After warning investors that it would be taking a $1.7 billion (€1.5 billion) charge this quarter due to a fine from the European Commission over anticompetitive advertising practices, today Google parent Alphabet reported its quarterly earnings for Q1. Overall it’s a tough quarter for the company that speaks to struggles with its growth. Alphabet reported revenues of $36.3 billion, with diluted earnings per share of $9.50.

Analysts were expecting Alphabet to report GAAP earnings of $10.17 per share, with adjusted EPS expected to be $13.10, on overall revenues of $37.34, according to estimates from Yahoo Finance.

The company’s stock is down by 7.35 percent in after-hours trading at the moment.

Google’s canned statement in the earnings release struck a positive tone: “We delivered robust growth led by mobile search, YouTube, and Cloud with Alphabet revenues of $36.3 billion, up 17% versus last year, or 19% on a constant currency basis,” said Ruth Porat, Chief Financial Officer of Alphabet and Google, in a statement. “We remain focused on, and excited by, the significant growth opportunities across our businesses.”

But the reality is that, as the advertising market matures and Google faces increasing competition, while newer areas of business have yet to mature enough to show if they will be profitable efforts for Google, which includes not just its moonshot “other bets” but even its extensive efforts in more established businesses like hardware and cloud services.

The latter represented the company’s biggest expenses in R&D in the quarter, Porat said, while Sundar Pichai, Google’s CEO, had to get defensive on its hardware investments.

He described the Google Home smart speaker as a “market leader” and that “our commitment is very strong” to its hardware business.

“We really see this as incredibly important to drive the future of computing forward, and to make sure our services are presented to users, in the way that we intended them to be.

“Computing will continue to evolve beyond phones, and so we want to make sure we are inthere are we’re very committed to it for the long term.”

Google had said that the EU fine is not tax deductible and will result in a direct reduction of its GAAP operating income, GAAP net income and GAAP EPS, so the EPS weight was not a big surprise.

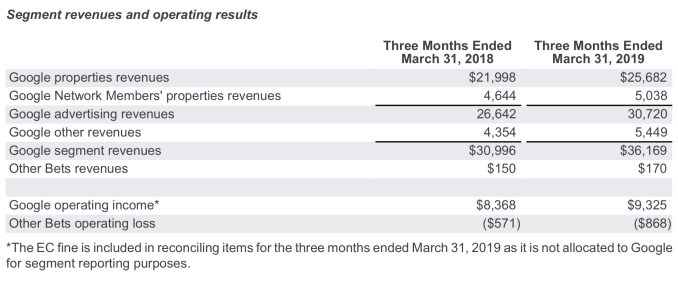

But the sales revenue, based primarily on advertising, was also not great: the figure grew 17 percent, compared to a year ago, when it was growing at 26 percent. (Both figures are on straight numbers; on a constant currency basis they are only slightly better for this latest quarter, at 19 percent.)

For some context, in the previous quarter, Alphabet reported that revenues were up 22 percent at $39.3 billion, with an EPS of $12.77. Its stock still dropped after hours

Advertising represented the bulk of Google’s revenues at $30.7 billion, while its “other bets” — projects in newer technologies and moonshots like its Waymo self-driving unit and the Project Loon internet balloons — is still a massively loss-making effort, pulling in an operating loss of $868 million on revenues of only $170 million.

More to come.