It’s no wonder Google is expanding its efforts to broaden Android’s reach by working with OEMs in emerging markets, via its Android One smartphone affordability program; the latest global smartphone market data from analyst Gartner shows growth slowing, and Android specifically recording its slowest ever year-on-year growth.

Gartner’s data on Q2 performance of the smartphone market overall indicates growth is the slowest since 2013, with global smartphone sales to end users totaling 330 million units in the quarter — an increase of just 13.5 per cent over the same period in 2014.

The analyst points to a saturated Chinese market for the slowdown — something it also flagged earlier this summer. The market represented just under a third (30 per cent) of total smartphone sales in Q2 making it the biggest single country for phone sales.

“Its poor performance negatively affected the performance of the mobile phone market in the second quarter,” notes Gartner research director Anshul Gupta in a statement. “China has reached saturation — its phone market is essentially driven by replacement, with fewer first-time buyers. Beyond the lower-end phone segment, the appeal of premium smartphones will be key for vendors to attract upgrades and to maintain or grow their market share in China.”

China’s weak performance also impacted Android’s growth, coupled with Apple’s strong performance in the market, according to the analyst. Gartner notes Apple’s iOS has taken share from Android there for the last three quarters. (Apple’s introduction of its first phablet-sized iPhone, the 6 Plus, has clearly helped boost its share in Asia).

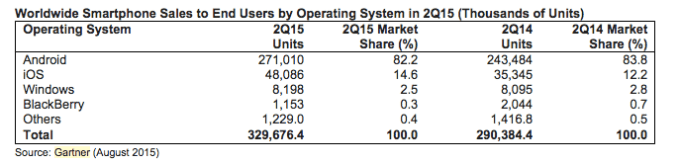

Despite its slowing growth, Google’s Android OS still took 82.2 per cent of the global smartphone market in Q2, recording 11 per cent year-over-year growth, by Gartner’s reckoning. While Apple’s iOS took a 14.6 per cent marketshare, up from 12.2 per cent in Q2 last year — with y-o-y growth in the region of 15 per cent, according to Gupta.

Is this peak Android then, in terms of marketshare? “Maybe… this is what we were really expecting the max, around 82 per cent,” Gupta tells TechCrunch. “I think last year it went up to 83.5 or 84 per cent of the overall sales.

“Still there is a lot of unit growth left in the market because globally we are expecting this year smartphones to be around roughly 1.2 billion, 1.25 billion, out of 1.8 billion [mobile devices], so it’s almost two-thirds which are going to come from smartphones, but then one-third is still left and expect Android to maintain their 80 per cent+ lead in that,” he adds.

Google’s Android One initiative is more about driving more Android competition into emerging markets to raise overall handset standards, reckons Gupta, rather than itself being a vehicle for generating huge sales volumes.

He notes, for instance, that competitively priced smartphones already exist in emerging markets where Android One plays. And that various Android OEMs — including Xiaomi, OnePlus and Motorola — are also pushing OS updates directly to users (another Android One feature).

“The market is quite competitive and that’s the reason we haven’t seen any huge success coming in from Android One so far,” he says, adding: “Google is pushing the program because it ensures that the users in those emerging markets get access to latest phone with latest operating system, so they are bringing in more competition in the market which pushes vendors to go for similar kind of offering.”

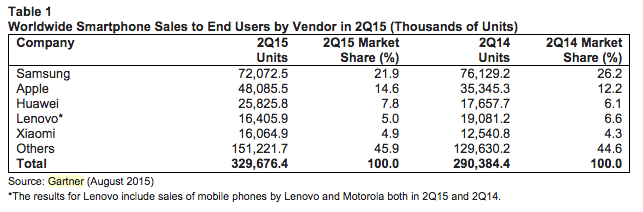

Turning to individual mobile makers, Gartner’s Q2 report puts Samsung losing 4.3 percentage points in marketshare in the quarter, and declining 5.3 per cent in unit sales — despite the launch of new Galaxy S6 models. Meanwhile iPhone sales were up 36 per cent, enabling Apple to carve out an extra 2.4 percentage points in marketshare.

Gartner says Apple recorded strong iPhone replacements in both emerging and mature markets, and especially strong performance in China. Total iPhone sales there grew 68 per cent to 11.9 million units.

Why is Apple doing so well in China? It comes down to the power of the brand, reckons Gupta. “It’s a big brand and people really associate that with their status and it’s kind of an aspirational brand so many of the consumers in China expect to own an iPhone at some point of time,” he says.

“To some extent it has affected replacement sales for Android phones because Android users are holding onto their phones for a little longer in the hope of buying an iPhone… Someone actually told me in China there are two kinds of smartphone: one is the iPhone, another is ‘all the phones’.”

In China there are two kinds of smartphone: one is the iPhone, another is ‘all the phones’.

And although China’s smartphone market as a whole is saturating, Gupta says there’s still room for premium smartphone growth there — which still accounts for less than 20 per cent of the market. Giving Apple room to continue growing the iPhone’s share in China.

“Apple sold roughly 7.5 million phones last quarter out of 102 million, or maybe 98 million, so that is closer to 8 to 9 per cent. Overall premium could be roughly around 20 per cent so that segment is still one-fifth of what the overall market is,” he adds. “So if that segment grows there are definitely more quantities for Apple.”

Apple’s double-digit Q2 growth caused headaches for rivals in the high-end segment, negatively impacting their premium phone sales and profit margins, with Gartner noting that many vendors had to realign their portfolios to remain competitive in the midrange and low-end smartphone segments — triggering price wars and discounting ahead of device refreshes planned for the second half of the year.

tl;dr: It sucks to be an Android OEM trying to make money from an Apple-style hardware margins focused business model right now. (Just ask HTC.)

“The market is very, very competitive. A smartphone has kind of become a commodity. And differentiation is really very, very challenging,” says Gupta. “That’s why some of the brands, like if you look at Xiaomi, they are trying to differentiate through the services. Where they’re offering exclusive content onto their devices.

“It also comes down to creating an ecosystem, with other consumer products which people might be interested in, like health bands or watches or other kinds of accessories. So it really helps to build an ecosystem around your product.”

“Those who really failed to transform or who failed to really understand market dynamics have suffered. So it’s the reason for the failure of HTC or Samsung — they couldn’t really understand how the markets are changing and the mature markets, as well as in the emerging markets. And that’s the reason they are struggling to grow their marketshares,” adds Gupta.

Despite fierce competition in the space, Gupta says Android’s low barrier to entry will continue to encourage “an array of new players” — specifically he predicts “further disruptions” coming from Chinese manufacturing and Internet players focusing on new business models that aren’t reliant on hardware margins. The reason being there’s still plenty of untapped marketshare in many emerging markets for smartphone growth.

“There is a lot of growth left in that space which really attracts other players to come into these markets — although knowing that it is very difficult to make profit in this market, because there are too many players already. But I think it is just the sheer volume which attracts these brands to come into the market and try their hand,” he adds.

“Just look at how Xiaomi has transformed themselves in the last three or four years. They were the number one player in China, they’ve come into India become number five player in no time, less than a year. So some of these players have successful exploited the quantities in these markets.”