Android Pay, Google’s answer to Apple Pay and other mobile payment technologies, today unveiled new partnerships with a handful of banks from around the world, who will integrate the service into their own apps. The feature will be available within the mobile banking apps provided by Bank of America, USAA, Bank of New Zealand, Discover, and mBank, says Google.

This is the first time Android Pay has been available within mobile banking apps.

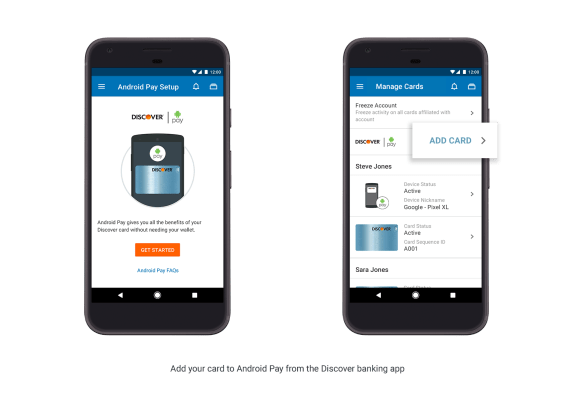

The integration may be slightly different in each bank’s app, but generally, the focus is on making it easy to add cards to Android Pay from within the banking app itself. This gives Android Pay an expanded avenue to distribution, as users who have not have signed up for Android Pay may notice the option in their more regularly used banking app, and then become interested in trying out the mobile payments service for the first time.

Increasing Android Pay adoption is key for Google, as it has so far been ceding the contactless market to rival Apple Pay. According to a report from Juniper Research released earlier this week, Apple Pay usage has nearly doubled year-over-year, and is expected to reach 86 million users by the end of 2017. Samsung Pay and Android Pay are also growing, but are only expected to reach 34 million and 24 million, respectively, during that same time frame.

After the card has been added within the bank’s app, Android Pay works as usual.

That means you’re able to tap to pay at checkout at the millions of stores offering the supported NFC-enabled terminals, says Google. Plus, you can use it in supported apps to make purchases or checkout on the mobile web, similar to Apple Pay. You’ll also receive a notification immediately after each transaction.

Google clarifies that the option to use Android Pay through the banking apps will work even if you don’t have the standalone Android Pay application installed on your smartphone.

As the company explains in a blog post about the new partnerships, customers of these participating banks will be able to manage their bank card choices, including selecting different default payment methods or deactivating cards, through the banks’ apps themselves. However, this feature will be limited to managing the cards associated with that particular bank – you can’t delete a Chase card from the Bank of America app, for example.