A big day for e-commerce startups in India, and a double boom for Japan’s SoftBank. Snapdeal, founded four years ago as a marketplace for third party retailers in India to sell goods online, has raised an additional $627 million from SoftBank Internet and Media to continue building out its business in the country, both organically and through acquisitions. It’s thought to be the biggest check ever written by a single investor for an Indian tech startup, and it brings the total raised by Snapdeal in 2014 alone to nearly $1 billion.

The investment comes on the same day that SoftBank is also confirming a $210 million investment in another Indian startup, Olacabs.

For SoftBank, it’s a strategic investment, made to capitalise on the rapid growth for e-commerce in India, but also to link up and “leverage synergies” between Snapdeal and Softbank’s bigger portfolio of companies. That porfolio includes recent additions like Tokopedia (announced just last week), as well as more high-profile, legacy holdings like Alibaba (SB’s share has been described as one of the “greatest ever” investments made, with its $20 million stake now valued at around $75 billion). It also includes companies in India such as mobile ad startup InMobi and the carrier Softbank Bharti.

“We had a lot of demand from investors,” Snapdeal CEO and co-founder Kunal Bahl said in an interview. “We were very clear that SoftBank was the partner that we wanted. We wanted a partner with a long horizon and SB demonstrated that with Alibaba, which went public 16 years after they invested. This was a real meeting of the minds and a deep philosophical investment.”

Speaking of Alibaba, we had heard rumors from a couple of different sources that now-public Chinese e-commerce leviathan was itself taking a stake in Snapdeal. Bahl would not comment on that, but he did note that there are other investors that are not being disclosed, on top of the $627 million from SoftBank.

While Bahl was mum on Alibaba as a possible investor, he was not shy to sing the Chinese company’s praises: “Snapdeal’s business model and traction and philosophy are similar to what Alibaba has been able to achieve in China,” he says. “Small biusinesses need to be aggregated on a platform and selling nationally to consumers. We’ve been focused on democratising retail in India both for small businesses and consumers.

Bahl is not commenting on Snapdeal’s valuation except to note that it is significantly higher than the $1 billion that it reached in its previous round. From what people were reporting when SoftBank’s investment was still only rumored, the valuation is now closer to $2 billion, although a report in The Times of India puts it to over $3 billion — as it notes that SoftBank’s investment is for a 20-25% stake.

In any case, it’s a huge investment, and makes SoftBank into Snapdeal’s largest shareholder, with SIMI CEO Nikesh Arora taking a seat on the board.

Snapdeal, like its national rival Flipkart, has been building out its e-commerce business at a time of huge growth in India’s internet market. Today, Snapdeal counts some 50,000 sellers on its marketplace, with 25 million registered users, and it’s been expanding fast. Bahl says that over the last 12 months its gross merchandise value (the amount processed on its platform) has have grown over 600%, with annual GMV currently at over $2 billion.

Mobile has been blowing up even faster.

Fifteen months ago, 5% of Snapdeal’s sales were made by phones, Bahl says. Today it is 65% — growth of 3,000% in the last year. “My sense is that over the next two years, over 80% of orders will be on mobile phones.”

And this seems to be just the tip of the iceberg, so to speak: currently 0.5% of all retail is e-commerce based in India, while in China the figure is closer to 10% of all retail. Bahl believes that with 70% of GDP in India coming from consumer spending, India will better China’s 10% by some way. “India is the last frontier,” he says of the e-commerce opportunity.

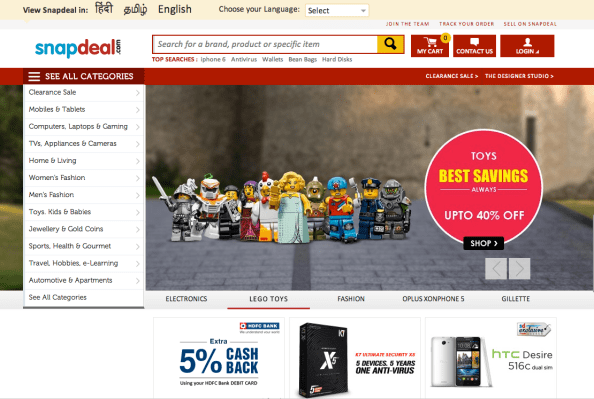

That will inevitably keep Snapdeal somewhat conservative in how it grows. Bahl says it will stay focused on what it is doing now — marketplaces for others rather than selling its own inventory. (Categories today include electronics, fashion, home goods, cars, and real estate.) And it will keep Snapdeal where it is right now: in India.

“I believe that the Indian e-commerce market will be worth $100 billion in the next 10 years and we want to have an 80% share of that,” he says. “That’s not going to be easy and will take a lot of work. It means that we have to be superfocused on this market only.”

Indeed, it’s partly that potential that brought SoftBank to the country: “India has the third-largest Internet user base in the world, but a relatively small online market currently,” noted Nikesh Arora, the ex-Googler who is now Vice Chairman of SoftBank Corp. and CEO of SIMI, in a statement. “This situation means India has, with better, faster and cheaper Internet access, a big growth potential. With today’s announcement SoftBank is contributing to the development of the infrastructure for the digital future of India. We want to support the leaders and entrepreneurs of the digital future; Kunal and (co-founder) Rohit Bansal are two such great leaders.

While U.S. giants Amazon and eBay (which is among Snapdeal’s investors) have both eyed up the Indian market for their own growth, Bahl notes that there are a lot of differences in India that really benefit those who understand the market well.

For example, one of the key gating factors for e-commerce business to thrive has been not the lack of Internet penetration among consumers per se, but the fact that many retailers lack the infrastructure to sell online. Early on, that led Snapdeal to build physical centers where businesses can come, list, and even store on consignment goods that they will sell on Snapdeal.

“They can have their Snapdeal stores up and running in four hours,” Bahl says. There are now 40 of these centers nationwide. It’s also given an opening to a lot of small businesses that would have been challenged to scale nationally, he says, noting that 30% of all the Snapdeal sellers are sole-trader female entrepreneurs who work from home.

That’s not to say that Snapdeal is pushing itself and its community to keep up with the wider change of tech tides: the company plans to hire 500 engineers with some of the funding, to add to the 500 that work for Snapdeal already. There is a mobile app that about 50% of all sellers now using to run their Snapdeal sites. And in terms of consumers, Bahl says that today one of every 10 smartphones sold in India is sold by his company — and each of those has the Snapdeal shopping app preloaded.

Tech will also be the main thrust of any acquisitions that Snapdeal makes in the near future, with the first coming in the next two months and aimed at expanding Snapdeal’s payments platform and more.