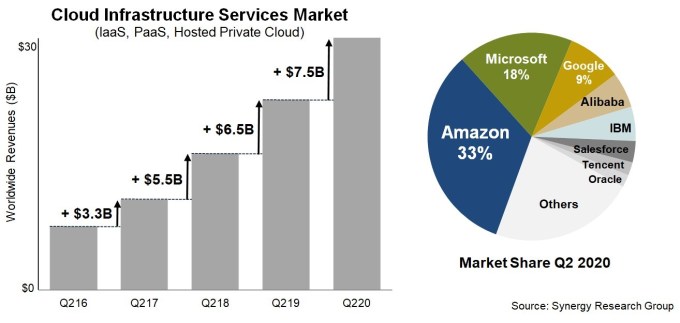

This week, the big three cloud infrastructure vendors — Amazon, Microsoft and Google — all reported their earnings, and while the numbers showed that growth was beginning to slow down, revenue continued to increase at an impressive rate, surpassing $30 billion for a quarter for the first time, according to Synergy Research Group numbers.

The pandemic has forced many companies to move to the cloud much more quickly than they might have without that catalyst. As businesses have shifted in large numbers to work from home, speed, agility and flexibility has become paramount. It’s just not easy having boots on the ground in a private data center, and IT departments with a cloud presence have an advantage right now. That has caused the dollars spent to increase in a fairly dramatic fashion, and the numbers keep going up.

The latest numbers

Let’s start with Amazon, the modern infrastructure cloud vendor that has maintained its first-mover advantage for years. That didn’t change this quarter as the company continued to post impressive numbers, with $10.81 billion, pushing its revenue run rate to over $43 billion — a substantial business on its own, never mind as one division in the Amazon juggernaut. The good news was that revenue was up 29% YoY, but the less good news was growth was beginning to slow from 33% to 29% since last quarter. More on that in a moment.

Microsoft too, experienced a slow down in growth moving from 59% last quarter to 47% this one. Microsoft lumps all of its cloud revenue into the Intelligent Cloud category, which includes Azure, Windows Server, SQL Server, GitHub and enterprise services. It came in at $13.37 billion, but according to Synergy, around $5.4 billion was attributable to Azure, up from $5.2 billion last quarter.

Meanwhile, Google Cloud improved to over $3 billion overall, of which around $2.7 billion would be attributable to infrastructure, according to Synergy.

John Dinsdale, chief analyst at Synergy Research Group, has maintained for some time that the slow down in growth is inevitable as revenue expands, due to the law of large numbers — the bigger the market share, the harder it becomes to maintain eye-popping growth — and that what’s important is the increase in revenue. In other words, when you have a small market share, it’s easier to grow at a larger rate, but as you grow market share, that’s bound to slow down.

“The growth rate percentage is now trending downwards, as it must for such a massive market, but in absolute dollar terms the incremental growth just keeps on getting bigger. Spending in Q2 2020 was $7.5 billion higher than the spending in Q2 2019, which was $6.5 billion higher than the spending in Q2 2018, and so on down,” Dinsdale said in a statement.

Patrick Moorhead, founder and principal analyst at Moor Insight & Strategies, said growth will return after we get past the pandemic (whenever that happens to be).

“On a percentage basis the top three IaaS vendors’ growth declined, but still had impressive dollar gains. I think we will continue to see growth, but I believe after the pandemic has passed we will see an increase in business as enterprises focus on more strategic projects. This will offset the slowdown in some hard-hit industries like airlines and hotels that are fighting for their lives,” Moorhead told TechCrunch.

Breaking down market share

As for market share, it depends who you ask, but the placement remains the same regardless. For Synergy, it breaks down as: Amazon 33%, Microsoft 18% and Google 9%. It’s worth noting that Chinese cloud infrastructure providers now account for 12% of overall market share, led by Alibaba with 6%, good for fourth place behind Google and ahead of IBM at 5%.

Image Credits: Synergy Research Group

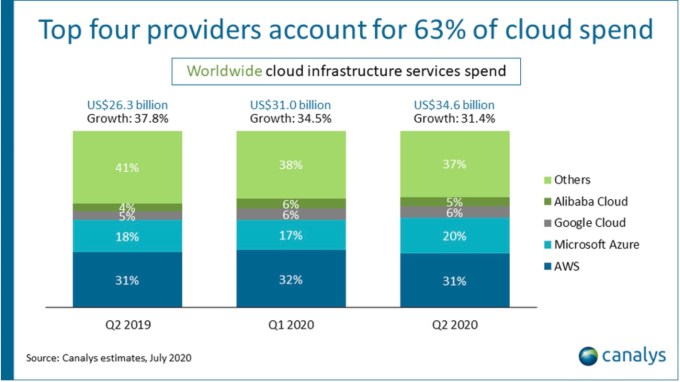

Canalys has slightly different numbers, breaking it down into dollars spent, with Amazon at 37%, Microsoft at 20% and Google at 6%.

Image Credits: Canalys

Looking Ahead

In spite of the way the positions have stayed fairly steady over the last several years, Canalys analyst Blake Murray sees the competition getting tighter as companies look for the optimal way to shift remaining workloads in a cloud-native way to the cloud, a process he believes will take several years, even with the acceleration we are seeing today.

“Security, code development and migration tools, support for multi-cloud and hybrid-IT deployments, as well as enabling more predictable costs will be key areas of focus as organizations look to move as quickly as possible, minimize disruption and keep within more constrained budgets. The top four cloud service providers have maintained the pace of innovation over the last six months and will look to add further capabilities to help win new business. But competition from other cloud service providers will intensify,” Murray wrote in a statement.

However you choose to slice it, Amazon remains firmly in control, with Microsoft a strong second. While Google is starting to edge up a bit, it still remains well behind in third position. The good news remains the market still has plenty of room to grow and we are likely to see revenue increases for some time to come, even as the growth numbers slow.