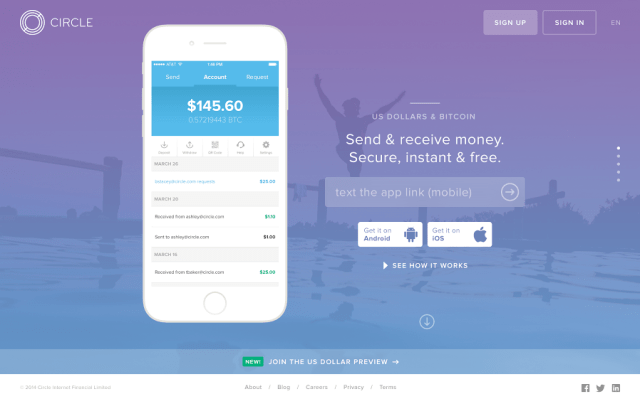

It may have started as a Bitcoin wallet but veteran entrepreneur Jeremy Allaire’s fintech startup Circle has since shifted focus to social payments, launching an app in Q4 last year that lets users send U.S. dollars to settle IOUs between each other, with its pitch being it makes payments as easy as firing off an SMS (and perhaps cheaper, given there’s no fees involved for Circle users).

And while fiat currency payments are now evidently the focal point for its business (rather than Bitcoin payments), Circle does still offer the ability to feelessly pay people elsewhere in the world, in some 150 countries — and for that it needs to loop Bitcoin into the mix, turning dollar payments into BTCs deposited into the recipient’s Bitcoin wallet.

But Allaire prefers to talk now about the other, more fashionable ‘b’ word — blockchain — asserting that Circle is utilizing blockchain technology to “build a model for money that works over the open Internet”.

“We never thought of ourselves as a Bitcoin startup. The media certainly classified us that way because we were involved with the technology. From the day we founded the company three years ago we’ve focused on trying to build a new consumer finance company. And one that makes money work the way the Internet works,” he tells TechCrunch.

“We want… to connect the benefits of digital currency with the existing financial system. And the existing currencies that people use, day to day, the currencies they’re paid in, the currencies they pay people with etc, and connect that not just with blockchain technology but other major technical innovations that make doing what we do possible.”

“When people use the Circle product… you don’t see Bitcoins. It’s sort of underneath. The blockchain is a technology that allows us to not just build another closed payments system but actually build something that’s interoperable with the rest of the world,” he adds.

Today Circle is adding support for its second fiat currency — UK sterling — so it can now offer its users feeless cross-border payments between US dollars and UK pounds (or vice versa), as well as Bitcoin payments.

Cross border currency transfers might prove more of a compelling draw to pull users into Circle vs the core proposition of an app to settle cash debts with friends/acquaintances, given the typical complexity and expense involved in sending fiat money abroad via traditional banking routes. And the relative hassle of asking your friend to sign up to an app just to redeem that $10 you owe them… Indeed, some might say that sounds like a dick move. (Albeit Circle claims it’s made sending/receiving money in the non-user scenario super easy, with the money sending Circle user entering just the recipient’s phone number to send, and the non-user able to snap a photo of their debit card to be able to redeem what’s owed.)

But Circle is convinced that domestic personal and social payments will be its future bread and butter, with Allaire pointing to the massive success of China’s WeChat Pay and Alipay as examples of the huge potential it sees here. Although, unlike China’s WeChat for example, Circle is having to build its network from scratch — rather than leveraging an existing and highly popular messaging platform.

It is trumpeting having gained an E-Money Issuer license from the UK’s FCA, which also extends to operating in a third fiat currency (Euros), claiming it’s the first time the financial regulator has issued such a license to a consumer Internet firm for cross-border payments with blockchain technology.

Allaire and co-founder Sean Neville say Circle will be gradually rolling out support for Euro payments in some European Union markets this year, although they’re not specifying which ones yet. But will say they won’t be launching it in all Euro-using markets in one big bang. Circle is also not disclosing any user numbers at this nascent stage.

The process of obtaining the necessary licences and regulatory approval to operate in the US and Europe has taken some two years, according to Allaire — who is very complimentary about the UK government’s support for the adoption of digital currencies.

In the UK Circle’s banking partner is Barclays which is proving the local accounts and infrastructure support to enable it to offer users sterling payments.

“We need a commercial banking partner because we’re not authorized to store directly the local currency,” he explains. “So we need a banking partner that allows us to hold the local currency… and also gives us access to the infrastructure that’s needed to move the funds in and out of any existing UK customers’ bank account with Circle.”

Another change today is that Circle is dropping prior transaction and withdrawal limits for users, with Neville saying it now has enough confidence in its risk assessment tech for extending short-term credit to be able to lift the caps on how much users can send and receive.

The startup took in a $50 million round this time last year, from investors including Goldman Sachs and IDG Capital Partners, and the co-founders say they still have a “significant chunk” of the total capital they have raised ($75M) in the bank so aren’t looking to raise again yet.

Circle is not itself taking revenue at this point, given it’s not charging users fees for settling their payments. The grand vision, says Allaire, is that moving money around digitally should always be feeless, and instead a socially sticky, consumer friendly payment app with messaging smarts encourages consumers to shell out for other handy features — once they’ve been conditioned to rely on Circle for their core money-sending needs.

“We really do fundamentally believe that sending and receiving money, which is really just updating databases, is something that is free… We don’t really believe that’s a viable business model,” says Allaire. “There are other valuable things that financial services companies do — future products that we would like to build and explore — but the payments side of it is intended to always be free. Or as very very close to free as we can possibly get it.”

“[WeChat Pay and Alipay] in a really interesting way combined messaging, social graph, media sharing and payments in an integrated experience. And it took hold and got enormous scale in China over the past two or three years to the point where 500 million people are using it and it’s become a part of their daily life.”

“It’s personal and social payments. Friends, family, co-workers, it’s across the board. Any personal or social payment. All that’s mediated through WeChat Pay and Alipay now in China. That category of social payment app hasn’t really emerged in a big way in the West. There’s virtually no major players,” he adds. “The opportunity is wide open.”

That said, he names Venmo as one existing competitor in the U.S., but argues it has not managed to gain “anywhere near the scale you see with traditional Internet apps”.

Another rather more well-known name — Facebook — might well be able to gain such scale, and is already playing in the space, although Circle is evidently hoping to steal a march on Zuck & co by rolling out its rival social payments app faster.

“Facebook haven’t fully rolled out what they’re doing with payments in Messenger but definitely we would view that competitively,” he adds.