DFJ Growth, the 10-year-old growth-stage arm of the 30-year-old Sand Hill Road firm, is raising a new $500 million fund, suggests an SEC filing first flagged by Fortune.

The timing fits the narrative of many Silicon Valley venture firms, many of which have been returning to their LPs in two years’ time, rather than a more traditional three or four years. Indeed, the firm raised its last growth fund, a $470 million pool, in May of 2014.

Among other firms to announce fast follow-on funds this year are DFJ’s early-stage group, which raised $350 million for its 12th fund back in February. It had raised its previous fund almost exactly two years earlier (a $325 million vehicle). Accel Partners, Founders Fund, General Catalyst Partners and Lightspeed Venture Partners have also raised new (and very big) funds this year, after closing on their previous funds in 2014.

VCs say they’re raising money right now because it’s a good time to invest, as well as because the fundraising pace was accelerated in recent years as startups raised rounds in faster succession than they have historically. (Because VCs invested more quickly, they also depleted their capital more quickly.)

However, there are skeptics, including Benchmark’s Bill Gurley, who has suggested VCs are raising faster than ever because the industry has “record [internal rates of return] on paper and record low liquidity” — meaning investors’ markups have not been turned into cash-on-cash returns just yet, and they don’t want to wait for those markups to fall before reaching out to their investors.

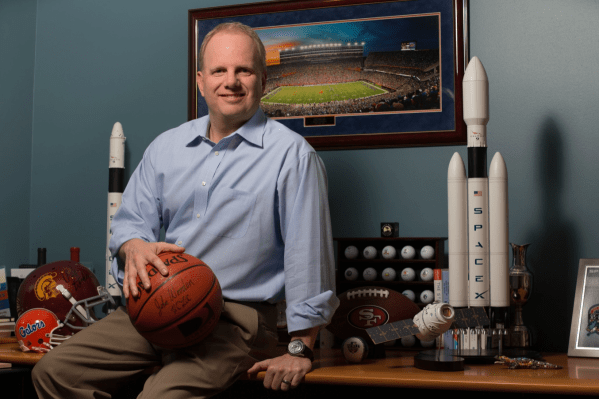

DFJ Growth is led by five general partners. We talked with co-founder Randy Glein in December about what the firm looks for, which he said are “companies [that] are generating low tens of millions of dollars in annual bookings, growing more than 100 percent a year, and playing in a market that’s big enough to support a large company. That can be $1 billion to $100 billion dollars, depending on the market opportunity.”

Glein also explained that DFJ Growth sometimes invests in the same companies backed previously by DFJ but that there’s been “less overlap” over the years.

Some of DFJ Growth’s biggest exits to date include the IPOs of Twitter, Solar City, Box and Tesla Motors, along with sale of Yammer, which was acquired by Microsoft; the sale of Tumblr, acquired by Yahoo; and the sale of AdMob, which was acquired by Google.

Photo of Randy Glein, courtesy of DFJ Growth.