It’s fair to say that even before the impact of COVID-19, companies had begun a steady march to the cloud. Maybe it wasn’t fast enough for AWS, as Andy Jassy made clear in his 2019 Re:invent keynote, but it was happening all the same and the steady revenue increases across the cloud infrastructure market bore that out.

As we look at the most recent quarter’s earnings reports for the main players in the market, it seems the pandemic and economic fall out has done little to slow that down. In fact, it may be contributing to its growth.

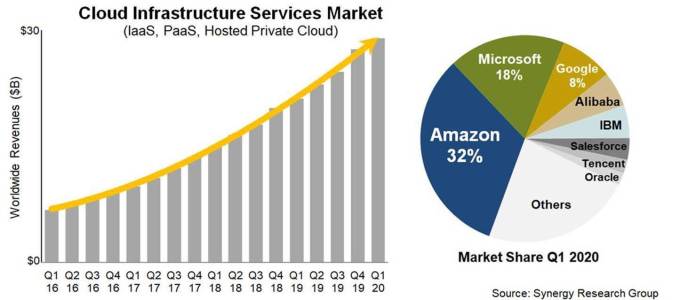

According to numbers supplied by Synergy Research, the cloud infrastructure market totaled $29 billion in revenue for Q12020.

Image Credit: Synergy Research

Synergy’s John Dinsdale, who has been watching this market for a long time, says that the pandemic could be contributing to some of that growth, at least modestly. In spite of the numbers, he doesn’t necessarily see these companies getting out of this unscathed either, but as companies shift operations from offices, it could be part of the reason for the increased demand we saw in the first quarter.

“For sure, the pandemic is causing some issues for cloud providers, but in uncertain times, the public cloud is providing flexibility and a safe haven for enterprises that are struggling to maintain normal operations. Cloud provider revenues continue to grow at truly impressive rates, with AWS and Azure in aggregate now having an annual revenue run rate of well over $60 billion,” Dinsdale said in a statement.

AWS led the way with a third of the market or more than $10 billion in quarterly revenue as it continues to hold a substantial lead in market share. Microsoft was in second, growing at a brisker 59% for 18% of the market. While Microsoft doesn’t break out its numbers, using Synergy’s numbers, that would work out to around $5.2 billion for Azure revenue. Meanwhile Google came in third with $2.78 billion.

If you’re keeping track of market share at home, it comes out to 32% for AWS, 18% for Microsoft and 8% for Google. This split has remained fairly steady, although Microsoft has managed to gain a few percentage points over the last several quarters as its overall growth rate outpaces Amazon.