In recent years, the venture capital and startup worlds have seen a significant shift towards globalization. More and more startups are going global and breaking borders, such as payments giant Stripe and their recent expansion to Latin America, e-scooter startup Bird’s massive European expansion, or fashion subscription service (an investment in our portfolio) Le Tote’s entrance into China.

Likewise, more VC Funds are spanning geographies in both investment focus and the limited partners, or LPs, who fuel those investments. While Silicon Valley is very much seen as an epicenter for tech — it is no longer the sole proprietor for innovation — with new technology hubs rising across the world from Israel to the UK to Latin America and beyond.

Yet, many have commented on a shift or slowdown of globalization, or “slobalization,” in recent months. Whether it be from the current political climate or other factors, it’s been said that there’s been a marked decrease in cross-border investments of late — leading to the question: Is the world still interested in U.S. startups?

To answer this and better understand the hunger from foreign investors in participating in U.S. funding rounds, both from a geographic and stage perspective, I looked at Crunchbase data in U.S. seed and VC rounds between the years of 2009 to 2018. The data shows that cross-border investments are far from dead — but they are getting smarter and perhaps even more global with the rise of investments from Asia.

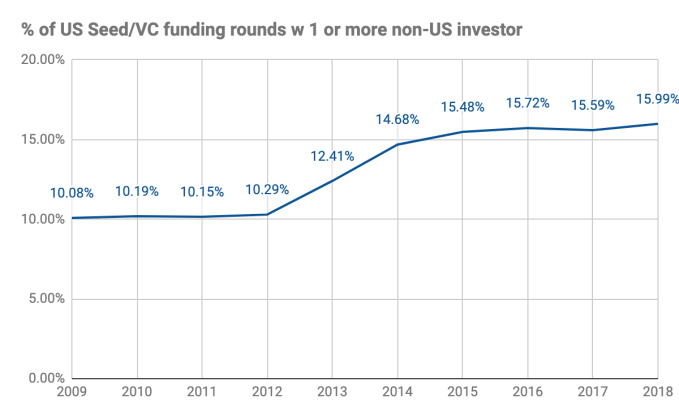

2012 – 2014 may have been “the golden age” of cross-border investments, but seed and VC rounds with foreign investments are still on the rise.

The data shows that seed and VC rounds with one or more non-U.S. investors has grown over the years, particularly between 2012 and 2014. What happened in 2012? Apart from the massive amount of innovation generally pouring into U.S. startups, social media companies specifically took the global spotlight with Facebook’s public debut in 2012 followed by Twitter in 2013. Facebook also made the $1B purchase of Instagram in 2012. These highly publicized IPOs and mega-deals certainly play a role in piquing interest from global investors in the U.S. startup scene.

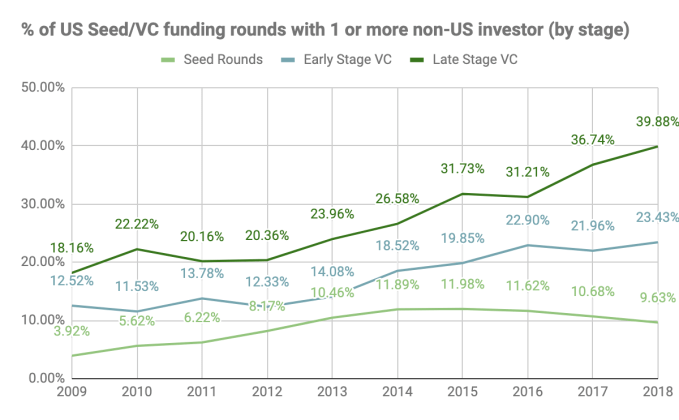

If you break this down by stage, you’ll find that the biggest growth came from late stage rounds (series C and beyond). As a matter of fact, the percentage of seed deals with foreign investment is on the decline — which shouldn’t come as a surprise given the drop in seed funding we’ve seen industry wide.

However, this does not mean that the world is losing interest in U.S. startups. Rather, it points to how foreign investors are learning to better navigate the startup ecosystem and invest more strategically. This makes sense as most early stage startups are laser focused on gaining traction in their home market first and simply aren’t ready to scale internationally. While the later stage companies are more developed and ready to expand operations across borders, which appeals more to foreign investors and corporations who can help these startups scale in their markets and entertain partnerships or deals to spur innovation.

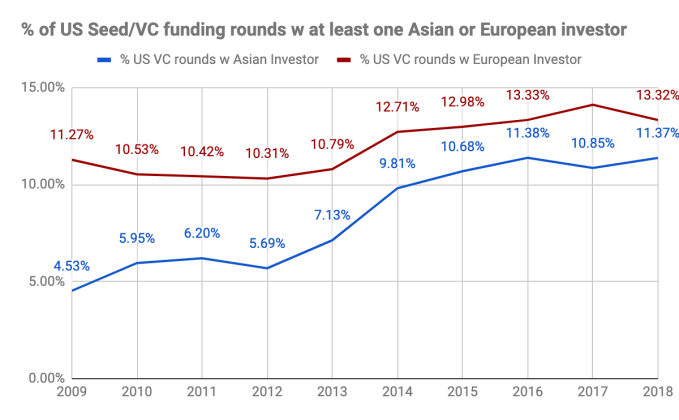

European investors are in more deals total, but growth is coming from Asia

Another interesting point is that while Europe leads in total number of deals and is on the upswing, Asia has seen faster growth in recent years, both for late and early stage VC rounds. The EU may take a natural lead in investments in the U.S. as home to more English speaking countries and therefore less of a language and cultural barrier compared to Asian countries.

Interest in seed rounds started waning for both regions in the 2014 and 2015 timeframe, likely for the same reasons mentioned above. The consistent drop in seed deals reinforces the point that regardless of geography, foreign investment may be better suited and more strategic from Series A onwards.

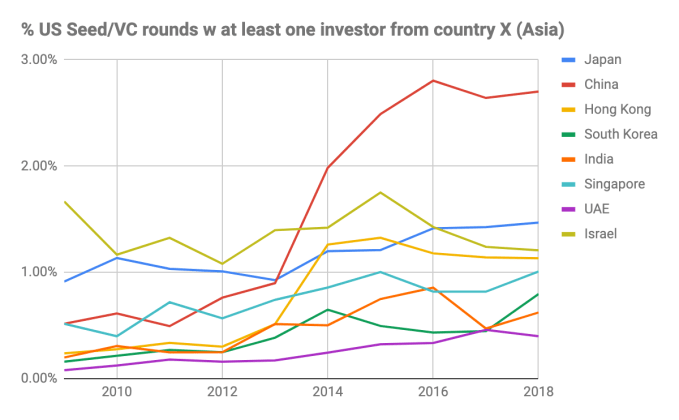

Major uptick in investment from China, with Japanese investments steadily growing

Looking at specific countries, most of the growth in Asia was driven by China, but investments from Japan is also steadily rising. We’ve seen this first-hand in working with more and more Japanese corporations, such as Dentsu Inc. or Panasonic, who are increasingly interested in connecting with startups from the U.S. and across the world. On a similar note, you can easily spot the increase in China’s activity just by looking at the current state of corporate venture capital – where 2 of the top 5 most active CVCs last year were Chinese firms — Baidu and Legend Capital.

It’s interesting to see such a sharp uptick in China investments between 2012 and 2014, no doubt part of what’s driving the recent CFIUS acts — a topic we won’t dive into too deeply here, but we’ll be tracking to see how it affects foreign investment activity in the U.S. overtime. Apart from the reasons previously stated, there’s a few other factors to consider when looking at the increase in investments from Asia:

2012 and the strengthening of the Yuan: In 2012, China upped the limit within which the yuan currency could fluctuate from 0.5% to 1% in trading against the U.S. dollar – and again to 2% in 2014. If you look at the Yuan to USD exchange rate, you see the yuan strengthening aggressively starting in 2013 — granting China more purchasing power in U.S. investments.

Western Investments as a “status symbol:” The uptick in Chinese and Japanese investments was likely driven from both a relatively sparse local startup landscape (compared to North America at the time) as well as a cultural element. To some, cross-border investments connotes a sense of “status.” Investment in the Western market can be compared to buying merchandise of famous Western brands – it’s a status symbol.

The next phase of cross-border investments

The benefits of maintaining an ecosystem that encourages global collaboration are too great to ignore. Not only does it spur innovation within large corporations or emerging markets, but it grants startups access to the expertise and invaluable networks that are critical to scale internationally.

Despite the current shift in attitudes or perception about “globalization,” the VC and startup space is continuing on this global trend of innovation at scale but has evolved to better suit the needs of both investors and startups.