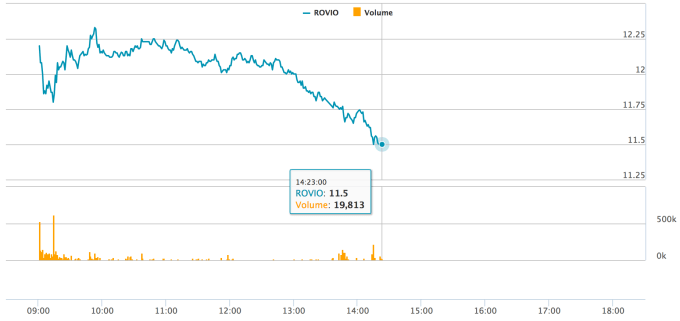

Rovio, maker of the Angry Birds gaming franchise, saw a small pop of 4.3 percent in its first day of trading as a public company, but like the very birds that get catapulted in Rovio’s original blockbuster game, the rise was not to last.

After pricing its IPO at €11.50 per share — the top of its range — to raise €30 million, today the stock opened on the Nasdaq Nordic exchange at €12.00, up 4.3 percent. But then, after morning trading took it as high as €12.34 a share, Rovio (trading as ROVIO) has fallen down to hovering around the same price it was yesterday evening, €11.50/share. And it’s actually dipped below that, going as low as €11.35 at one point. Its current market cap is $1 billion (€896 million).

Rovio had said yesterday that its initial offering price of €11.50 was oversubscribed and valued it at $1 billion, although previously the company had hoped for a $2 billion valuation. It appears that the U.S. waking up has done little to boost trading so far. Rovio’s 37,073,010 IPO shares were offered to private individuals and entities in Finland, Sweden and Denmark and in private placements to institutional investors in Finland and internationally.

Rovio counts the U.S. market as one of its very biggest — the company said that “most” of its revenue comes from North America and Europe — and it also has a high profile there. But unlike Spotify, another company based out of the north of Europe that counts the U.S. as a key area for current business and future growth, Rovio chose to list closer to home.

Rovio once had designs to become the next Disney. But the fortunes of gaming companies rise and fall with the popularity of their titles, and that has impacted that lofty goal. (Indeed, you could argue that this has been a sticking point for some other gaming companies that have gone public in recent years, such as King — which eventually sold to Activision Blizzard — and Zynga. Their economics do not necessarily follow those expected of public companies.)

Rovio has had a number of strong follow ups to the original Angry Birds — it had three mobile in Apple’s top 100 highest grossing apps over the summer, for Angry Birds Blast, Angry Birds Evolution and Angry Birds 2 — but no new brand so far has quite broken through as a blockbuster in quite the way as the original Angry Birds did.

According to Verto Analytics, the Angry Birds franchise (comprising all the titles) has seen its monthly US visitors over the age of 18 tripled over the last year. There are now 5.9 million visitors compared 2 million in July 2016. But while Angry Birds (2.1 million visitors) and Angry Birds 2 (1.4 million visitors) have grown respectively by 351 percent and 128 percent, Angry Birds is down from a peak of 3 million earlier this year.

“Even the most successful Angry Birds titles still lag well behind flagship offerings from their biggest rivals: King’s Candy Crush Saga has 10.2 million monthly uniques and Supercell’s Clash of Clans has 5.6 million,” noted Connie Hwong, of Verto, who also questions the model of building a number of games around a single brand.

“King and Supercell have exercised greater restraint in rolling out expansions or sequels to their existing mobile games franchises,” Hwong wrote. “Candy Crush has a handful of sequels while Clash of Clans has just one spinoff, Clash Royale. Is a smaller, more carefully edited catalogue of game titles a better bet for mobile game companies?”

Rovio has been right-sizing in a different way: after investing in a number of areas in its “Disney” heyday, the company has since pulled back on many of its most ambitious ventures outside of games (such as amusement parks) in favor of a licensing model, where a third party takes on the investment and risk of new projects.

Other moves in the future for the company will include more geographic expansion. With China currently the world’s biggest market for gaming, Rovio is focusing its strategy there.

“We are working on a number of high profile potential partnerships in China,” Rovio’s EVP of games, Wilhelm Taht, said in an interview with TechCrunch last month. In China, foreign companies need to align with a local company in order to build a business in the country. “We have gone through several potential partnerships and with 600 million downloads in the region already, we will try to strengthen the China business.”

The company reported revenues of €266 million ($314 million) for the year that ended June 30, 2017, with an operating profit of €29,483 ($35 million).

We are updating this story with more detail and price changes throughout the day.