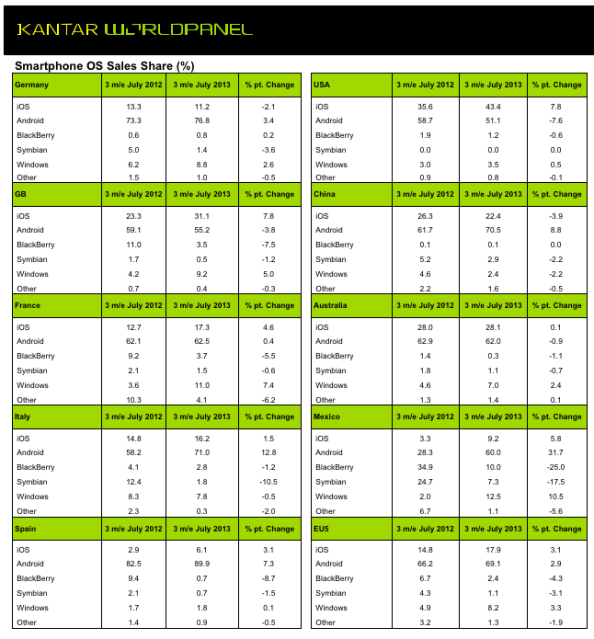

The latest smartphone sales figures are out today from Kantar WorldPanel Comtech, and in case you needed one more metric to underscore the topline trend that’s been the case for years, the WPP-owned market-research analysts are giving it to you: led by Samsung, Android accounted for 65 percent of all smartphone sales in the nine influential smartphone markets in the world (UK, Germany, France, Italy, Spain, USA, Australia, China, Mexico) for the 12-week period to the end of July.

Apple, meanwhile, is an increasingly mixed picture, with shares as low as 6 percent in one country, Spain, and as high as 43 percent in the U.S., for a nine-market share of 26.3 percent. Kantar’s figures also highlight another important trend. Microsoft’s Windows Phone OS devices — and by association its biggest partner, Nokia — continue to gain ground, if slowly. The platform is now at 4.4 percent of sales across these markets, says Kantar, nudging up to 3.5 percent of sales in the U.S., and in Europe, doubling its share in the last year to 8.2 percent of sales.

It’s not all rosy for Windows Phone, though: in China, its already-tiny share halved over a year ago, and it’s now at just 2.2 percent of sales.

Kantar’s figures are an interesting counterbalance to figures from analysts like IDC, Gartner and Strategy Analytics, which chart shipments from handset makers (and therefore may be overshooting or undershooting how many consumers are actually buying). In comparison to Kantar’s 65 percent figure for its nine markets, for example, Gartner and Strategy Analytics both noted recently that Android took nearly 80 percent of smartphone sales in Q3 globally.

Regardless of specific percentages, all of these analysts’ figures point to a very big and now pretty established smartphone leader in the form of Google’s OS, and specifically how it is used by Samsung, which makes up 52.7 percent of all Android sales, and 35 percent of all smartphone sales in these nine markets.

What this trend also does is set the stage to see how the market responds to the all-but-confirmed introduction of some new, and possibly price-busting iPhone models from Apple.

Dumbphones but not a dumb strategy

Kantar points out an interesting trend in how Windows Phone is growing. While Android and Apple’s iOS platform picked up a lot of speed by tapping smartphone users from Symbian and BlackBerry looking for something more dynamic, Windows Phone appears to be finding new people from somewhere else: the still-large amount of feature phone users in the world, with 42 percent of sales coming from those making their first moves off feature phones.

That’s a smart move: according to Gartner’s figures, feature phones (AKA dumbphones) still account for 48.2 percent of all mobile handset sales in Q3. These consumers are less likely to be entrenched in an existing smartphone platform. “27 percent of Apple and Android users change their OS when they replace their handset,” writes Dominic Sunnebo, an analyst with Kantar.

It will be interesting to see whether Windows Phone manages to pick up mindshare along with marketshare; or whether we finally start to see that success in one does not necessarily lead to success in the other. As Sunnebo points out, “Android and Apple take the lion’s share of the headlines and continue to dominate smartphone sales, so it’s easy to forget that there is a third operating system emerging as a real adversary.”

He points out that low-price models like the Lumia 520 now represents around one in 10 smartphone sales in Britain, France, Germany and Mexico. “For the first time the platform has claimed the number two spot in a major world market, taking 11.6 percent of sales in Mexico,” he notes.

Among the other players, BlackBerry continues to languish and one wonders how a player that has all but disappeared will manage to claw back, strategic resolve to embrace “niche” or not. In the “big five” markets in Europe of the UK, France, Germany, Italy and Spain, BlackBerry now accounts for 2.4 percent of sales; in the U.S. its share is now 1.2 percent of sales.

The full table below:

(Note: first paragraph and title updated with smartphone platform shares from across all markets surveyed, provided to me after I published a version of the story.)

Image: Flickr