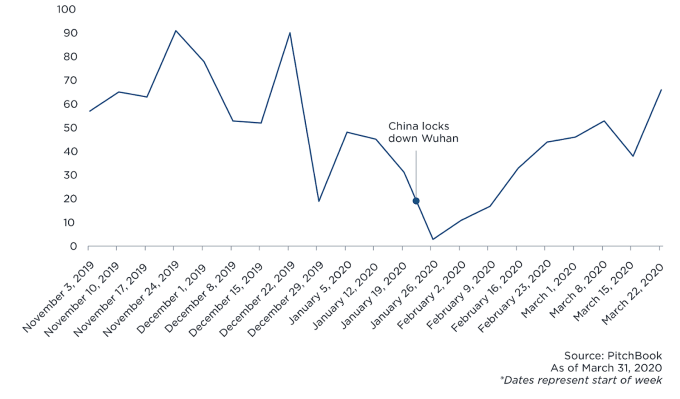

For the past month, VC investment pace seems to have slacked off in the U.S., but deal activities in China are picking up following a slowdown prompted by the COVID-19 outbreak.

According to PitchBook, “Chinese firms recorded 66 venture capital deals for the week ended March 28, the most of any week in 2020 and just below figures from the same time last year,” (although 2019 was a slow year). There is a natural lag between when deals are made and when they are announced, but still, there are some interesting trends that I couldn’t help noticing.

While many U.S.-based VCs haven’t had a chance to focus on new deals, recent investment trends coming out of China may indicate which shifts might persist after the crisis and what it could mean for the U.S. investor community.

Image Credits: PitchBook

Just like SARS in 2003 coincided with the launch of Taobao and pushed Jingdong to transform from an offline retailer into online giant JD.com, there may be dark horses waiting to break out when this pandemic is over. Paraphrasing “A Tale of Two Cities” — this is the worst time, but also maybe the best time.

In addition to obvious trends about food delivery, digital content, gaming and other sectors, I have identified five other trends that are closing the most deals in Q1 on the early-stage side that could define the post-pandemic environment: e-commerce, edtech, robotics and advanced manufacturing, healthcare IT/life Science and AI/enterprise SaaS.

![]()

Image credits: PitchBook

1. E-commerce

Back in 2003, confinement during the SARS epidemic gave an unexpected boost to China’s nascent e-commerce sector and became the catalyst of Taobao, Alibaba’s B2C services. Since the recent pandemic, Taobao has tried to help merchants and brands innovate out of the crisis with Taobao Live, a live-stream shopping platform where hosts interact with products in a very detail-rich and relatable way.

It’s like QVC or a next-level infomercial, but on your mobile and much more interactive. This is particularly helpful for high-priced “non-essential” items, which took the hardest hit during the pandemic. Sportswear giant Adidas live-streamed an exclusive online debut of its limited-edition Superstar sneaker that drew 2.23 million viewers and generated more than $28 million in sales in 10 hours; a domestic cosmetic brand also turned around its business with a live stream that surpassed same-day sales last year by 45%. Similarly, rural farmers have used live streaming to sell local farm products and reduce food waste.

There are a few others experimenting in this direction: Amazon Live was launched last year but hasn’t seen massive uptake yet; Feiyu, a live e-commerce platform for used luxury handbags just raised a Series A led by N5Capital and Matrix Partners China in February, and Wukong Boss is like Shopify for all social e-commerce platforms (including live streaming). Others continue to innovate in the vertical space: Zhongzhuang Supei is a B2B e-commerce platform for customized home and office furniture and appliances; and Yesmro provides automation machinery accessories and industrial supplies for small businesses.

2. Edtech

Earlier this month, Chinese online education startup Yuanfudao (backed by Tencent) hauled in $1 billion at a $7.8 billion valuation, the largest single round in Chinese edtech history, at a time when online learning came to rescue a world that found itself abruptly sheltered in place.

Because of the shutdown of many schools, China’s less digital-savvy users like parents and grandparents are picking up new skills, like setting up live-streaming classes. DingTalk, Alibaba’s enterprise communication tool, offered to help primary and middle school students take online courses (Japanese schools also adopted it). With added features such as grading homework and video replays, it received many one-star reviews from students who are not happy about being asked to learn from home.

To be fair, there was already a lot of online education going on in China, especially in the private tutoring market due to pressure from college entrance exams, a $64 billion market, according to Frost & Sullivan, with less than 7% conducted online. In 2018, China made up over 50% of all global VC investment in edtech, with the U.S. at 20%, India at 10% and Europe at 8%.

With the pandemic, China’s education system has made all learning online and is expanding access to students in rural areas, which is why K-12 edtech is surging. In addition to Yuanfudao, Rice eSchool (VIPKid-owned) and Guorou eSchool are moving in this direction, both providing live-streamed lectures for primary school and middle school students. The former bagged ~$11 million of Series A venture funding led by Tencent and Sequoia Capital China in January, the latter raised an undisclosed amount of Series A led by Welight Capital.

3. Robotics and advanced manufacturing

To stop the virus from spreading, China has deployed robots and drones to allow communication with patients, scan temperatures, disinfect rooms and deliver food and supplies as part of the effort to fight the spread of COVID-19. Robots might not be the most cost-effective way to fulfill the task yet, but it is the safest during the trying time:

- Food and medical supply delivery. During the Wuhan lockdown, e-commerce giant JD.com began using drones to fulfill orders, and autonomous vehicles to deliver donated goods and purchases to hospitals and communities in Wuhan. In Beijing’s Shunyi District, Meituan worked with local authorities to set up Unmanned Distribution Centers and unmanned vehicles running at the speed of 20km/h with the optimization of the 5G network in the designated area to meet the demands for smooth autonomous driving.

- Disaster relief and disinfection. First-responders were using drones to fly sample tests and supplies to get them into the hands of those in need faster. They were also used to check people’s temperature at their windows and some hospitals used UVD Robots to kill airborne viruses and bacteria on surfaces. Chinese farmers also used drones to spray disinfectant liquid on roadways, and with government subsidies, farmers acquired drones to automate water and pesticide spraying as they faced labor shortages.

- Advanced manufacturing. Previously slow to gain traction, industrial robots and other automation systems are being prioritized in investments when manufacturers face the double-hit of an unreliable supply chain and a labor force that needs to stay at home. CRP Robot develops industrial robot and control systems automation and raised a Series B in March; Leaper, which uses computer vision learning for manufacturing material and equipment inspection, raised a Series B in February; Percipio.xyz, which produces industrial cameras and algorithms that detect product flow and improve operational efficiency, raised a Series A+ in January.

4. Healthcare IT/life science

Healthcare, a trillion-dollar market, is a clear opportunity for tech in China, where there’s a huge disparity between supply of healthcare professionals versus the demand of 1.5 billion people. China has about 1.8 physicians per 1,000 citizens, which is less than half of the average for high-income western countries like Sweden (5.4) or Italy (4.1). With an uneven distribution of good doctors, physicians on the highest tier are in top demand.

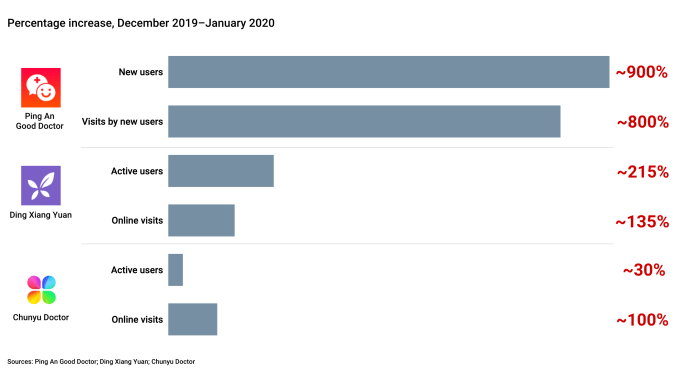

During the pandemic, as hospitals are overwhelmed by patients and people don’t want to risk infection by going to the hospitals, usage and signups for telemedicine surged. Ping An Good Doctor, a healthcare services platform, saw a nearly 900% increase in new users between December 2019 and January 2020 when the virus was spreading across China. Similar trends were observed at Ding Xiang Yuan, an online community for healthcare professionals and Chunyu Doctor, a telemedicine platform, according to data from Bain Insights.

Image Credits: Bain Insights (opens in a new window)

COVID-19 has brought huge consumer awareness to telemedicine, however, it still has a long way to go (health expenditure in China was 6.6% of GDP in 2018, compared to 17.8% in the U.S.). Telemedicine still feels like an inferior substitute for face-to-face care, as it’s less efficient for patients to communicate with doctors online and remote treatment is only good for simple symptoms. However, it also creates opportunities for innovations that will advance the digitalization of China’s healthcare system. IT infrastructure for online prescriptions, electronic records and online insurance still needs to be developed, systematically tracked and analyzed. Regulations are needed to follow up on how prescriptions and consultations handled by online platforms can be reimbursed under medical insurance. AI will eventually help hospitals improve diagnostic efficiency and accuracy.

In the long term, VCs in China are long for life sciences, and the sector has come a long way from lacking diagnostic capabilities in the early 2000s to boasting more than 100 companies that are developing tests for COVID-19. This category has also garnered the most funding in Q1, with startups innovating in biotherapeutics, molecular diagnosis and gene therapy.

5. AI/enterprise SaaS

DingTalk, a telecommuting application, surged more than 350% during the Chinese New Year week to become the most downloaded software in China’s app stores during this new remote work era.

April has also been a great month for applied AI startups that have raised at least $420 million so far this month, many focused on enterprise applications ranging from machine learning platform 4Paradigm (which raised $230 million of Series C+ from Cisco, Lenovo and China CITIC Bank), to RPA platform Encoo Tech (which raised $30 million of Series B led by Sequoia Capital China in March), marketing tech Laihua and medical imaging startup Soundwise.

Historically, China has been slow in terms of enterprise SaaS and cloud penetration, and global players such as Adobe, Oracle and Salesforce have relatively modest market penetration. However, with rising human capital cost, a mindset shift by younger management teams and emerging 5G, more enterprises are considering moving to the cloud and adopting enterprise software. This pandemic will accelerate the development of many aspects of enterprise functions, such as marketing tech, as distribution channels get more fragmented and user acquisition moves even more online, back office automation like invoices go paperless and AI adoption, as different machine-learning techniques such as neuro-linguistic programming and computer vision continue to be applied in video analytics.

Closing thoughts

Despite early signs of a recovery among some investors and consumers who remained largely optimistic, the COVID-19 outbreak will likely have a significant impact on China’s tech sector as a whole.

While we still need to wait and see how many of these trends are truly going to last, it’s fair to wonder what this might mean for U.S. investors and founders — will we see similar trends but in different flavors? Which categories could emerge even stronger after the pandemic? I’ll unpack some trends and make some predictions in a follow-up to this post.