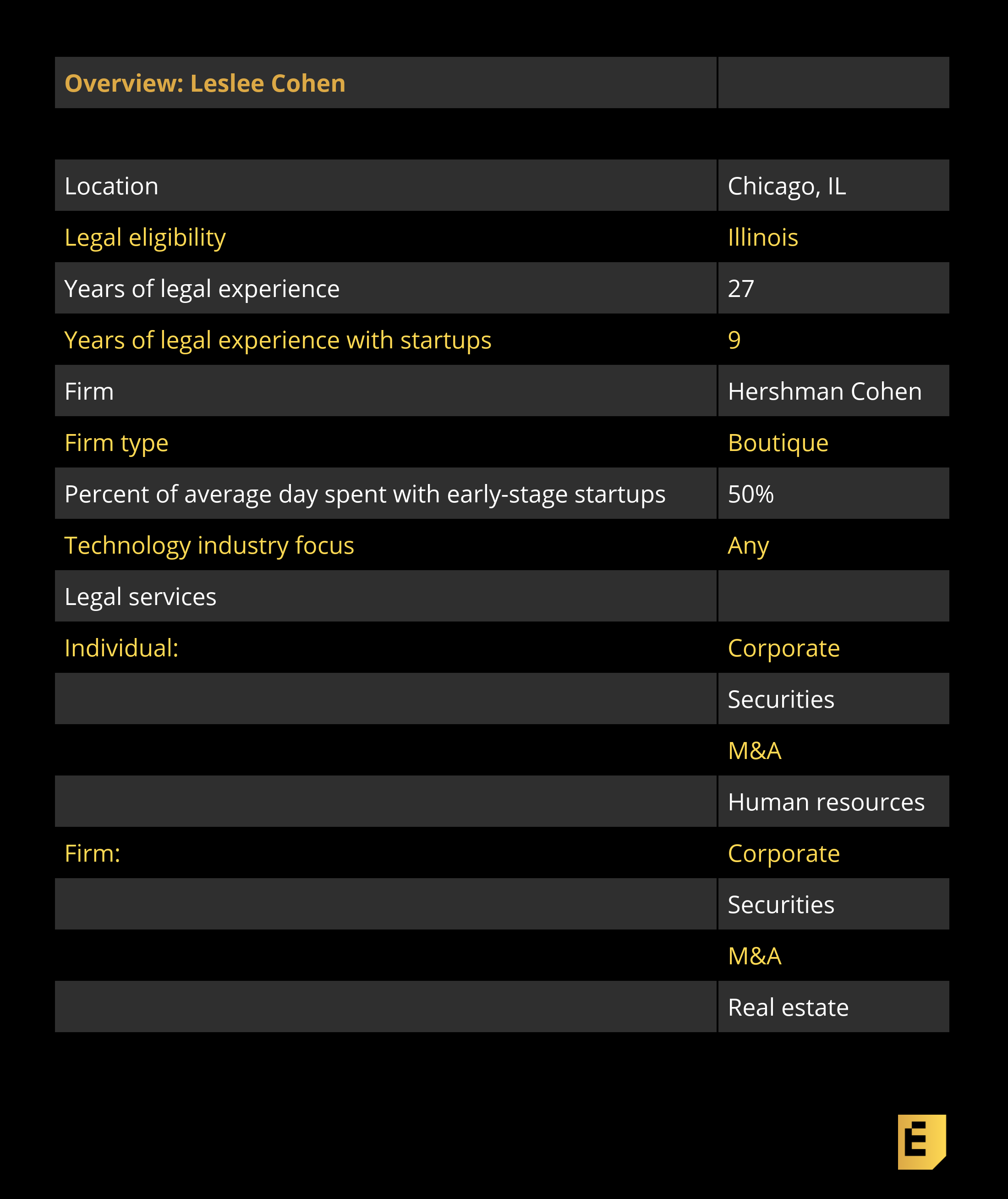

Leslee Cohen has been practicing law for decades in her hometown of Chicago. She’s been working with more and more startups over the last ten years, after co-founding her own firm (Hershman Cohen) and expanding along with the city’s tech scene.

On her approach:

“I have one partner and we have now hired two other women to join us. We are extremely conscious of the fact that startups and small businesses have a lot of important uses for their dollars other than legal fees. We are all senior-level attorneys and we never double bill. What that means to our clients is that if one of us does the work and needs a second set of eyes in a particularly complex contract, those additional hours are not billed.

“Leslee’s ability to make even the most complicated issues simple and easy to understand has been invaluable to our company!” Larry Bellack, Chicago, President, Mobile Doorman

On founder-investor relations:

“I feel that maintaining the founder’s relationship with its investors is of great importance, even through sometimes difficult negotiations, and make every effort to be the lawyer that fosters that relationship rather than hindering it in any way. I recently worked on a Series A offering and the founder-investor relationship was extraordinarily positive until one particular issue arose — the founder’s first gut reaction was fury and ‘how could she say that to me and how could she do that to me and I’m gonna call her and tell her what I think.’ My response was ‘write out an email with everything you want to say and send it to me and then we’re gonna delete it. Two weeks ago you loved each other and you’re going to again. She’s a strategic investor, she knows what she’s doing and she’s bringing so much credibility to your business — this is not the way you want the relationship to go.’

“So the founder wrote that email, and it was vicious, and then he called me back two hours later to thank me profusely. Sure enough they sat down, talked it out, and their relationship is strong again.”

Below, you’ll find the rest of the founder reviews, the full interview, and more details like their pricing and fee structures.

This article is part of our ongoing series covering the early-stage startup lawyers who founders love to work with, based on this survey (which we’re keeping open for more recommendations) and our own research. If you’re a founder trying to navigate the early-stage legal landmines, be sure to check out our growing set of in-depth articles, like this checklist of what you need to get done on the corporate side in your first years as a company.

The Interview:

Eric Eldon: How does your practice work, given that you’ve struck out from a big law firm to cofound a boutique firm? What are you focused on with early-stage companies?

Leslee Cohen: One is startup formation and I do work with those ‘I have an idea’ kind of companies. I’ll talk for an hour for free to anybody who is at that point, but usually other than entity formation — which a paralegal can do — you probably should focus on developing your idea a little more before you spend money on a lawyer. Once someone is ready to actually start a company, I’ll do it all at that stage, even pre-funding, and help with entity selection and formation, organizational documents, bylaws and what-have-you.

And then co-founder agreements, a lot of co-founder agreements. I think that’s really important, I understand if someone comes to me and says I’m starting a company with my sister or with my best friend from kindergarten that’s not your first thing you want to spend money on in terms of legal fees. But, with those few exceptions, I’ve seen so many co-founder breakups that it’s really important to me.

The more common way that companies come to me is when they’re raising their seed round. I will work with them on SAFE and convertible note rounds. I will work with them on the disclosure part of the round, the SEC filings, any state filings necessary, structuring the round, what it’s going to look like. And then the companies have money and start hiring their first employees, so I draft employment agreements, handle HR issues and structure equity grants to advisors and restricted stock agreements. I also provide a privacy policy, terms of use, NDAs, and then once they start doing business, day-to-day contracts with customers and on the other side with vendors and suppliers. Determining employee versus independent contractors, cap tables, incentive stock plans — those are all right in my wheelhouse.

The furthest I’ll go into real estate is the first lease.

Eldon: How does this compare versus what you used to do in BigLaw?

Cohen: I was in that world, so I understand what goes on — the fees, and really the pressure to bill hours — and that’s my number one pet peeve that we really focus on here.

I have one partner and we have now hired two other women to join us. We are extremely conscious of the fact that startups and small businesses have a lot of important uses for their dollars other than legal fees. We are all senior-level attorneys and we never double bill. What that means to our clients is that if one of us does the work and needs a second set of eyes in a particularly complex contract, those additional hours are not billed.

The pressure at the big firms is: how many hours have you billed? If someone called me with a quick question in my prior days as a big firm attorney, my thought was ‘I get to put .2 on my billing sheet.’ And that’s just the complete opposite of what our practice is about; it’s about forming those relationships with startups and continuing to serve in that general counsel role for as far down the road as possible. Having our clients go tell everyone how great we are is so much more important to me than an extra .5 on a timesheet.”

Eric Eldon: Tell me a little more about what you’ve seen from working with startups so far. Chicago is a huge city, but the startup scene has at least from my perspective been relatively small over the years. How do you see your role in nurturing that community and developing bigger companies out of it, helping people really figure out how to navigate the whole world of tech?

Cohen: I speak all around the city and like to impart a lay person’s knowledge on the law impacting their financings. I start out by saying: you typically will turn to your neighbor who lives on the left of you, who’s a real estate lawyer and really doesn’t work with startups. Good lawyer, but doesn’t really work with startups, doesn’t know the market. They’ll say ‘oh yeah, you can just do convertible notes, you’re just selling to some friends and family, it’s no big deal, you don’t need to do anything, just hand them a convertible note, and get the form off the internet.’

And then you’ve got your big-firm attorney who lives on the other side of you who says ‘oh no, no, no, you’re selling securities, you need a private placement, it’s $50,000 in fees.’

And so the question becomes what’s the right answer in between those two. My goal is that my listeners can walk into a meeting with whomever they choose to represent them with some knowledge about the applicable law, and to educate founders on where they can get into trouble, where they should draw that line between how much disclosure you provide and whether you need to file with the SEC and related questions.

I do that because it helps me bring in work, but a lot of times people go to other lawyers too, and at least they’re educated. That’s one way I try to help nurture Chicago’s startup community. I also do a lot of mentoring through a couple different accelerator programs.

Ultimately, the toughest part of being a startup is finding money. There’s just so much competition for that early-stage money so I have tried to cultivate a network of high-net-worth individuals who like to support young people who are doing cool new things in the tech industry but know that their $250,000 may turn into nothing. I have relationships with most of the VCs in town, so there’s someone who I can run a pitch deck by, but obviously getting funded is so tough.

Eric Eldon: Could you tell me about a specific challenge you’ve seen or an example of a challenge you helped a client navigate successfully? Like one of the co-founder issues you were talking about?

Eric Eldon: Could you tell me about a specific challenge you’ve seen or an example of a challenge you helped a client navigate successfully? Like one of the co-founder issues you were talking about?

Cohen: I had a client who came to me and was a 50/50 business owner, with no agreement between cofounders — so they couldn’t extricate themselves from each other. It got so ugly and nasty and so expensive after ending up in litigation. It was really just awful to watch. When a client comes to me and they’re 50/50 owned, it’s so important to me that they have an agreement with each other. It’s dicey, though, to figure out how to resolve an issue that doesn’t exist yet, when you’re excited and you’re sure that you’re going be best friends forever. I recently had two women who had a start up together and two years later, one of them was really not pulling her weight; like a night-and-day difference. One continued working at her full time job and the other woman was working full-time for the startup. While the business divorce was definitely a stressful experience for both of them, it was far less so and one hundredth of the cost because we had a legal document that pointed the way through it.

Eric Eldon: That’s a classic issue. Can you tell me more about a biggest legal mistake you see early stage founders make?

Cohen: Well, there’s the classic forming an LLC when you want to look for venture capital money in the future and you have to convert to a corp, which isn’t the end of the world. And there’s not entering into an agreement with your co-founder. I think also investor relations is a big one. I think if you don’t maintain your relationship with your investors and communicate regularly with them, it gets really difficult to do next round investments, especially when if you’ve done a seed round and the relationship turns not necessarily sour, but distant.

I recently worked on a Series A offering and the founder-investor relationship was extraordinarily positive until one particular issue arose — the founder’s first gut reaction was fury and ‘how could she say that to me and how could she do that to me and I’m gonna call her and tell her what I think.’ My response was ‘write out an email with everything you want to say and send it to me and then we’re gonna delete it. Two weeks ago you loved each other and you’re going to again. She’s a strategic investor, she knows what she’s doing and she’s bringing so much credibility to your business — this is not the way you want the relationship to go.’

So the founder wrote that email, and it was vicious, and then he called me back two hours later to thank me profusely. Sure enough they sat down, talked it out, and their relationship is strong again.

Eric Eldon: Can you tell me how your firm works in terms of billing for early stage companies?

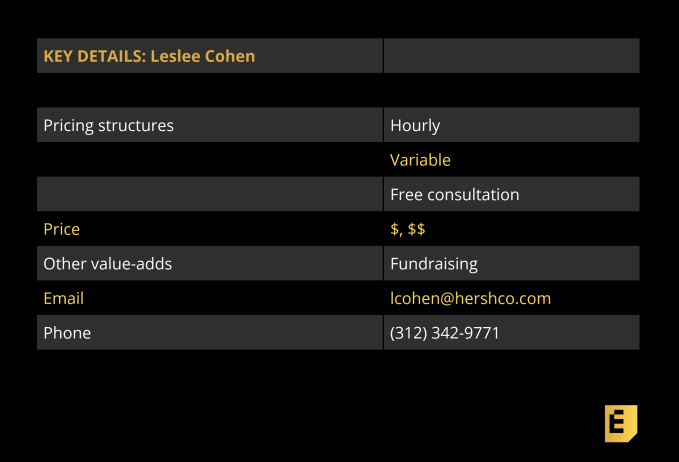

Cohen: I don’t have a startup package because I’ve found that very few startups are standard in any way. I do have a list of documents that startups will need over time. I will always give an hour of free consultation and sometimes I end up talking people through questions for a long time before they actually retain me. Obviously that’s not my favorite, but I’m willing to do that. And that’s how I try to be supportive of the community in general.

I’ll send an estimate with ‘here’s what we decided, what we want to go forward with right away, here’s what we think we can put off.’ And I’ve done enough of them that probably 80% of the time I end up right within the estimate. The caveat comes when you’ve got opposing counsel that’s either difficult or more often just doesn’t know the startup world. And so they’ll say ‘what are these terms?’ In Chicago, I’ve found early-stage investors negotiate the hell out of funding — they try to negotiate SAFEs and convertible notes on issues other than the cap and the discount and that can get expensive. So I usually tell clients that, assuming they use a lawyer who knows the startup space, this is what it’s gonna cost and I can guarantee it. But if not, you never know.

I bill at $395 an hour for startups and our paralegal is at $160. She does all of the entity formation, bylaws, organizational resolutions and she usually does all of it for a startup within two hours. So it’s very small cost for that and then it’s hourly billable. I bill at the end of each month with 30 days to pay.

Founder recommendations:

“Leslee helped us throughout our fundraising process, onboarding of new investors, and navigating the complexities of investor ups and downs. She’s amazing.” — Nicole Vasquez, Chicago, cofounder of Second Shift

“Leslee was invaluable as I navigated the intricacies of best practices of corporation creation while involving the needed eccentricities my company required. In sum, we create the appropriate bespoke relationship that is invaluable to any organization with an eye towards growth and sustainability.” — Montana Butsch, Chicago, CEO and founder, Spotivity

“Leslee guided my startup through its early stages with respect to corporate formation, convertible note issuance, stock issuance, restricted stock issuance, shareholders agreement creation, and appointment of our board of directors. She also connected me to other attorneys regarding IP creation and to insurance brokers who focus on startups.” — Marty Elisco, Chicago, CEO, Augmented Intelligence

“Leslee has always been very sensitive to my financial limitations as a startup. For standard legal documents, she will find me the best template to customize which reduces the hours she ultimately needs to spend reviewing them. She also has a great local network that she has tapped into for my benefit. As a new entrepreneur, Leslee has been the perfect fit. She is honest, authentic, knowledgeable, passionate and fun to work with. All of these qualities have allowed me secure a solid legal foundation without overspending.” — Justin Lyons, Chicago, Founder of Blaze, a Lilsure company.

“Leslee has helped us with incorporating our business in Delaware as well as Illinois. She has served as a mentor to help us establish Research Planet. She is always there to provide us with the most accurate guidance. Leslee has a strong background working with Startups and technical founders.” — Rafael Sid, Chicago, IL , Founder of Research Planet

“Leslee was instrumental in setting our corporate structure and compensation to protect against founder/employee fallout, which happened more than once. She also ensured that our structure prepared us to raise funding and grow the team quickly.” – A founder in Cleveland

“Gave big law insight in a boutique style.” — Jim Pesoli, Chicago, media and entertainment Entrepreneur

“Leslee has been our attorney for over three years. She has guided us through multiple rounds of funding, always providing great legal and business advice. She is also extremely responsive, particularly when a deal is closing. This level of service is another level up from a majority of attorneys I’ve dealt with in the past. Leslee understands how important it is to help clients during stressful transactions.” — Bob Matteson, Chicago IL, CEO, Mobile Doorman

“Leslee and her firm have produced for us restricted stock agreements, advisory agreements, employment agreements, and more. She and her firm have also reviewed our contractor agreements and MSAs with third party vendors. She has personally made introductions to other law firms who might have more expertise in a given area, such as to Tricia Meyer and Meyer Law.” — Ben Margolit, Chicago, cofounder and CEO at Rentgrata, Inc

“Leslee has done all of our legal work. Everything from initial vesting agreements, company formation documents, customer contracts, and terms of service. She was particularly helpful regarding terms of service and privacy policy for our health technology service. There was a lot of complexity regarding HIPAA and health data, but she made it incredibly easy for us.” — Kelley Halpin, Chicago, CEO at Karrot Health

“Leslee’s ability to make even the most complicated issues simple and easy to understand has been invaluable to our company!” — Larry Bellack, Chicago, President, Mobile Doorman

“I own and operate a boutique advisory firm that provides consulting services and funding solutions to small businesses, including start-ups. Leslee has provided tremendous value helping us conceptualize, frame, and document solutions that have proven to be highly beneficial and pragmatic for our common clients. Her relationship with my business and our mutual clients goes way beyond the traditional scope of corporate counsel. Leslee brings a personal commitment as well as valuable insights both within and outside the legal framework that helps business owners and their companies achieve success!” — Ken Goldberg, Lincolnshire, IL, consultant

“Outside-the-box thinker on our contracts. Goes above and beyond with her communications. Incredibly compassionate and empathetic throughout difficult situations.” — Andy Marsh, Chicago, partner at TagPrints