Oink — a user-review app created by Kevin Rose’s startup lab Milk before Milk was acquired by Google and Rose later joined Google Ventures — never made it past its six-month birthday, but today the name and domain at least are getting another lease of youthful life. Virtual Piggy, a payments service aimed at minors (COPPA-compliant, with parental controls and an educational bent) is today rebranding as Oink after buying the domain, trademarks and social marks from Milk (not Google) for $57,500.

Founder and CEO Jo Webber — originally from the UK and with a PhD in quantum mechanics, now based in Southern California, and with many years of enterprise IT behind her — tells me that the reason was strategic: the company was originally founded to target younger, pre-teen consumers, and to date that business has attracted 750,000 active users. But in doing research on those active users, the company found that 66% were already over the age of 13. So now, it’s biting the bullet and formally widening its focus to include teenagers. “Piggy” sounded too infantile, they decided. But “Oink” lets them retain some of the branding association with piggy banks while sounding more punchy in a way that will resonate better with the the older end of the youth market — or so the company believes.

Webber tells me that the rebranding is coinciding not only with a push to picking up teens, but also a product expansion.

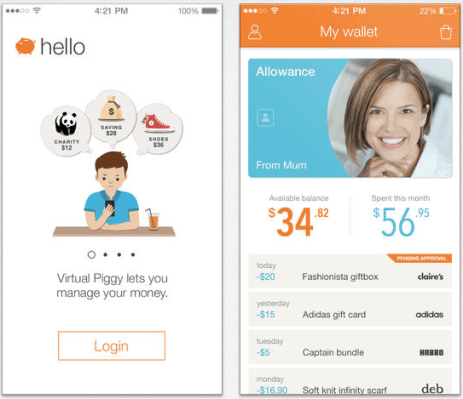

Today, there is an online store of Oink-approved merchants, which include brands like Banana Republic, GameStop, Claire’s and Toy’s ‘R’ Us and can be accessed via desktop and mobile browsers, and via a new app. (Parents and other approved sources pay money into users’ accounts, and this is what those users then use to buy goods.)

Coming soon, she says, Oink will give its users the ability to pay for goods in physical stores as well. A smart business move, considering that 90% of retail spending is still happening in physical stores, despite all the strides made online.

Merchants have not been announced for this next phase, but a good indication of who might come first, and where Oink is aiming its sights, is that list of existing merchants online.

“We are excited to partner with Oink to offer their payment technology on Claires.com,” said Dina Keenan, global CMO at Claire’s Stores, Inc. “Our Claire’s friends are a bit younger and Oink will help educate her about shopping and spending responsibly as she continues to gain independence and explores new ways to express her personal style. At Claire’s we believe in empowering our young girls but we also always want to be Mom approved. The safety and control features of Oink’s family wallet is something we know our Moms love.”

Webber tells me that in-store payments will come “a couple of ways.” The app will have the ability to generate a barcode, she says. A user can walk into the store, click a button on Oink to see how and how much they have in their virtual allowance, withdraw the required amount, and create a barcode to deduct that amount from the account. Longer term, in places where NFC is accepted, Oink will have functionality in its app to work with a handset’s NFC capabilities to wave the device to complete a purchase by debiting from an Oink mobile wallet.

Meanwhile the move to target the older end of the minor spectrum goes along with what might be bigger trends in lawmaking and the usage of technology like smartphones by teens.

On the lawmaking side, legislators in Washington are once again reviving the Do Not Track Kids bill, which will extend the online privacy regulations of Coppa to teens aged between 13 and 15 (Coppa is for 12 and unders); along with that comes a renewed focus on what governments’ role is in protecting minors. E-commerce goes hand-in-hand with other kinds of internet use, and as it becomes a more prevalent force, it’s natural that parents and likely merchants would like to see more ways of ensuring that kids learn to act responsibly with money online.

Meanwhile, Pew Research points to a growing use of smartphones among teenagers in the U.S., particularly as a primary way of accessing the Internet. In data published in April of this year, Pew found that 37% of teens in the U.S. have a smartphone; 25% of those aged 12-17 access the Internet “primarily” via a cell phone or smartphone; and among teens with a smartphone, 50% access the Internet primarily via the mobile device. It also found that girls are more likely than boys to rely on their smartphone as their primary Internet access device, an interesting stat, considering that women dominate e-commerce.

The idea, Webber tells me, is to create a service that kids can carry into young adulthood, university and beyond. “All the games and other apps that are appealing to kids encourage them to buy and spend, and we’d like to help make purchases, but in a controlled manner, she says. “But just because you are over 18 doesn’t mean you are out of the bank of mom and dad.” (note: I sort of hope my kids will be out of the “bank of mom and dad” by the time they’re 18.)

Oink, Webber tells me, has raised about $25 million in funding from undisclosed investors, which include “high net worth individuals who care about child privacy.” Among its other assets are patents on some of its technology for enabling deposits and payments. “We first put in the patent applications in 2009 and they are just starting to come through,” she said. “Frankly it’s surprising that no one was doing this before us.”