The IPO rush of 2021 continued this week with a fresh filing from NoSQL provider Couchbase. The company raised hundreds of millions while private, making its impending debut an important moment for a number of private investors, including venture capitalists.

According to PitchBook data, Couchbase was last valued at a post-money valuation of $580 million when it raised $105 million in May 2020. The company — despite its expansive fundraising history — is not a unicorn heading into its debut to the best of our knowledge.

We’d like to uncover whether it will be one when it prices and starts to trade, so we dug into Couchbase’s business model and its financial performance, hoping to better understand the company and its market comps.

The Couchbase S-1

The Couchbase S-1 filing details a company that sells database tech. More specifically, Couchbase offers customers database technology that includes what NoSQL can offer (“schema flexibility,” in the company’s phrasing), as well as the ability to ask questions of their data with SQL queries.

Couchbase’s software can be deployed on clouds, including public clouds, in hybrid environments, and even on-prem setups. The company sells to large companies, attracting 541 customers by the end of its fiscal 2021 that generated $107.8 million in annual recurring revenue, or ARR, by the close of last year.

Couchbase breaks its revenue into two main buckets. The first, subscription, includes software license income and what the company calls “support and other” revenues, which it defines as “post-contract support,” or PCS, which is a package of offerings, including “support, bug fixes and the right to receive unspecified software updates and upgrades” for the length of the contract.

The company’s second revenue bucket is services, which is self-explanatory and lower-margin than its subscription products.

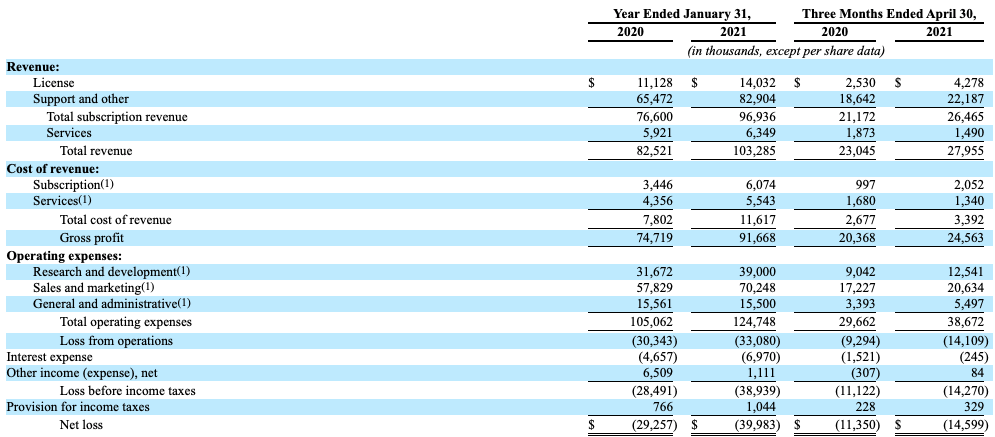

How does all of that sum up? Discounting data concerning costs relating to dividends for convertible preferred stock from its most recent investment, here’s Couchbase’s financial reporting, which details its aggregate results:

Image Credits: Couchbase S-1

The company makes the bulk of its income from its PCS efforts, something that is common among software firms with an open-source component. Red Hat’s final earnings report as a public company showed a similar breakdown of subscription and services revenue. We’ll return to Red Hat shortly because its sale to IBM could help form the market’s opinion of what Couchbase could be worth.

In numerical terms, Couchbase grew 25% from its fiscal 2020 to its fiscal 2021, its most recent full-year fiscal periods. Zooming into the company’s most recent quarterly results, the company grew a more modest 21%. Looking at ARR, the company grew its annual recurring revenue by 22% in both its fiscal 2021 and its most recent quarter.

Its historical growth has come at a cost, namely rising net losses in GAAP terms. The company has also seen its gross margins dip slightly in recent periods, from 90% in its fiscal 2020 to 89% in its fiscal 2021; the figure was 88% in its most recent quarter, a result that was flat on a year-over-year basis.

In better news, the company’s operating cash flow deterioration that it experienced during its two most recent fiscal years — negative operating cash flow grew from -$30.3 million to -$33.1 million during the period — turned around in its most recent quarter. For the three months ending April 30, 2021, Couchbase consumed just $3.2 million in cash on an operating basis, down from $6.1 million in the year-ago quarter.

Couchbase loses money because its operating costs are greater than its revenue, let alone its gross profit, meaning that the company spends lots more than it brings in. This is not a wild way to run a growth-focused technology business. As the revenues that Couchbase earns are high-margin and recurring, they are valuable; spending cash to capture such top line is normal.

For Couchbase the question will be how investors weigh its growth rate against the pace of its losses; the fact that Couchbase operates in a competitive market will also carry weight. MongoDB is one such company. NoSQL offerings also exist from Microsoft and Amazon through their public-cloud services.

Now, back to Red Hat.

What’s it worth?

Red Hat sold to IBM for around $34 billion. At the time, it had just posted $934 million in revenue, up 15% in year-over-year terms. That valued the well-known Linux company that blended open-source software, its own code, and support at around 9x its then-current run rate. At the same ratio, Couchbase is worth around $900 million.

The Red Hat-Couchbase comparison is not perfect; 2019 is ages ago in technology time, the database company is smaller and other differences exist between the two companies. But Red Hat does allow us the confidence to state that Couchbase will be able to best its final private valuation in its public debut.

Couchbase could double its valuation provided that investors are more interested in its faster-than-Red-Hat growth than they are worried about its history of cash consumption and growing net losses.

More when it prices.