Card.io, the toolkit for mobile app developers which lets users pay for items by holding their credit card up to the phone’s camera, is today launching a consumer-facing app. It’s something like Square, but without the dongle. It’s also not aimed at merchants, as Square is. Instead, the new Card.io applications, available for both iPhone and Android, are meant for person-to-person payments. Splitting lunch, borrowing money, paying for gas – that sort of thing.

This doesn’t represent a change in direction for the mobile commerce company, though, explains former AdMob employee Mike Mettler, now Card.io Co-founder and CEO. He says the company will continue to invest in both its consumer and developer businesses. To that end, Card.io is launching a new, fully functional mobile SDK (software development kit) for developers this morning, also available for iOS and Android.

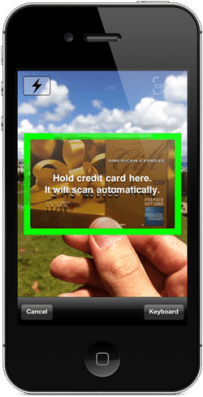

For those unfamiliar, Card.io’s mobile payment solution is meant to speed up the process of inputting credit card numbers on the small screens of mobile devices, like smartphones. Instead of having to manually type in the digits using your phone’s keyboard when making a purchase, Card.io-enabled apps let you simply hold up the credit card to the phone’s camera. Card.io will then “see” the numbers using advanced machine viewing techniques.

There are now over 160 apps which have integrated with the Card.io solution, including Venmo, Qthru, Newegg,Spotze, EventDay, Clinkle, TaskRabbit, Ambur, BeagleApp, Floktu, WillCal, and others.

With its new consumer-facing app, Card.io is actually now competing with some of its developer partners, as it, too, will enable easy, person-to-person mobile payments. After “scanning” the card using the app, Card.io users will enter in their friend’s email address to send them a receipt and the money is transferred to either their bank or PayPal account within seven days. The app is free and there are no monthly charges, but pricing is 3.5% plus $0.30 per transaction.

Also new today is the mobile SDK. Previously, Card.io’s mobile SDK was for scanning credit cards only – meaning developers would have to have their own merchant account and payment gateways set up in order to use the service. Now, with the updated mobile SDKs, developers have access to an end-to-end solution provided by the company itself. This puts Card.io in closer competition with payments company Jumio, which launched a similar service for both desktop and mobile this past summer. Like Jumio, Card.io now offers its own payments network.

It should be noted, however, that Jumio just raised $25.5 million in funding on top of the $6.5 million raised last year. Card.io, meanwhile, has $1 million in seed funding from angel investors Michael Dearing of Harrison Metal, Jeff Clavier and Charles Hudson of SoftTech VC, Manu Kumar of K9 Ventures, Alok Bhanot (former VP, Risk Technology at PayPal), and Omar Hamoui (CEO and founder of AdMob).

In addition, the company won’t talk much about how it fights fraud, only saying that it takes precautions, like Square does, which are its “secret sauce.” These involve things like tracking a user’s location and using a one-way hash of the phone’s unique identifier (UDID on iOS).

The new mobile applications are available for download here: iOS and Android. And the SDK is here.