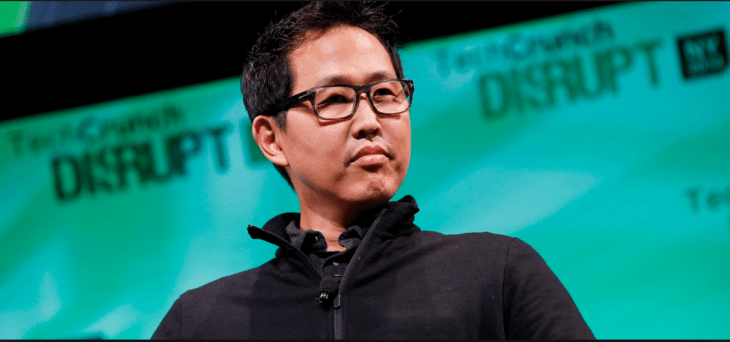

David Lee, a former Google executive who for several years ran the seed-stage venture fund SV Angel, is back with his own new firm, shows an SEC filing. The outfit is called Refactor Capital and it’s apparently targeting $50 million for its debut fund.

Refactor, which was incorporated seven months ago, doesn’t appear to have a site up and running yet. But the SEC filing lists as Lee’s cofounders Zal Bilimoria and Rick Barber.

Bilimoria has spent the last 2.5 years as a partner at Andreessen Horowitz, where, according to his LinkedIn profile, he co-led the firm’s investments in Cyanogen, Teespring, Omada Health, ToutApp, Altschool, Lyft, Product Hunt, Honor, HumanAPI, Mixpanel, SolveBio, uBiome, and Zenefits, among others.

Bilimoria says on LinkedIn that he also recently helped get Andreessen Horowitz’s new $200 million Bio Fund off the ground.

He looks to be leaving just as Andreessen Horowitz nears a close on its fifth multi-stage venture fund, which sources have told us will be at least $1.5 billion in size. (That’s where the firm capped its fourth fund two years ago.)

Rick Barber, who also worked briefly at Andreessen Horowitz — he was a data scientist on staff in 2013 — most recently served as the chief of staff at Nuna, a five-year-old, San Francisco-based health care analytics company.

Reached at his L.A. home, Lee declined to comment about the fund, citing SEC regulations.

Seemingly, the firm is an extension of the angel bets that Lee has been making since leaving SV Angel, which is itself raising a fresh $46 million and with which Lee somewhat abruptly parted ways in May of last year. (Firm cofounder Ron Conway said at the time that Lee had “made a personal decision to spend more time with his wife, children, and extended family in Los Angeles.”)

Among his numerous personal bets over the last year, Lee has backed Fitzroy Toys, a new, L.A.-based online marketplace connecting indie toymakers with retailers.

He has also seemingly spent a lot of time looking at health care-related startups, with other investments in Notable Labs, a year-old, San Francisco-based personalized drug combination testing service for cancer patients; CoFactor Genomics, an eight-year-old, St. Louis, Mo.-based company that’s building disease diagnostics using RNA (as opposed to DNA); and Call9, a year-old, Palo Alto-based telemedicine startup that calls doctors on demand. (We profiled the company here in January when it closed on $10 million in Series A funding.)

Indeed, sources familiar with Refactor’s plans say the firm plans to spend much of its time on the intersection of healthcare and software.

It isn’t surprising. Lee, a cancer survivor, had talked about his interest in healthcare informatics beginning in 2013.

News of Refactor’s new fund was first reported in Term Sheet.