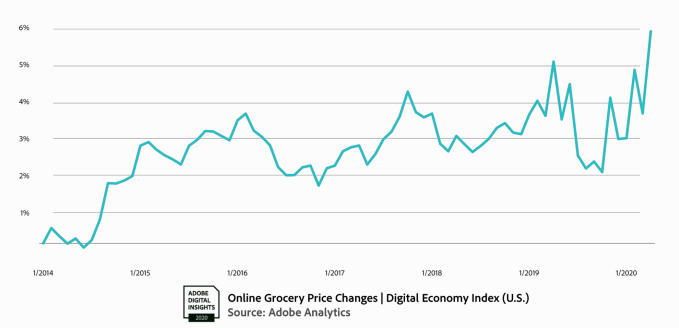

Online retailers are seeing Black Friday-like sales due to the impact of the COVID-19 pandemic on their business. According to new data from Adobe’s Digital Economy Index, U.S. e-commerce jumped 49% in April, compared to the baseline period in early March before shelter-in-place restrictions went into effect. Online grocery helped drive the increase in sales, with a 110% boost in daily sales between March and April. Meanwhile, electronic sales were up 58% and book sales have doubled.

The data comes from Adobe’s index of the digital economy, which analyzes more than one trillion online transactions across 100 million different SKUs. The company works with 80 of the top 100 U.S. online retailers to gather its data.

The numbers indicate that consumers are willing to spend on products that will help them manage the COVID-19 crisis. This includes, in large part, online grocery pickup and delivery.

Companies, including Amazon, Walmart and Instacart, have hired more workers to aid with the increased consumer demand across their retail operations. Instacart even became profitable for the first time, The Information recently reported, due to the surge triggered by the coronavirus outbreak. The company sold around $700 million worth of groceries during the first two weeks of April, up 450% over its December 2019 sales, the report said.

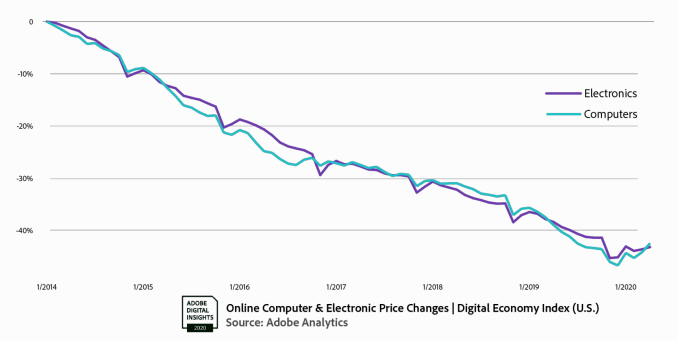

Meanwhile, the electronics category of online sales saw its first inflation in years. According to Adobe, online electronics prices have been experiencing deflation at a steady rate since 2014, but COVID-19 has led to electronics prices flattening.

Computer prices even crept up in April, due to rising demand. Plus, sales of audio mixers, microphones, microphone cables and other audio equipment jumped 459% in April as would-be podcasters and various creatives set up their home studios.

The overall electronics category also appears to now be on an upward trajectory. This may not end anytime soon, Adobe’s report cautions, as COVID-19’s impact on the electronics supply chain may continue for many months to come.

Meanwhile, consumers turned online to shop apparel in April, with a 34% increase in sales as prices fell. With no need to dress for work — either due to unemployment or new work-from-home policies — April saw the largest monthly drop in apparel prices in more than five years. While April typically sees average price growth of -2.9%, this April the growth was -12%. Prices fell even further as retailers looked to rally sales by clearing inventory earlier.

When consumers did shop, they not surprisingly shifted their purchases toward comfort items. April saw increases in things like pajamas (up 143%) and decreases in business apparel like pants and jackets (down 13% and 33%, respectively).

In addition to the growth in specific categories, April also saw sizable growth in “buy online, pickup in store” orders. From April 1 through April 20, these surged 208% year-over-year as people attempted to practice social distancing while shopping.

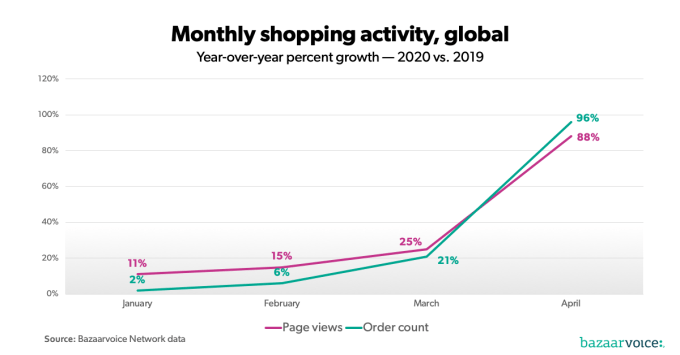

Adobe’s data comes alongside other reports that indicate a huge jump in online shopping in April.

For example, Bazaarvoice’s data, based on its network of over 6,200 brand and retail sites, indicated that April was a much larger month for e-commerce than March. As consumers finished stocking up on essentials (like toilet paper, perhaps!) in March, they turned to online shopping for toys, games, entertainment, sporting goods and pet supplies in April in greater numbers.

Adobe’s report also found that e-commerce purchases of wine, beer, spirits and related accessories were up 74% in April, as consumers plowed through the COVID-19 crisis.

According to Bazaarvoice, April 2020 grew even faster than March across every indicator it tracked — including page views, order count, review submission and question submission.

March ended with a 25% year-over-year increase in page views, the report said, while April ended with an 88% increase. And March ended with a 21% year-over-year increase in order count, while April ended with a 96% increase. In addition, while browsing behavior like page views had outpaced purchasing behavior in March, that trend reversed in April.

The overall impact of the shift to online could be rising prices, Adobe warned.

“As online is absorbing the offline retail economy, some inflation is being observed for the first time in years, especially in categories that have consistently experienced online deflation, such as electronics,” said Taylor Schreiner, director, Adobe Digital Insights. “Americans are used to things getting cheaper online, but that trend may be ending, and online commerce may never be the same. It appears that COVID-19 has accelerated that process.”