Information technology shifted 15 years ago from perpetually licensed, on-premise software to Software as a Service (SaaS).

The shift created significant opportunities for startups, but led to the death of companies that ignored the change. These companies were stunned to find that traction was not enough to interest investors and, at best, they sold at low valuations to legacy technology companies.

Today, information technology is shifting from the SaaS workflow applications that characterized the cloud computing era to those that help customers make decisions. Characterized as the intelligence era, the source of competitive advantage is shifting from code to unique data + self-learning code. As with the previous shift, this brings a change in the expectations of investors. We are seeing investors outright ignore SaaS companies with solid traction in favor of companies that have a strategic position in the market granted by their “intelligent” software.

This post generalizes the requirements of enterprise software investors in the intelligence era in the hope that it helps founders of enterprise software companies think about how to sequence their fundraising, product development and data strategy.

The new funding strategy

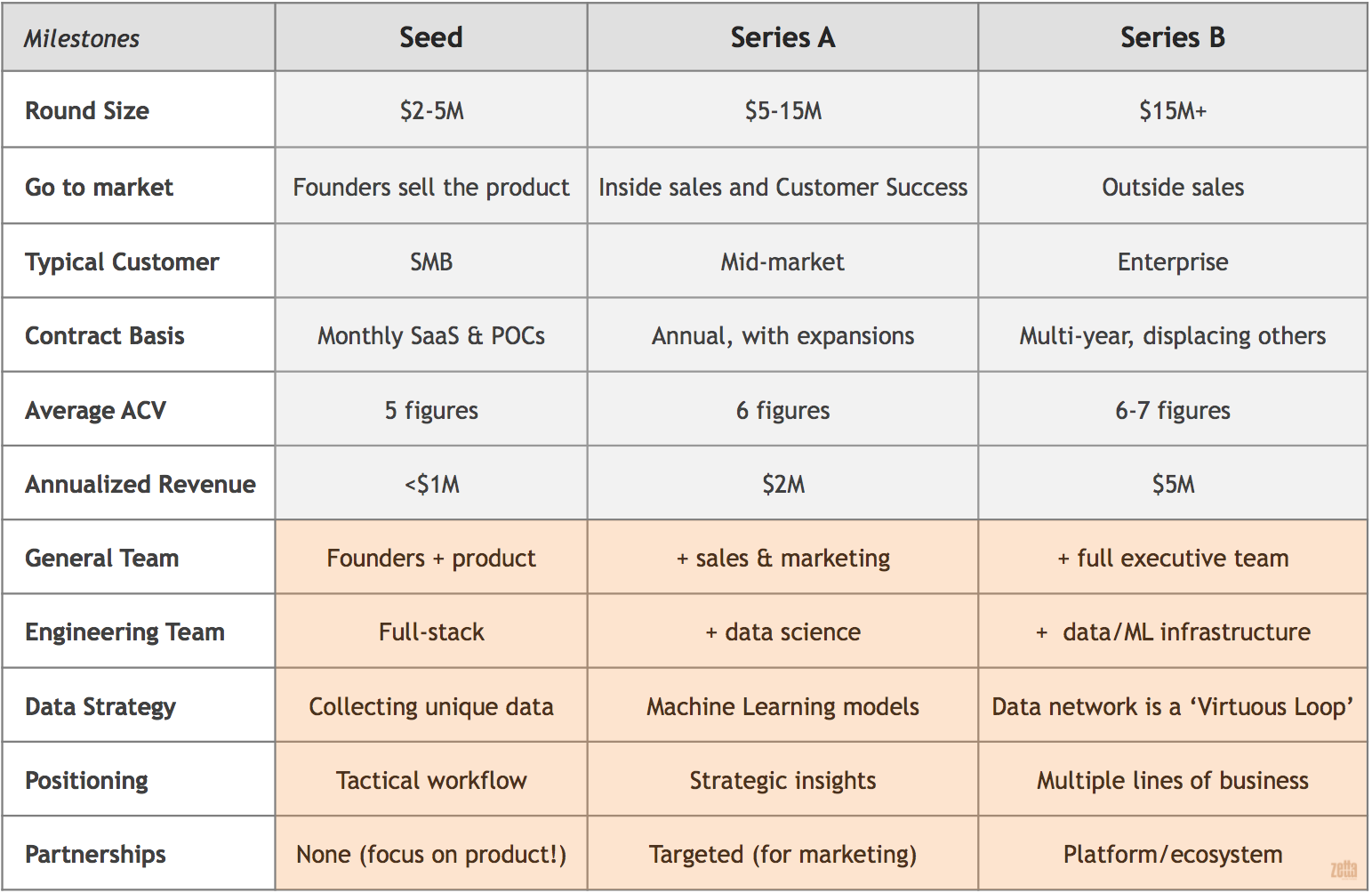

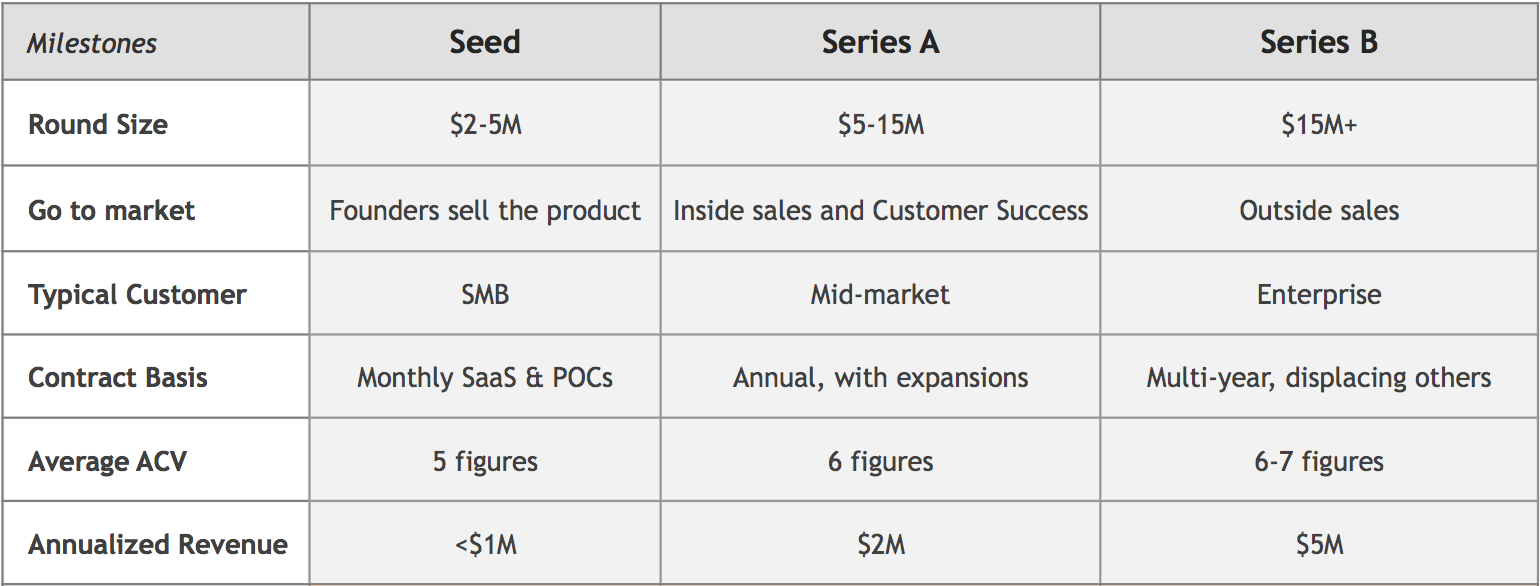

The company characteristics below are what investors generally expect at the point of raising that round. For example, Series A investors generally expect to see annual contracts with examples of where you’ve expanded revenue with specific customers before investing. Seed investors focused on intelligent enterprise software generally expect to see that you’re collecting unique data before investing.

We’re seeing that the bottom half of this table (shaded in tan) is increasingly important. Companies need to show they’re building a competitive advantage through unique data + self-learning code to raise a Series A from a world-class investor. SaaS without data is not enough. This means that companies need to pick seed investors that are savvy to the impending shift to the intelligence era, help them with this strategy and have the track record of attracting world-class Series A investors. The best seed investors play the role of a “Data Product Manager” until the full team comes together.

Let’s define the characteristics on the left and explain the rightward progression, separating table stakes from what’s truly necessary today.

SaaS table stakes

The top half of this table includes the characteristics required to raise money from a world-class investor when the cloud was a new thing, and SaaS was the future. Was. Today, deploying to the cloud is a given and you need more to break away from the competition. But first, let’s talk about the basics.

Go to market: How you reach potential customers. “Bottom up” means that you don’t spend money on sales and marketing, instead relying on word-of-mouth through social channels and free PR to build an initial base of customers. Companies now tend to graduate from here by hiring customer success and inside sales reps to mine that initial base of customers for those with big budgets. Outside sales reps are hired after exhausting this bottom-up strategy.

Typical Customer: The profile of a typical purchaser. This determines their level of sophistication, revenue potential and sales cycles. Some startups may start by selling to large companies. Small to medium businesses (SMB) are less sophisticated and have lower revenue potential but are easier to reach, have shorter sales cycles and are less likely to be using a high-quality alternative. Interestingly, a startup can gather a large volume of data across SMBs such that it can build machine learning models that compete with those built by larger companies.

How will my investors add value?

Contract Basis: The basis on which revenue recurs. Companies get the leverage to negotiate for longer terms as they build stickiness with customers by providing better products.

Average ACV: Average Annual Contract Value. Larger average ACV means that you’re successfully selling to larger customers, into more divisions and/or at higher prices. Some companies may keep ACV constant but significantly increase volume.

Annualized Revenue: There are many useful measures of revenue, but this is a universal number that you can calculate by annualizing last month’s revenue. This is not the same as annual recurring revenue (ARR). Churn is important here, but it’s hard to define a milestone. Seed investors will not have enough data to draw conclusions about churn. Series A investors, depending on the sales model, will dig into 12+ months of data to understand churn — and usually need to see negative churn.

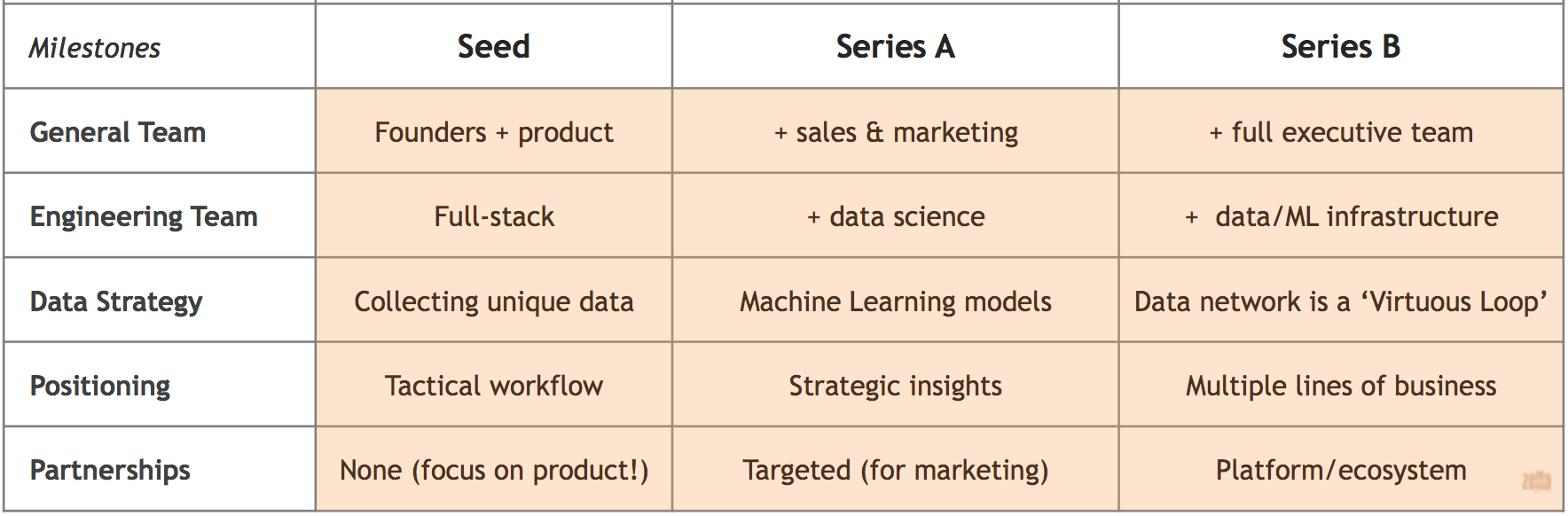

What you really need

Rightward progression with respect to these characteristics, as represented by the tan shading in the table, means you’re building a competitive advantage through unique data + self-learning code — crucial to raising a Series A from a world-class investor.

General Team: Those on your team who aren’t software engineers. This is probably just founders and a designer at the seed stage, adding sales/marketing (a strategic marketer, inside sales and customer success) by the Series A stage and rounding out the executive team (with BD, finance, operations and HR) by the Series B stage.

Engineering Team: The people making the software. Start with those who can efficiently get the product into your customers’ hands. Then, as you collect data, you can use data science talent to deliver insights to your customers in the form of predictive features. This is where hiring gets hard; you’ll need your investors to give you every advantage you can get. As you scale, you’ll need some infrastructure specialists and great engineering managers.

Data Strategy: A crucial part of your plan to build an intelligent software product. A clean, unique data set is a competitive advantage in itself (so don’t sell it!). From there, you can start building predictive models with your customers’ data and turning successful experiments into features that help them make decisions. Finally, you will have a product that uses incremental data to improve models; making the product better, attracting more customers, getting more data and so on — a “‘Virtuous Loop.”

Companies were stunned to find that traction was not enough to interest investors.

This compounding competitive advantage is something that only Google and a few others have built, but is within reach of today’s startups. As you can see, one has to be purposeful about this strategy from Day One. Great investors will focus on helping you create a coordinated data and business process strategy. They will guide data set, model and feature development to build a Virtuous Loop. Investors focused on similar companies will help you assess whether you’re collecting unique data compared to your competition.

Positioning: How are you different from everyone else in the market? Where you are on a Gartner map determines how many big enterprise customers take notice of your company — like it or not. Seed-stage companies usually have a workflow product that is better/cheaper/nicer than existing products, collecting data in the background. The addition of predictive features helps customers make decisions, making your product key to their strategy and giving you lock-in. A full-featured product will quickly expand to all lines of business within your customers’ companies such that it’s a “must-have.”

Partnerships: Partnerships are a distraction before the seed stage. However, companies can leverage a few key marketing partnerships with complementary product companies to get enough traction to raise a Series A. Further, companies can form partnerships to get access to large data sets, bootstrapping their machine learning efforts. Hiring full-time business development talent after your Series A will help you form an ecosystem of sales, marketing and product partnerships ahead of a Series B.

Examples

InsideSales

InsideSales.com is a sales acceleration platform that automatically recommends prospects. InsideSales started as a SaaS company but is now a quintessential intelligent software company, using data to build a self-learning engine that drives up to 30 percent revenue growth for their customers after just 90 days. Here’s how they made this rightward progression.

Typical Customer: InsideSales started by signing up SMBs, gathering a large volume of data across those customers with which to build machine learning models. Roughly 100,000 sales reps at more than 3,000 companies, including ADP, GE and Salesforce, use their software today.

Seed investors focused on intelligent enterprise software generally expect to see that you’re collecting unique data before investing.

Engineering Team: InsideSales started with a team of generalist engineers and now have 30 machine learning engineers with PhDs working with well over 100 billion records of data, adding 5 billion per month — the largest sales database in the world.

Data Strategy: InsideSales started by collecting data on phone calls and emails, then built some predictive features to tell you when to call/email someone to maximize the chance of closing a deal. The software anonymizes and normalizes data from one customer, learns over that data, synthesizes the learning into a prediction and delivers that to another customer. They’ve closed the Virtuous Loop.

Positioning: The initial product was a Call Dialer that helped an inside sales rep crank through a prospect list. The addition of automatic recommendations saw InsideSales reposition as a sales acceleration platform and increase its average selling price per seat to be 2-3x that of complementary system of record vendors in the ecosystem.

Partnerships: InsideSales has a marketing partnership with the leading CRM platforms — Microsoft Dynamics and Salesforce — and strategic investment from both parent companies. The recent launch of the Neuralytics platform allows any company to feed their data into InsideSales’ core machine learning technology, opening up opportunities for InsideSales outside of the sales use case.

Affirm

Affirm uses data to give companies the confidence to offer monthly payment terms to their customers.

Data Strategy: Affirm initially provided merchants with a way to offer financing to customers based on public data. Now, it uses a combination of public data and individual lender data to manage repayment and buyer fraud risk. Additionally, Affirm uses that data to optimize the checkout flow for merchants, increasing average basket size.

Positioning: Affirm evolved its positioning from a widget on e-commerce websites to a company re-building core parts of financial infrastructure and an independent banking brand for millennials.

Partnerships: Affirm built a strong set of partnerships as it grew. First, with Shopify to offer financing on any Shopify store. Then, with First Data to offer financing to customers in brick-and-mortar stores through the Clover Point of Sale system. These partnerships could also provide Affirm with new customer data that it can feed into its credit scores.

Euclid Analytics

Retail, quick-service restaurants and shopping malls use Euclid’s products to understand customer behavior in their physical locations to optimize marketing and operations.

Data Strategy: Euclid invented a novel way to identify and triangulate shopper behavior through Wi-Fi signals and mobile phones. It uses the combination of hundreds of millions of shopper events and external data sources to provide recommendations to its retail, restaurant and mall customers. For example, which marketing campaigns, staffing changes and menu updates increase restaurant visits?

Positioning: Euclid evolved from “Google Analytics for the real world” to “insights and personalization for the physical world.” That is, the company went from offering dashboards to offering insights by adding complementary data sources and enabling online-to-offline attribution and engagement in physical locations.

Partnerships: Euclid partners with Wi-Fi OEMs, VARs and MSPs to integrate with major hardware providers. Further, the Euclid ecosystem analyzes location data alongside a range of additional data sources, including Door Counters, POS, CRM, MAP and staffing systems.

EventBoard

EventBoard started out as those iPads you see in meeting rooms and is now the leader in optimizing the workplace and workforce. Here’s how they made this rightward progression.

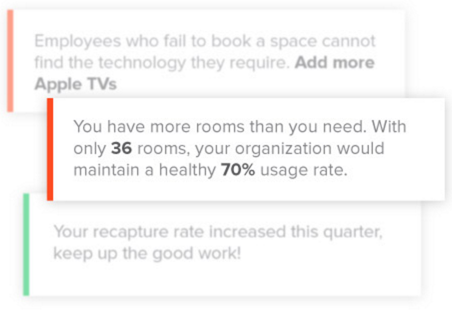

Data Strategy: The company signed up 300 SMBs before raising a seed round, and has since onboarded more than 1,800 customers, including Viacom, National Instruments and GE. The product now generates more than 150 million unique data points per month, combines that with data from integrated products and offers analytics on the workplace and workforce, e.g. room utilization, causes of meeting cancellations, re-booking rates, frequently skipped meetings and the cost of meetings.

Positioning: EventBoard evolved from conference room scheduling to digital workplace and workforce optimization. The product seamlessly brings together people, places and technology to create a better and more efficient workplace, and a more effective workforce.

Partnerships: Apple recommended EventBoard to many large companies because it changed the value proposition of iPads in the enterprise. Today, EventBoard has strong strategic investors and solid partnerships with Apple, Google, Aruba/HP and GE. GE provides access to rich data sets that the company leverages to provide even deeper insights and analytics. EventBoard also started to build a channel strategy.

The new, focused investor

Over the next decade, cloud-based software will require intelligent features to effectively help customers increase revenue, lower cost or be in compliance. This will be true for both existing lines of business in the enterprise and new markets such as the industrial internet, precision agriculture, smart cities and bioinformatics.

The key question for an entrepreneur is the same as always: How will my investors add value? Today that means: How will my investors help me build a next-generation team, form a data strategy, position my company, make partnerships and keep me funded with the best syndicate for the marathon ahead? On top of being a great business partner, they need to be an expert in helping you create a beachhead in the intelligence era.