Earlier this year, Rocket Internet announced the closing of a huge fund of $500 million that it would use to develop its portfolio companies in markets outside of Western Europe.

Today, one of the big backers of that fund, Access Industries, is leading a $112 million investment into two of Rocket’s big e-commerce plays in the Asia-Pacific region, Zalora in Asia and The Iconic in Australia. Rocket Internet says that this is the biggest single funding announcement for any e-commerce site to date in the region — breaking Zalora’s own record from just six months ago, when it raised $100 million.

The purpose of the funding will be to keep growing out the businesses, the company says, targeting some 600 million “potential online shopping customers in the region.” That region, today, includes Brunei, Hong Kong, Indonesia, Malaysia, the Philippines, Singapore, Thailand, and Vietnam for Zalora; and Australia and New Zealand for the Iconic.

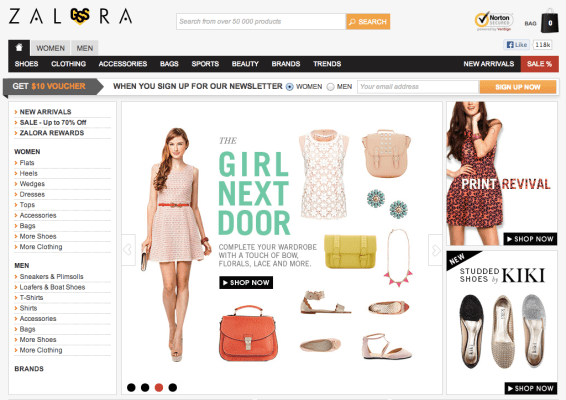

“The investment allows us to continue building out our position as the leading fashion and beauty e-commerce retailer in Southeast Asia,” Michele Ferrario, Managing Director of the ZALORA Group, said in a statement. “We are focused on offering the best possible customer experience paired with a unique product offering of local and international brands. We will use this new investment to improve our position as the high-street fashion authority in Southeast Asia. We will grow our assortment and further enhance the portfolio of our private labels. Our goal is to continue serving up world-class products and services, so everyone in South-East Asia can benefit from the wide selection of products at ZALORA.”

Rocket Internet has confirmed to me that this $112 million investment is completely separate and “has nothing to do with the $500 million fund”. Along with Access Industries, Scopia Capital Management LLC and other institutional investors also participated.

The huge sums getting raised point to a few trends:

The first is the growth of e-commerce in emerging markets.

While countries like the U.S. and those in Western Europe with more mature economies continue to rake in billions of dollars in revenue from the sale of goods online (the recent holiday shopping week in the U.S. is one recent testament to that), new markets are actually a very important target for all online players looking to tap into the next mass of yet-to-be “owned” users.

In many cases, the infrastructure for offline commerce is actually less good in emerging markets, creating a new kind of business that is not so much disruptive as it is establishing a new opportunity altogether to sell to consumers — along with all the payments and logistics and distribution that come along with that.

On the other hand, the bottom-line revenue opportunity remains a less good one. AT Kearney, cited in the FT, estimates that the e-commerce market in Southeast Asia is worth $6 billion to $7 billion a year. In contrast, Alibaba alone made $5.7 billion on a single day in November.

Still, there is 30% growth in SEA amid a burgeoning middle class. And the lack of competition also means potentially higher margins, even if the businesses are targeting what are by and large less wealthy economies.

As Oliver Samwer told me when announcing the $500 million fund earlier this year, “If you look at the most successful mobile carriers, it’s the ones who have moved into emerging markets. In Brazil, for example, the growth as well as the margins for mobile carriers are higher than they are in Europe, so that complexity is rewarded,” he said, pointing to the size of the future. “People often refer to all these emerging markets as the ‘rest of the world,’ but we’re talking about 5 billion people here.”

The second is that Rocket Internet continues to be very aggressive in pursuing these markets.

While companies like Amazon and eBay have become the defacto e-commerce leaders in mature economies, with thousands of smaller players underneath them; in markets like Asia they are less established. That means that Rocket Internet has more of a chance to build the “next” Amazon or eBay — putting in a bid to be the ones controlling that operation, or potentially selling it to one of the other giants yet to enter those markets. (eBay, for example, has been very clear about its ambitions in emerging markets.)

Rocket Internet traditionally is bullish on raising money to build these businesses not just because expanding e-commerce operations can be capital-intensive, but because they want to build them out quickly to fend off any potential competition from local players and big international companies with local ambitions.

Generally, Rocket Internet has not been super transparent about how much money individual companies have raised. Or how much they make — Rocket today only offers the following information: “This new round of funding signals investors’ strong confidence in the online retailer after a period of ongoing accelerated growth. Since its inception in 2012, ZALORA has grown to be Southeast Asia’s leading online fashion & beauty retailer offering more than 130,000 products and over 500 international brands.” Meanwhile, Patrick Schmidt, CEO of THE ICONIC, notes that The Iconic is “approaching one million orders being shipped” in Australia.

In this case, we don’t know how much of the $112 million is going to Zalora, and how much to The Iconic. Prior to the $100 Zalora raise in May, it had raised $26 million as well as another round “in the double-digit millions.”

The third is Rocket Internet’s reliance on repeat business from existing investors.

Access Industries is what you might call a Rocket regular — not just taking part in the $500 million fund, but also leading a $130 million round in Lamoda, Rocket’s fashion commerce site in Russia.

Access Industries has also put money into Rocket Internet’s Pinterest clone Pinspire and home furnishings site Westwing. And in May 2012, Blavatnik and Access Industries also put $200 million as a direct investment into Rocket Internet itself. (That’s aside from other huge investments, such as its stake in music streaming site Deezer.)

What to say about that? It seems that there is an enormous amount of money swirling around when you are the right person asking for it, and while we don’t know how much money Zalora or The Iconic are making today, clearly it’s interesting enough that Access Industries keeps coming back for more.

“ZALORA’s experienced management team has put the company on a path to become a premier online fashion destination. We are pleased to be part of this dynamic success story,” said Jörg Mohaupt, ZALORA Board Member from Access Industries, in a statement.