A new comScore study out today has taken a deeper look at the behavior of cord cutters here in the U.S., in order better understand how this growing demographic differs from pay TV subscribers, as well as what factors may have influenced their decision to leave cable TV behind. According to the report, cord cutters tend to be lower- to middle-income, and – despite spending more time on streaming services than the average viewer – they watch far less television than your typical pay TV customer.

What’s notable about the comScore study is that it’s based on behavioral data, rather than relying on people’s own self-reporting, like many of the cord cutter studies release prior to today. Simply put, that means this study measured what cord cutters actually did, rather than what they say they did.

ComScore says it came to its conclusions after analyzing over-the-top viewing data in the month of March, 2017 for around 870 cord-cutting homes in its 12,500+ household panel.

Some of the results are not all that surprising.

For example, cord cutters watch a lot more over-the-top content – that is, streaming video that’s available without a cable or satellite TV subscription. In fact, comScore found they spend 79 hours per month (2.5 hours per day) viewing over-the-top content, compared with the U.S. average of 49 hours per month. That’s 60 percent more than average – a figure that may lead you to think that cord cutters are actually heavy consumers of TV and video.

But that’s not actually the case, as it turns out. Traditional TV viewers in the U.S. watched 225 hours of television during the month of March. Even with 79 hours of streaming video watched per month, today’s cord cutters are watching far less total TV than the average viewer.

ComScore suggest that a decreased appetite for television may have contributed to their decision to cut the cord in the first place. That would make sense, given that there are only so many hours in the day for people to spend on entertainment. And over the years, the rise of the internet – with its social networking sites and video sharing networks – along with the rise of mobile phones, with their numerous apps and games, have contributed to TV’s declining viewership.

For example, back in September, 2015, analytics firm Flurry found that U.S. consumers had begun to spend more time using apps than watching television. Meanwhile, a number of studies over the years have found that younger consumers are generally less interested in watching TV, favoring online video services instead.

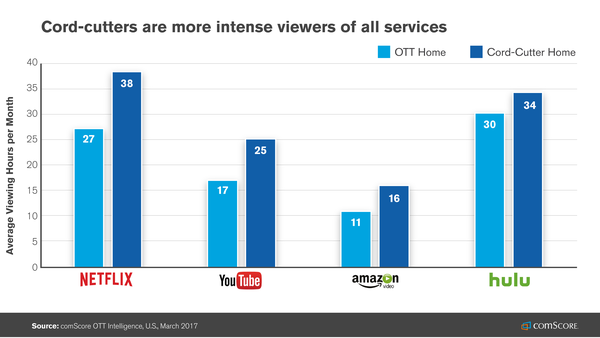

When cord cutters do want to watch TV or other over-the-top content, they turn to online services like Netflix, YouTube, Amazon Video and Hulu, says comScore. And without pay TV competing for their time, they spend more hours per month on these sites.

Cord cutters spend 41 percent more time on Netflix, 47 percent more time on YouTube, 45 percent more time on Amazon Video, and 13 percent more time on Hulu, compared to the average over-the-top viewer.

Also not surprisingly, they’re more likely to own a streaming box or stick, which are in 71 percent of cord cutters homes, compared with only 59 percent of all Wi-Fi homes where over-the-top viewing takes place. And they’re also slightly less likely to use connected TV and gaming consoles than average, which hints that they seek out streaming-first devices when choosing to cut the cord says comScore.

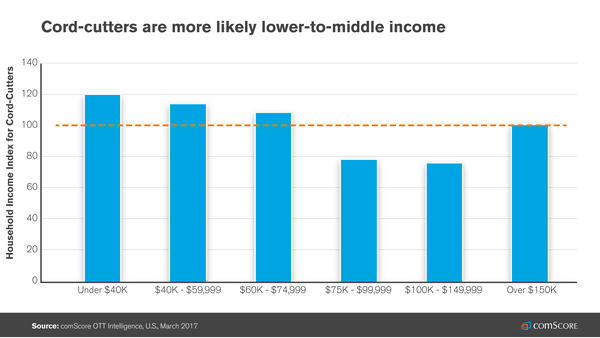

One of the more interesting – though not entirely shocking – findings from comScore’s report touches on the household income for cord cutters. It finds that cord cutters are likely to be lower to middle income. They’re more likely to have annual incomes of $75,000 or less, and the lower the income, the more likely they are to have cut the cord.

Those least likely to have cut the cord are homes with household incomes between $75,000 and $150,000. Meanwhile, homes with less than $40,000 in annual income are 20 percent more likely to have cut the cord.

Or, another way of putting it is that people who don’t see cable TV as an unbearable expense are probably still paying for it.

But these figures do suggest that – for now at least – cord cutting is about saving money just as much as it is about a cultural shift in how people want to watch TV. That could signal a challenge ahead for the newer, live TV services – like Hulu’s live TV option, Sling TV, DirecTV Now, PlayStation Vue, and YouTube TV.

When you start looking at the higher tiers on these platforms – the ones including all the add-ons like cloud DVRs or more simultaneous streams, or larger channel lineups – you’ll find that they cost as much as some pay TV subscriptions.

If cord cutters are looking for cost savings, then these services will need to better compete by having attractive packages at their lower end. (They can later try to sucker upgrade customers to join their pricier, cable TV-like plans.)