Isis, the carrier-led mobile payments venture backed by AT&T, Verizon and T-Mobile, is today announcing a partnership with USA Technologies, to introduce up to 7,500 NFC-enabled vending machines in Isis’ two test markets of Austin and Salt Lake City. The machines will allow for payment acceptance using USAT’s ePort hardware and ePort Connect service. That means consumers can soon purchase items in the machines by simply tapping their phones to pay.

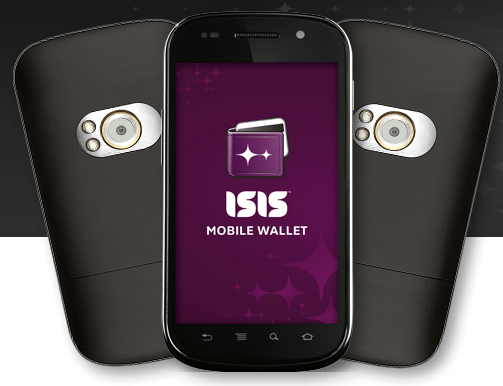

Isis formally launched its mobile payments venture in October 2012, but only in the cities listed above as a part of a limited test. In order to use the service, consumers must be a customer of one of the three mobile operators indicated, and must use a supported device (currently select Android devices) with a special secure element SIM card. Using a downloadable Isis mobile wallet application, users can make payments by tapping or waving their phones at point-of-sale terminals where contactless payments are accepted such as McDonald’s, Rite Aid, 7-Eleven, The Sports Authority, and Petco, for example. The wallet supports major credit cards, including Amex, Capital One, Chase or Barclaycard.

The challenge with using NFC for mobile payments is that support for contactless payments is far from ubiquitous – not only do consumers have to use very specific phones and configurations, not all merchants’ point-of-sale systems will work with such a platform. In addition, Isis competes with other NFC initiatives from Google Wallet and PayPal, which USAT already supports.

That’s why even a small step, like NFC enabling a network of vending machines, is notable for the NFC ecosystem as a whole. For NFC to succeed, there needs to be support for contactless payments everywhere that consumers want to pay, including retailers, transportation ticketing stations, point-of-sale kiosks and more. It’s debatable whether such traction will occur before another alternative to traditional payments, like Square or PayPal (the non-NFC variation, that is) takes over.

According to Stephen P. Herbert, chairman and CEO of USA Technologies, teaming up with Isis made sense for his company in terms of being another step toward NFC adoption. “We also believe that our work with Isis sends a clear message to vending companies in these two cities — and to the broader market we serve — that there is tremendous opportunity in cashless adoption,” Herbert noted in a prepared statement. “Through the Isis Mobile Wallet, we believe these merchants will have unparalleled new opportunity to attract consumers as well as participate in marketing programs with global brand names.”